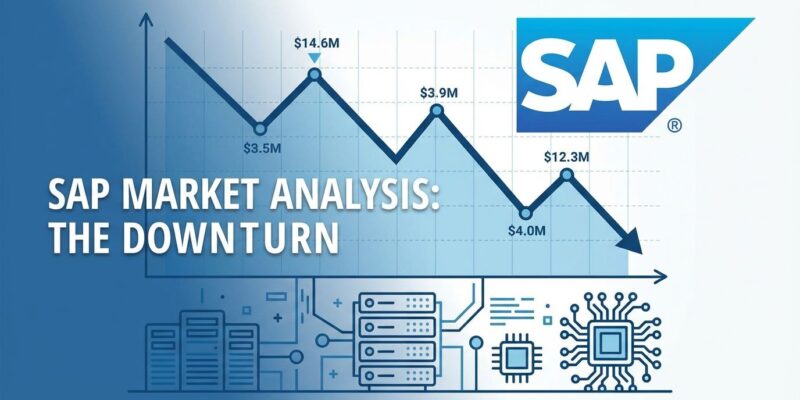

SAP SE shares plunged 17% yesterday after the enterprise software giant reported cloud contract backlog growth of 16% versus analyst expectations of 26%. The selloff wiped over €40 billion off SAP’s market value – the company’s steepest drop since October 2020. This wasn’t just another earnings miss. It was a flashpoint for the question keeping software investors awake: Is AI disrupting traditional enterprise software?

The Numbers Behind the Panic

SAP’s fourth-quarter current cloud backlog grew 16% in constant currency, missing the 26% growth analysts expected. While total cloud backlog hit a record €77.29 billion, investors focused on the deceleration. The stock fell to its lowest level since February 2024.

The reaction was extreme because SAP is Europe’s largest software company and a bellwether for the cloud sector. If SAP is slowing, what about everyone else? The answer arrived swiftly: Salesforce dropped 6.3%, Adobe fell 2.5%, and Datadog slid 5%. The iShares Software ETF is now down 21% from its peak – officially in bear market territory.

SAP’s Defense: Sovereign Cloud and Deal Complexity

CFO Dominik Asam offered three explanations. First, deal mix shifted toward larger transformations, with 71% of Q4 cloud orders exceeding €5 million. These bigger deals have longer ramp periods. Second, increased sovereign cloud demand driven by geopolitical tensions extended sales cycles. Third, certain public-sector contract terms affect backlog metrics.

Asam admitted the slowdown was “more pronounced than anticipated.” CEO Christian Klein noted sovereign cloud deals carry similar margins but involve lengthier negotiations due to regulatory requirements.

Here’s the problem: Every company that misses estimates blames timing and complexity. SAP’s explanation sounds plausible, but the market isn’t buying it. Investors see AI disruption instead.

The AI Disruption Question

Global AI spending is approaching $500 billion by 2026, with enterprise LLM budgets growing 75% year-over-year. AI has graduated from experiment to core operating expense. That shift reveals something crucial: companies aren’t testing AI anymore, they’re deploying it.

The build-versus-buy calculus is changing. AI agents make custom solutions easier to create, pressuring traditional SaaS subscriptions. Why pay per-seat licensing when you can build something tailored? Anthropic’s Claude Opus 4.5 and rapid advancements fuel fears that AI will replace software licenses entirely. Software earnings growth is slowing from 19% in 2025 to 14% in 2026.

But here’s the counterargument: SAP’s cloud revenue still grew 26% in constant currency. Total cloud backlog reached record levels. Business AI appeared in two-thirds of Q4 cloud orders. Analysts from Goldman Sachs and Citi maintain fundamentals remain intact. Growth slowdown doesn’t equal decline – it’s natural market maturation.

The market is pricing a worst-case scenario where AI replaces every enterprise software seat. That’s either prescient or panic.

What This Means for Developers

Software sector consolidation is accelerating, with M&A deal volume expected to increase 30-40% in 2026. For developers, the implications are clear: traditional SaaS development roles may slow while AI/ML positions grow. The enterprise tool landscape is shifting from pure SaaS toward AI-native solutions.

Enterprise buyers gain negotiating power as SaaS vendors face pressure. Companies evaluating build-versus-buy now have AI strengthening the “build” case.

If you’re building in this space, the question isn’t whether AI disrupts SaaS – it’s whether you’re creating the disruptor or watching from the sidelines.

What Happens Next

Watch for earnings from Salesforce, ServiceNow, and other major software vendors in coming weeks. If they report similar backlog slowdowns, the AI disruption narrative gains credibility. If they deliver strong results, SAP’s issues become company-specific.

SAP needs to prove its sovereign cloud pipeline converts and large transformations ramp as promised. The software sector needs to demonstrate it can integrate AI rather than be replaced by it.

One of two things is true: either enterprise software faces existential disruption from AI, or this selloff represents a buying opportunity. The next six months will reveal which scenario we’re living through.