The $500 Billion Semiconductor Gamble

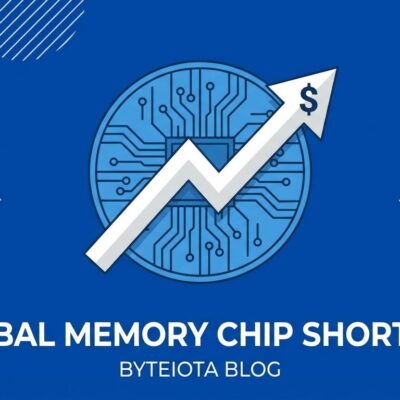

On January 15, Taiwan and the US announced the largest semiconductor investment in history: $250 billion from Taiwanese companies plus $250 billion in government credit guarantees. The goal: relocate 40% of Taiwan’s semiconductor supply chain to the US. For developers depending on Nvidia GPUs and TSMC-manufactured chips, this reshapes everything. The uncomfortable question: Does this reduce supply chain risk or just relocate it?

Taiwan commits $250 billion in direct investment from semiconductor companies, backed by $250 billion in credit guarantees from Taiwan’s government. In exchange, the US caps tariffs at 15% on Taiwanese goods (down from 20%) and drops them to 0% on pharmaceuticals and aircraft components.

The rationale: reverse 34 years of decline. The US controlled 37% of global semiconductor manufacturing in 1990, falling to less than 10% by 2024. Meanwhile, TSMC manufactures 92% of the world’s advanced AI chips—every Nvidia H200, AMD Instinct MI300, and Apple M-series chip. That’s a single point of failure sitting 110 miles from mainland China.

Developer Reality: 2026 Brings Pain, Not Relief

TSMC’s Arizona fabs are under construction, not producing chips. The second fab starts equipment installation Q3 2026, hitting production in 2027. Full capacity won’t arrive until 2028 or later.

Meanwhile, the chip crisis accelerates. Memory prices surged 50-55% in Q1 2026—TrendForce called it “unprecedented.” SK Hynix sold out its entire 2026 RAM production by October 2025. Nvidia received orders for 2 million H200 chips but has inventory of only 700,000 units. GPU manufacturers cut consumer card production 30-40% to prioritize AI accelerators.

Developers and AI startups get squeezed. Hyperscalers like AWS and Google Cloud secure priority allocation. Without multi-year chip contracts, 2026-2027 will test your resourcefulness. Training costs rise, inference becomes expensive, and GPU access becomes a competitive moat.

Silicon Shield Erosion: Taiwan Loses Leverage

Taiwan’s semiconductor dominance has long been its “silicon shield”—the principle that Taiwan’s chip industry is so critical that it deters Chinese invasion. Taiwan’s chips represent 18% of its GDP and 60% of exports. China imports up to 60% of its chips from Taiwan.

This deal weakens that shield. Moving 40% of Taiwan’s supply chain to the US reduces Taiwan’s indispensability. As Lawfare noted: “The more both sides treat advanced AI as a decisive strategic imperative, the greater the risk that Taiwan’s silicon shield becomes a target.”

The uncomfortable implication: Taiwan sacrifices geopolitical leverage for economic incentives. If the US becomes less dependent on Taiwan for chips, does Taiwan’s strategic value decline? Could that embolden China? The CNBC analysis suggests the deal is “unlikely to fully wean Washington off Taiwan’s most advanced semiconductors anytime soon,” but the long-term trajectory is clear—Taiwan’s shield is eroding.

Does Reshoring Actually Improve Resilience?

The official narrative claims reshoring reduces supply chain risk. That’s debatable.

The old risk: 92% of advanced chips made in Taiwan, vulnerable to Chinese aggression. The new risks: US fabs cost 30-50% more to build and operate. A single fab requires $15-20 billion and 3-5 years from groundbreaking to production. The US faces a workforce crisis—67,000 semiconductor workers are needed but don’t exist. TSMC delayed its Arizona fab opening from 2024 to 2025 due to “shortage of specialist workers.”

Even when Arizona fabs come online, they lag behind Taiwan. TSMC’s “N-2 rule” means overseas plants trail at least two generations behind Taiwan’s cutting-edge nodes. Arizona produces 3nm chips while Taiwan advances to 2nm. The US still depends on foreign suppliers for 60% of chemicals and materials needed for chip fabrication.

We’ve traded one form of concentration for another. Instead of 92% in Taiwan, we’re building toward concentration in Arizona. True resilience requires geographic diversification across Taiwan, the US, Europe, Japan, and South Korea. Relocating from one country to another doesn’t eliminate single points of failure—it shifts them.

What Developers Should Watch

Assume chip scarcity persists through 2027. Memory prices stay elevated as AI demand outstrips supply. GPU allocation favors hyperscalers. Plan accordingly: optimize for cost efficiency, adopt multi-cloud strategies, and watch TSMC Arizona production milestones.

Geopolitical tensions matter. US-China-Taiwan relations directly affect supply chains. Alternative architectures like Groq’s LPUs and Cerebras wafer-scale engines may offer escape hatches if traditional GPU access tightens.

The $250 billion bet is historic, but it’s not a silver bullet. Reshoring takes a decade, introduces new risks, and doesn’t guarantee resilience. Developers building on this infrastructure should plan for a long, uncertain transition.