Anthropic closed a $13 billion Series F in September 2025 at a $183 billion valuation, then signed a term sheet this month for $10 billion more—targeting a $350 billion valuation just four months later. Revenue surged from $1 billion to $9 billion run-rate in a single year, with 300,000 enterprise customers now on the platform. Yet Anthropic’s president Daniela Amodei insists the company’s governing principle is “do more with less.”

That’s $23 billion raised while preaching efficiency. The contradiction raises questions about whether Anthropic’s positioning is strategic clarity or clever marketing in an overheated AI market.

The “Do More with Less” Contradiction

In a January 3 CNBC interview, Amodei positioned Anthropic against the AI industry’s “scale as destiny” mentality. The strategy: higher-quality training data, post-training techniques for improved reasoning, and model efficiency per unit of compute. “The exponential continues until it doesn’t,” she said, suggesting rivals’ massive infrastructure buildouts aren’t sustainable.

Meanwhile, OpenAI has made roughly $1.4 trillion in compute and infrastructure commitments. Anthropic’s response? Raise $23 billion while pledging $30 billion for Azure compute capacity. The messaging says “efficiency,” but the fundraising says “we need billions to compete.”

Can both be true? Perhaps. If $23 billion counts as “less” in a market where competitors spend $1.4 trillion, Anthropic’s bet is that smarter spending beats bigger spending. But that requires believing the efficiency narrative while Anthropic closes the second-largest AI fundraise in history.

Revenue Growth That Actually Justifies Valuation

Here’s the case for Anthropic: revenue exploded from $1 billion at the start of 2025 to $9 billion by year-end—9x growth in twelve months. Bloomberg reported the company now projects $20-26 billion for 2026, meaning revenue could double or triple again this year.

Enterprise customers jumped from under 1,000 two years ago to 300,000 today—a 300x increase. About 85% of Anthropic’s revenue comes from business clients including Uber, Netflix, Spotify, Salesforce, and Snowflake. This isn’t consumer hype; it’s enterprise adoption at scale.

The numbers suggest $350 billion might not be a bubble valuation—it’s pricing in continued hypergrowth. If Anthropic hits even the low end of projections, the company will have scaled faster than almost any enterprise software business in history.

AI Bubble Red Flags Persist

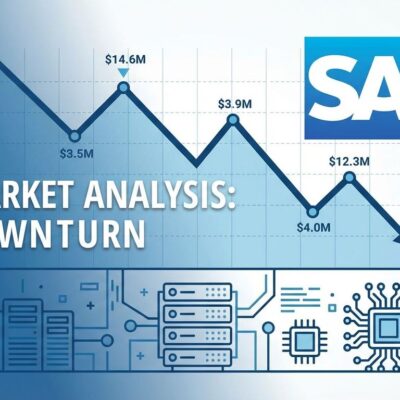

Yet the broader AI market shows classic bubble characteristics. Thirty percent of the S&P 500 is now concentrated in the top five companies—the highest level in 50 years. The index trades at 23x forward earnings, well above historical averages. A Fortune analysis noted that MIT Media Lab research found 95% of enterprises report zero ROI on $30-40 billion in generative AI investments.

Morgan Stanley estimates data center debt could exceed $1 trillion by 2028, with Meta, Alphabet, and Oracle needing to raise $86 billion combined this year alone. JP Morgan CEO Jamie Dimon warned there’s a “higher chance of a meaningful drop in stocks than the market reflects,” while investor Ray Dalio noted the technology is real but investors “may be pricing the future far too early.”

Anthropic’s $9 billion revenue proves real enterprise demand exists. But does that insulate the company from a broader market correction if AI valuations crater? History says no.

Developer Backlash During the Fundraise

The timing of Anthropic’s $350 billion fundraise couldn’t be worse for developer relations. The Register reported on January 5 that Claude Code developers hit usage limits within 10-15 minutes on Pro plans, with some claiming a 60% reduction in token allowances. Anthropic blamed the expiration of a “holiday bonus” that doubled limits in late December, but developers weren’t buying it.

Ruby on Rails creator David Heinemeier Hansson called the approach “very customer hostile.” Anthropic also cracked down on third-party tools, blocking OAuth wrappers that let developers use flat-rate subscriptions with external coding environments. GitHub Issue #17084 captured the sentiment: “Opus 4.5 usage limits significantly reduced since January 2026—most restrictive since launch.”

Raising $350 billion while alienating the developers who actually use your product sends a clear message: investors matter more than users. That works until it doesn’t.

The Anthropic vs OpenAI Bet

Anthropic is now valued at roughly 70% of OpenAI’s $500-750 billion, with revenue running at about 70% of OpenAI’s $13 billion. The gap is closing fast, but the strategies differ fundamentally: Anthropic leads in enterprise market share (per Menlo Ventures), while OpenAI dominates consumer usage with ChatGPT.

OpenAI projects $14 billion in losses for 2026. Anthropic targets positive cash flow by 2027 and profitability in 2028. One company bet big on consumer scale and infrastructure; the other bet on enterprise efficiency and faster profitability. Both raised massive amounts—OpenAI’s $19.1 billion plus a $100 billion NVIDIA commitment versus Anthropic’s $23 billion.

The “do more with less” narrative only holds if Anthropic actually reaches profitability first. Until then, both companies are burning billions to outrun each other in a market that may not support two $300+ billion AI labs.

What This Means for Developers

Anthropic’s fundraising validates enterprise AI adoption—$9 billion in revenue from 300,000 customers proves companies are spending. But the developer experience controversy suggests growth is coming at a cost. Usage limits tightened precisely when Anthropic needed to show investors sustainable unit economics.

For developers choosing between Claude and alternatives, the question isn’t just capability—it’s whether Anthropic will prioritize user experience or investor returns. The January backlash hints at the latter.

The AI funding war escalates while bubble warnings intensify. Anthropic’s $350 billion target may be justified by revenue growth, or it may be the market pricing in a future that arrives slower than expected. Either way, the “do more with less” messaging rings hollow when you’re raising $23 billion. Call it efficiency if you want. The rest of us will call it what it is: expensive.