Tesla killed the option to buy Full Self-Driving outright and stripped basic Autopilot features from new vehicles, forcing customers into a $99/month subscription that Elon Musk promises will increase “as capabilities improve.” The January 14 announcement gave buyers until February 14 to purchase FSD for $8,000—after that, it’s subscription-only. Tesla simultaneously removed lane-centering and Autosteer as standard equipment, leaving only basic cruise control. Customers who chose Tesla to own their car’s capabilities now face perpetual rental for features that were free last month.

This isn’t innovation. It’s subscription creep consuming the automotive industry. And if Tesla succeeds, every automaker follows.

The Bait-and-Switch Nobody Asked For

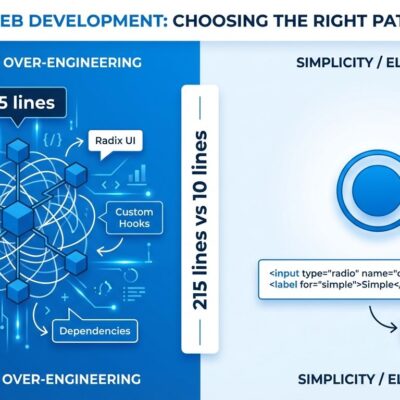

Tesla’s move is more aggressive than any software subscription shift we’ve seen. Compare the break-even math: Adobe’s Creative Cloud takes 13 months to match the old Photoshop purchase price. Microsoft 365 takes 5 years to match Office 2021. Tesla’s FSD subscription takes 81 months—nearly seven years—to match the $8,000 purchase option they just eliminated.

Worse, Tesla didn’t just create a subscription option. They removed features that were standard equipment. TechCrunch reports lane-centering and Autosteer no longer come with new Teslas. You get Traffic-Aware Cruise Control and nothing else unless you pay $99 monthly. The hardware is in your car. The software is locked behind a paywall.

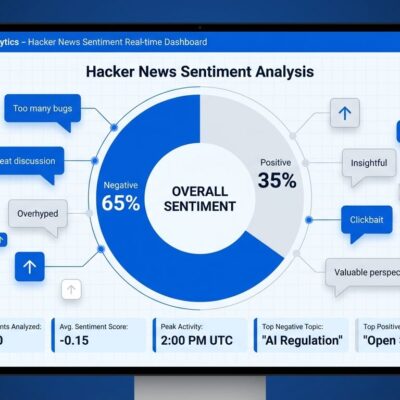

Only 12% of Tesla’s fleet uses FSD despite years of availability, according to CFO Vaibhav Taneja’s October 2025 earnings call. That’s an 88% rejection rate. Yet Tesla’s response isn’t to improve the value proposition—it’s to eliminate alternatives.

Customers Are Furious (And They’re Right)

Fortune documented the backlash from Tesla owners who thought they were buying a car, not renting one. “People want to own their stuff outright, not be eternally beholden,” one user wrote in response to Musk’s announcement. Another crystallized the core problem: “You will never actually own your EV, because it will be useless without the software that you can never remove, replace, or modify.”

They’re describing a fundamental shift in what vehicle ownership means. You own the hardware. Tesla owns the software. You can’t install competing software. You can’t modify it. You can’t even transfer your FSD subscription when you sell the car—it stays with your account, lowering resale value. This is ownership theater.

The broader context makes it worse. Consumer willingness to pay for connected car services dropped from 86% in 2024 to 68% in 2025, according to S&P Global Mobility research. Subscription fatigue rose 30% across the automotive industry. Customers are already paying monthly for phones, streaming, cloud storage, and software. Cars are becoming another recurring bill competing with their entire household budget.

The Strategic Bet Tesla’s Making

Tesla isn’t stupid. They’re betting that locked ecosystems overcome customer preferences. The math is compelling from their perspective: $99/month across 10 million subscribers (Musk’s stated goal, required for his compensation package) generates $11.88 billion annually. Compare that to $8,000 one-time purchases from 10 million customers—$80 billion total, but spread over many years. Recurring revenue is worth 3-5x more to investors who value SaaS multiples over product sales.

They have precedent. Adobe moved to subscription-only in 2013 despite massive backlash. Customers threatened to boycott. Customers swore they’d never pay monthly for Photoshop. Adobe’s revenue more than tripled over the next decade, and subscriptions became the industry standard. Microsoft, Apple, JetBrains, Autodesk—everyone followed.

The automotive industry is watching. The Register notes Musk confirmed the $99 price will rise “as FSD’s capabilities improve,” with no timeline or ceiling specified. Mercedes-Benz is targeting €1 billion in recurring software revenue by 2025. The vehicle subscription market is projected to grow from $4.96 billion in 2025 to $14.20 billion by 2030—a 23.39% compound annual growth rate.

If Tesla Succeeds, Everything Becomes Subscription

BMW tried this in 2022 with heated seat subscriptions. Customers revolted. BMW reversed course. But Tesla’s bet is that FSD is different—more complex, more valuable, more defensible. If they’re right, every feature in your car eventually sits behind a paywall. If they’re wrong, this becomes a case study in how far you can push subscription models before customers break.

The stakes extend beyond automotive. Physical products becoming perpetual rentals represents the subscription economy’s final frontier. Software made sense because distribution costs dropped to zero and continuous updates added value. Cars have neither advantage—the hardware ships complete, and “full self-driving” has been “coming next year” since 2016.

Developers and tech professionals are the target market here. You built the subscription economy. You normalized SaaS. You accepted that software ownership was obsolete. Now it’s consuming your cars. Your tools. Your household appliances. The Overton window shifted so gradually you didn’t notice until everything you own became something you rent.

Key Takeaways

- Tesla eliminated the $8,000 FSD purchase option after February 14, 2026, forcing customers into a $99/month subscription that will increase over time with no specified ceiling

- Basic Autopilot features (lane-centering, Autosteer) were removed as standard equipment, leaving only Traffic-Aware Cruise Control—hardware remains in the car but features are paywalled

- The subscription takes 81 months (6.75 years) to match the old purchase price, compared to 13 months for Adobe Creative Cloud or 60 months for Microsoft 365—this is more aggressive than any major software subscription model

- Only 12% of Tesla’s fleet uses FSD despite years of availability, yet Tesla’s response to low adoption is eliminating alternatives rather than improving value

- If Tesla succeeds, the automotive industry follows—BMW’s heated seat subscription attempt failed in 2023, but Tesla’s larger ecosystem lock-in might succeed where others failed

The subscription economy you built is eating your car. The question isn’t whether it’s coming—it’s whether you’ll accept it.