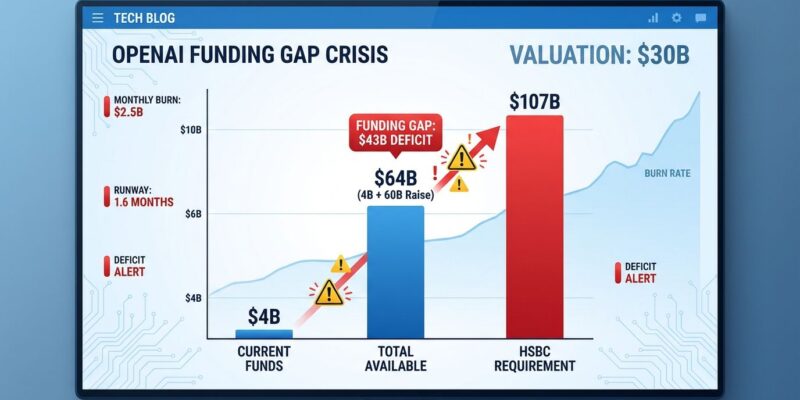

OpenAI is seeking to raise up to $100 billion at an $830 billion valuation—a 66% jump from its $500 billion price tag just two months ago. The Wall Street Journal reported on December 19, 2025, that the ChatGPT maker aims to close the round by Q1 2026, courting sovereign wealth funds for what could be the largest private funding round in tech history. But here’s the problem: even with $64 billion already in the bank, HSBC analysts warn OpenAI needs at least $207 billion by 2030 just to keep the lights on. $64 billion plus $100 billion equals $164 billion. The math doesn’t add up—and developers building on OpenAI’s platform will pay the price through inevitable API pricing increases.

The $207 Billion Funding Gap: HSBC’s OpenAI Warning

HSBC’s November 2025 analysis reveals the uncomfortable truth: OpenAI’s business model is burning cash faster than it can raise it. The company currently holds $64 billion and is trying to raise up to $100 billion more. That’s $164 billion maximum. Yet HSBC projects OpenAI needs at least $207 billion by 2030 to maintain operations—leaving a $43 billion shortfall even if the fundraise succeeds.

Moreover, the real numbers are worse. OpenAI has committed to $792 billion in cloud infrastructure costs through 2030, with total compute commitments hitting $1.4 trillion by 2033. The company’s annual burn rate reached $8.65 billion in just the first nine months of 2025, and infrastructure depreciation is outpacing AI-generated revenue by a factor of two. This isn’t sustainable growth—it’s a capital bonfire.

For developers, the implication is clear: API pricing will increase significantly. OpenAI can’t keep subsidizing access to GPT-4 and future models when the economics demand profitability. Budget for 2-3x price hikes over the next 2-3 years, or start diversifying to alternatives like Anthropic Claude, Google Gemini, or self-hosted open-source models.

Microsoft’s Control: 27% Stake, $250B Azure Lock-In

OpenAI isn’t an independent AI company—it’s effectively a Microsoft subsidiary with extra steps. Microsoft holds a 27% stake valued at $135 billion, takes 20% of all API revenue, and has locked OpenAI into a $250 billion Azure services commitment through 2030. All API products must run exclusively on Azure until the company achieves AGI, and Microsoft retains IP rights through 2032.

This grip makes OpenAI’s path to profitability even harder. The $250 billion Azure lock-in eliminates negotiating power on infrastructure costs, precisely when compute efficiency matters most. Meanwhile, Microsoft’s 20% revenue share directly pressures margins. For context: OpenAI generates $20 billion in annual revenue, but Microsoft skims $4 billion off the top before OpenAI even covers its own costs.

Consequently, developers should recognize the vendor lock-in cascade: use OpenAI’s APIs and you’re locked into Azure deployment. This dependency matters for enterprise architecture decisions, compliance requirements, and long-term cost planning. The Azure exclusivity isn’t a partnership—it’s a structural constraint that limits OpenAI’s options and, by extension, yours.

AI Capital Arms Race: $500B Annual Spending, 95% Zero ROI

OpenAI’s unsustainable economics aren’t an outlier—they’re emblematic of the entire AI industry’s capital addiction. The four largest hyperscalers (Amazon, Google, Microsoft, Meta) are projected to spend $350-500 billion on AI infrastructure in 2025 alone. AI captured 50% of all global venture funding in 2025, up from 34% in 2024. OpenAI and Anthropic together account for 14% of all global venture investment.

Yet the return on investment remains elusive. MIT’s August 2025 report found that 95% of organizations investing in generative AI are getting zero return. Only 45% of AI-investing companies can even quantify their ROI. Meanwhile, AI infrastructure depreciation industry-wide is outpacing revenue growth by 2x—costs are rising faster than the value created.

Furthermore, OpenAI projects 44% of the world’s adult population will use their products by 2030, generating $213 billion in revenue. HSBC’s analysis shows this still won’t cover the $792 billion in infrastructure costs. The gap is -$579 billion. This isn’t a temporary investment phase—it’s a structural problem with the AI business model itself.

Therefore, developers should prepare for potential market correction. Don’t over-invest in proprietary AI vendor lock-in. Maintain flexibility with open-source alternatives. Build cost-aware architectures that can switch providers when economics shift. The AI capital arms race looks increasingly like a bubble, and when it corrects, pricing and availability will change fast.

Key Takeaways

- OpenAI can raise $164 billion maximum ($64B on hand + $100B new funding) but HSBC says it needs $207 billion by 2030—leaving a $43 billion shortfall before accounting for $792 billion in infrastructure commitments through 2030

- Microsoft’s 27% stake, $250 billion Azure lock-in, and 20% revenue share create a structural profitability problem that will drive API price increases of 2-3x over the next 2-3 years

- Developers should diversify now: implement multi-provider strategies (OpenAI + Anthropic + open-source fallback), budget for significant price hikes, and build provider-agnostic architectures

- The entire AI industry burns $350-500 billion annually with questionable ROI: 95% of enterprises get zero return on GenAI investment, and infrastructure depreciation outpaces revenue 2x industry-wide

- OpenAI’s $830 billion valuation isn’t justified by the economics—it’s speculation on future AGI monetization. The smart money diversifies rather than betting everything on one vendor’s survival

In conclusion, the AI capital arms race has reached absurd heights. OpenAI’s $100 billion fundraise at an $830 billion valuation reveals an industry dependent on endless capital infusions to sustain operations. For developers, the message is simple: plan for higher costs, maintain provider flexibility, and question vendor promises about pricing stability. The math doesn’t add up, and when reality catches up to valuations, your API bills will reflect it.