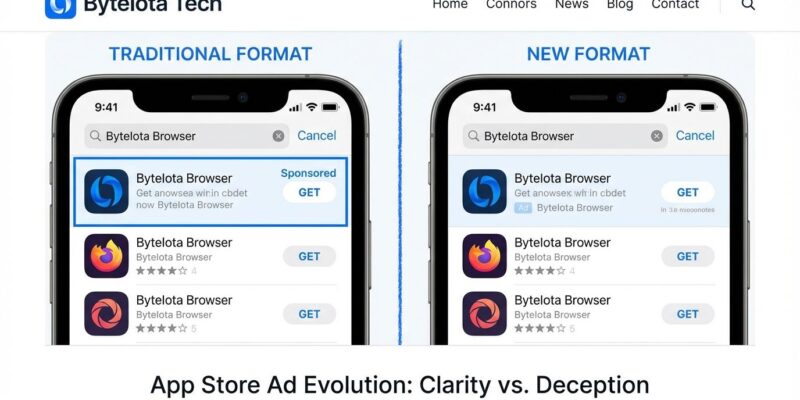

Apple began testing a redesigned App Store search interface on January 16, 2026, that removes the blue background from sponsored results—making it significantly harder for users to distinguish paid advertisements from organic app listings. With only a small “Ad” label identifying sponsored placements, the change affects 1.4 billion iPhone users globally. This mirrors controversial practices from Google, Amazon, and Facebook that the FTC investigated for deceptive advertising in September 2025.

The timing isn’t coincidental. Apple’s Services division generated $109.2 billion in fiscal 2025, with advertising becoming a key growth driver. The question is whether Apple will maintain its premium brand positioning or follow the revenue-maximization playbook that put competitors under regulatory scrutiny.

The Services Revenue Pressure

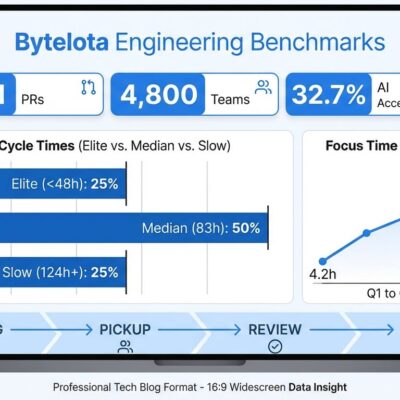

Apple’s Services segment grew 14% year-over-year in fiscal 2025, with advertising as the primary catalyst. Current search ads convert at over 60% average rates—impressive numbers that create powerful financial incentives to boost click-through rates further. In April 2025, Apple rebranded its ad division from “Apple Search Ads” to simply “Apple Ads,” signaling expansion beyond search. Consequently, the company announced plans for multiple ad placements throughout App Store results and is testing Maps advertising for 2026.

CFO Kevan Parekh expects Services to maintain similar double-digit growth rates in 2026. With hardware sales plateauing, advertising represents a high-margin path to meet investor expectations. The math is straightforward: reduce visual distinction between ads and organic results, increase accidental clicks, boost revenue. Apple’s blended ad design isn’t innovation—it’s revenue optimization at the expense of user experience.

Following Google’s Controversial Footsteps

Apple’s redesign copies the exact playbook that landed Google and Amazon under FTC investigation. In September 2025, the FTC probed both companies for misleading search advertising practices. Google was ruled an illegal monopoly in digital advertising just months earlier in April 2025. Moreover, the FTC’s “Bringing Dark Patterns to Light” report specifically identifies “advertisements designed to look like independent, editorial content” as user deception.

Amazon pioneered blended ads with deliberately muted “Sponsored” text in light gray. Google reduced ad labeling prominence in Search years ago. Meta made Instagram and Facebook ads virtually indistinguishable from organic posts. According to Hubspot, 34% of users report clicking ads by mistake when they’re disguised as content. Apple is implementing the same dark pattern, just later than competitors.

The Hacker News community reaction was swift and negative—362 points and 280 comments within hours. One user captured the sentiment: “It’s shocking that Apple hasn’t done this trick yet when everyone else started years ago.” The comment wasn’t praise. It was disappointment that Apple abandoned its differentiation.

Organic Discovery Is Dead

For iOS developers, this accelerates the shift to pay-to-play. Developers already report that App Store search is “fundamentally broken”—searching for specific app names returns dozens of irrelevant results before the target app appears. Blending ads with organic listings makes the problem worse. Industry consensus is clear: paid advertising is becoming mandatory, not optional. Furthermore, App Store ads are expected to become “a standard line item in launch budgets” by late 2026.

Small developers without ad budgets face near-invisibility. Apple profits twice from this dynamic: 30% commission on app sales plus revenue from search ads. The barrier to entry for indie developers rises while Apple’s Services revenue grows. Additionally, ASO data shows 70% of app installs originate from search, making ad-free discovery critical. When ads dominate search results and blend seamlessly with organic listings, organic rankings become irrelevant.

Apple’s Premium Promise Under Question

Apple has positioned itself as the privacy-first, user-first platform for years. “What happens on your iPhone stays on your iPhone” wasn’t just a tagline—it was brand differentiation justifying premium pricing and 30% App Store commissions. The company charges more than competitors specifically because it claims to offer superior user experience without compromising principles for revenue.

This ad redesign contradicts that promise. Tim Cook has criticized other platforms for dark patterns and deceptive practices. Now Apple adopts the same techniques. The 30% commission was defended as payment for a curated, quality ecosystem. However, when Apple prioritizes ad revenue over search transparency, that defense weakens considerably.

If the A/B test shows higher click-through rates—which it almost certainly will, since user confusion drives clicks—expect universal rollout in 2026. More ads are coming: Maps advertising, multiple App Store placements, potentially Apple TV+ and News+ monetization. The trajectory is clear. Every tech platform eventually prioritizes revenue extraction over user experience. Apple is choosing the same path.

Key Takeaways

- Apple is testing App Store ads that blend with organic results, removing blue backgrounds and leaving only small “Ad” labels—the same dark pattern that put Google and Amazon under FTC investigation.

- Services revenue pressure ($109.2B in fiscal 2025, 14% YoY growth) is driving user-hostile design decisions that contradict Apple’s “premium UX” brand positioning.

- For developers, paid advertising is becoming mandatory for App Store visibility, with organic discovery effectively dead—raising barriers for indie developers while Apple profits from both commissions and ad spend.

- This represents a test of Apple’s values: maintain brand differentiation or maximize short-term revenue like every other platform.

- If the test succeeds (higher CTR through user confusion), expect rollout across App Store search, Maps, and potentially other Apple services in 2026.