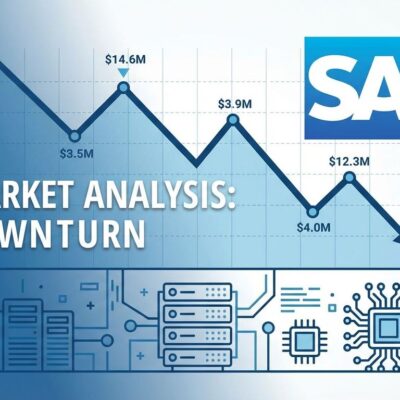

Microsoft lost between $350 and $400 billion in market value on January 29, 2026—the biggest single-day drop since the March 2020 COVID crash. The kicker? This happened one day after Microsoft beat earnings expectations with $81.3 billion in revenue and earnings per share that exceeded consensus by 6.7%. Meanwhile, Meta announced plans to nearly double AI infrastructure spending and gained 10 percent. Investors are done rewarding AI spending without immediate proof it generates revenue.

When Beating Earnings Isn’t Enough

Microsoft reported Q2 fiscal 2026 results on January 28, delivering impressive numbers: revenue up 17 percent year-over-year, operating income up 21 percent, and earnings that beat Wall Street estimates. Azure and other cloud services grew 39 percent. Microsoft Cloud revenue hit $51.5 billion, up 26 percent.

The market’s reaction? A 10 to 12 percent stock plunge that erased $350 to $400 billion in a single trading session. Meanwhile, Meta Platforms reported Q4 2025 earnings the same evening, announced 2026 capital expenditures of $115 to $135 billion (nearly double 2025’s $72.2 billion), and watched its stock surge 10 percent. Same playbook. Opposite results.

The Receipts vs The Bill

A trader captured the contrast perfectly: “Microsoft showed the bill. Meta showed the receipts.” The difference comes down to execution and revenue acceleration.

Meta’s fourth quarter revenue grew 24 percent year-over-year, with first quarter 2026 guidance well above consensus. CEO Mark Zuckerberg predicted a “major AI acceleration” in 2026, backed by numbers showing AI spending directly driving ad revenue growth. Meta proved massive AI infrastructure investment can translate to immediate revenue gains.

Microsoft’s revenue grew 17 percent—a deceleration despite spending $72.4 billion on capital expenditures in the first half of fiscal 2026 (annualized to $144 billion-plus). Azure growth came in at 39 percent, flat from the previous quarter, when Wall Street expected acceleration to 45 to 50 percent. Morgan Stanley analysts noted: “Capex is growing faster than we expected, and maybe Azure is growing a little bit slower. This fundamentally comes down to a concern on the return on investment.”

Microsoft’s capital spending is growing 100 percent year-over-year while revenue grows 17 percent. Consequently, investors rewarded Meta’s execution and punished Microsoft’s promises.

Capacity Constraints Signal Execution Failure

Microsoft admitted Azure capacity constraints will persist “at least” through June 2026. Despite spending $72.4 billion in six months, the company still can’t meet customer demand. This should signal strong demand—a positive indicator. Instead, investors interpreted it as an execution failure. The company reported a demand backlog that doubled to $625 billion, yet unfulfilled demand isn’t a win when you’ve spent tens of billions on infrastructure.

The Era Shift: Prove ROI or Die

January 29, 2026 marks an inflection point. For the past two years, investors rewarded any AI investment announcement. Return-on-investment questions were dismissed as premature. Microsoft’s historic loss signals the end of that era.

The new rule: Show AI generates revenue now, or get punished. Goldman Sachs projects hyperscaler AI capital expenditures will exceed $600 billion in 2026, a 36 percent increase over 2025. However, AI-related services generated only about $25 billion in revenue in 2025—roughly $0.075 per dollar spent. Moreover, only 25 percent of AI initiatives have delivered expected ROI to date.

An MIT study from August 2025 found that 95 percent of generative AI projects at businesses failed to deliver measurable return on investment. Goldman analysts warned: “If 2026 arrives without evidence of that monetization, market sentiment could reverse with dramatic speed.” That reversal just started.

Developer Implications Beyond Wall Street

This isn’t just a stock market story. The reckoning affects every developer, CTO, and tech startup. Azure pricing pressure is likely as Microsoft needs returns on $144 billion in annual AI spending. Enterprises face capacity constraints through June 2026, potentially delaying AI deployment projects. Furthermore, if Microsoft can’t justify AI spending despite being the most successful cloud provider, CFOs will apply the same scrutiny to corporate AI budgets.

For developers, career decisions become more complex. AI infrastructure startups face a higher bar for fundraising—venture capitalists will demand clear unit economics and ROI paths. Skills diversification becomes critical. Additionally, cloud cost optimization and FinOps expertise gain value as every dollar of cloud spending requires justification.

What Happens Next

The next two to four weeks determine whether this is Microsoft-specific or industry-wide. Amazon reports AWS results in February 2026, followed by Alphabet’s Google Cloud earnings. If they face similar punishment, the trend is confirmed and the AI reckoning is real. Otherwise, it’s an execution problem specific to Microsoft. Either way, ROI scrutiny is here to stay.

Microsoft CEO Satya Nadella told the World Economic Forum in Davos on January 20 that “a telltale sign of if it’s a bubble would be if all we are talking about are the tech firms.” One week later, his company lost $350 billion in market value. The market delivered a verdict: AI spending now requires quarterly revenue proof. No more promises. No more patience. Show the receipts, or watch the stock tank.

Key Takeaways

- Microsoft lost $350-400 billion in market value on January 29, 2026, despite beating earnings—its worst trading day since March 2020

- Meta announced similar AI spending and gained 10 percent; the key difference is Meta showed 24 percent revenue growth vs Microsoft’s 17 percent deceleration

- Azure growth flat at 39 percent despite $72.4 billion in H1 FY26 capital spending (annualized to $144 billion-plus), signaling poor ROI

- Capacity constraints persist through June 2026 despite massive spending—investors see this as execution failure, not demand success

- January 29 marks inflection point: “AI at all costs” era ends, replaced by “prove quarterly ROI or get punished”

- Industry implications: Hyperscalers spending $600 billion in 2026 on AI, but only $25 billion in AI revenue in 2025 ($0.075 per dollar spent)

- Developer impact: Azure pricing pressure expected, AI infrastructure careers face sustainability questions, VC funding bar rises for AI startups

- Next catalyst: Amazon and Alphabet earnings in February 2026 determine if this is Microsoft-specific or industry-wide AI spending reckoning