On January 16, 2026, ClickHouse dropped a triple bomb: a $400M Series D led by Dragoneer (tripling valuation to $15B), the acquisition of Langfuse—the leading open-source LLM observability platform serving 19 Fortune 50 companies—and a commitment to keeping Langfuse MIT licensed. The message is clear: AI infrastructure vendors must own the full stack. Analytics alone won’t cut it; observability isn’t optional. ClickHouse is betting they can deliver both.

This isn’t just another acquisition. It’s a strategic declaration that the database wars are expanding. ClickHouse, already competing with Snowflake ($70B market cap) and Databricks ($43B valuation), is now claiming territory in LLM observability—a market Datadog and New Relic thought they owned.

LLM Observability is a Data Problem

The technical rationale is unusually strong for an acquisition. Langfuse v3 already runs on ClickHouse internally, not because of partnership talks, but because the technical fit was obvious. As Langfuse CEO Marc Klingen put it: “LLM observability and evaluation is fundamentally a data problem.”

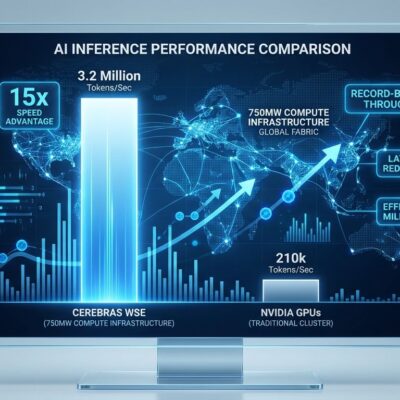

Consider the data volume. Every LLM API call generates traces: prompts, responses, token counts, latency measurements, cost tracking. At scale—Langfuse handles 23.1M+ SDK installs per month—this becomes a columnar analytics problem, exactly where ClickHouse excels. The platform delivers 2-10× faster performance than Snowflake on similar workloads while costing 3-5× less.

Langfuse migrated from Postgres to ClickHouse precisely because Postgres hit bottlenecks at millions of rows. Fortune 500 companies running production LLM applications can’t tolerate slow observability queries. When debugging a hallucination or cost spike, developers need answers in sub-second timeframes, not minutes.

The acquisition validates the technical bet. Klingen notes: “Now, as one team, we can deliver a tighter end-to-end product: faster ingestion, deeper evaluation, and a shorter path from a production issue to a measurable improvement.”

Related: AI Infrastructure ROI Crisis: $3T Investment, $25B Return

The Open Source Promise—Will It Last?

Both companies publicly committed to keeping Langfuse MIT licensed and self-hostable post-acquisition. On paper, this looks solid. ClickHouse has open source DNA—it’s been Apache 2.0 licensed since the 2016 release from Yandex and maintained that commitment through the 2021 spinout.

But developers should be skeptical. Acquisition history is littered with broken open source promises. Companies announce license commitments during PR cycles, then quietly relicense 12-18 months later when attention fades. MySQL, Redis, Elastic—the pattern repeats.

The community is watching. Langfuse’s 20,572 GitHub stars represent real developers who chose the platform specifically for its MIT license and self-hosting capabilities. Enterprise customers aren’t naive; they know vendor lock-in risks. The license commitment matters for compliance, data governance, and long-term control.

ClickHouse’s advantage is that open source serves their business model. The more developers self-host and prove the platform at scale, the easier the upsell to managed ClickHouse Cloud becomes. Killing the open source version would eliminate their primary growth channel.

Still, watch for signs: changes to CLAs, new proprietary features exclusive to managed service, or “enterprise-only” observability capabilities. If ClickHouse starts walling off functionality, the promise was performative.

Database Wars Expand into AI Tooling

The $15B valuation puts ClickHouse in elite territory, though still dwarfed by Snowflake’s $70B market cap. But this acquisition signals a strategic shift. Database vendors aren’t just competing on analytics anymore—they’re racing to own the entire AI data stack.

ClickHouse CEO Aaron Katz made the strategy explicit: “We are expanding our offering to include LLM observability, so AI application builders can evaluate the quality and behavior of AI outputs as they move into production.” Translation: developers shouldn’t need separate vendors for analytics and AI observability. One platform, one bill, one integration.

The competitive implications are immediate. Langfuse already serves 63 Fortune 500 companies. With ClickHouse’s financial backing and deeper technical integration, adoption will accelerate. Datadog and New Relic, currently building out LLM observability features, face a platform-native competitor with proven enterprise traction.

Snowflake and Databricks can’t ignore this. Expect consolidation: acquisitions of LLM observability platforms or rapid feature development to match ClickHouse’s unified offering. The days of point solutions are ending. Enterprises want fewer vendors, not more.

Related: Snowflake Drops $1B on Observe—Datadog’s Nightmare

What This Means for Developers

The immediate takeaway: LLM observability is no longer experimental infrastructure. When 19 Fortune 50 companies standardize on a platform, it’s validated. Production AI applications require observability just like traditional services need monitoring—no debate.

Choose platforms that support open standards. Langfuse integrates with OpenTelemetry, allowing traces to pipe into Datadog, Grafana, or New Relic if needed. This flexibility protects against vendor lock-in, especially critical as consolidation accelerates.

Watch for Snowflake and Databricks responses. If they acquire LLM observability platforms in the next 6-12 months, the market direction is clear: unified AI data platforms win, point solutions lose. Plan accordingly.

The $15B valuation reflects AI infrastructure premiums, but also real technical value. ClickHouse’s 2-10× performance advantage and 3-5× cost savings compound at scale. The Langfuse acquisition adds enterprise-validated observability on top of proven analytics—a compelling package.

Developers building production LLM applications can no longer ignore observability. Costs spiral without token tracking. Hallucinations hide without tracing. Performance degrades without latency monitoring. The tooling exists, Fortune 500 companies use it, and now it’s backed by a $15B database vendor.

The database wars aren’t slowing down. They’re expanding. And AI observability just became the newest battlefield.