Mistral AI released OCR 3 on December 18, 2025, with industry-disrupting $2 per 1,000 pages pricing—undercutting AWS Textract by 97%, Google Document AI by 93%, and Azure Form Recognizer by 50-75% for structured document extraction. The model achieves a 74% win rate over its predecessor on forms, scanned documents, complex tables, and handwriting recognition, with batch processing available at $1 per 1,000 pages. Document processing just shifted from premium enterprise service to commodity infrastructure.

Pricing Disruption Creates New Market Tier

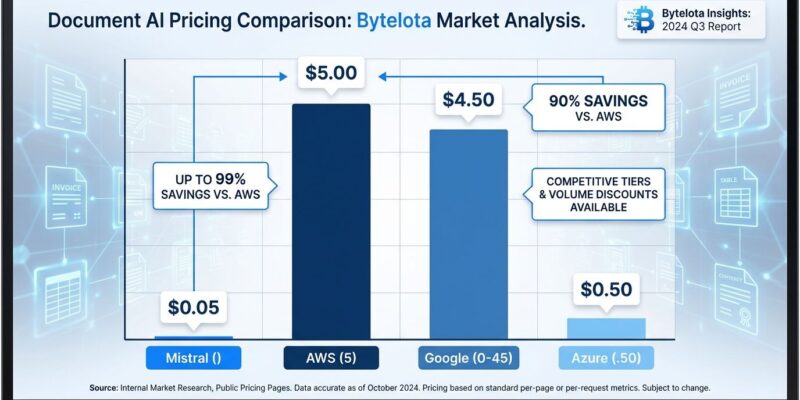

Mistral OCR 3 costs $2/1000 pages via standard API or $1/1000 with batch processing, compared to AWS Textract’s $65/1000 for forms and tables, Google Document AI’s $30-45/1000, and Azure Form Recognizer’s $1.50/1000 for basic extraction. For structured document extraction—forms, tables, handwriting—Mistral undercuts incumbents by 50-97%.

The cost delta isn’t theoretical. Processing 10,000 invoices monthly costs $20 with Mistral’s batch API versus $650 for AWS Textract, $300-450 for Google, or $150 for Azure. That’s 97%, 93%, and 87% savings respectively. The document AI market is projected to grow from $14.66 billion in 2025 to $27.62 billion by 2030, with 80% of enterprises planning to increase document automation investment. Mistral’s pricing makes API-first OCR economically viable for mid-market teams previously locked out by cost barriers.

This pricing compression follows a familiar 2025 pattern: specialized AI capabilities transitioning from competitive moats to commodity infrastructure. DeepSeek’s $0.55 per million input tokens (20-40x cheaper than OpenAI) triggered an AI stock selloff earlier this year. Mistral OCR 3 applies the same playbook to document processing—sacrifice margins to capture market share and force incumbents to either match pricing or differentiate on enterprise features.

Related: Cloud Egress Fees: The $43B Tax on Moving Your Data

What $2/1000 Pages Buys You

Mistral OCR 3 (model identifier: mistral-ocr-2512) targets enterprise pain points with specialized improvements over generic multimodal LLMs. Handwriting recognition handles cursive, mixed annotations, and text over printed forms. Forms processing extracts key-value pairs from boxes, labels, and dense layouts. Complex table reconstruction outputs HTML with colspan and rowspan attributes, preserving structure for downstream parsing into pandas DataFrames or SQL databases. Scanned document handling manages compression artifacts, skew, distortion, and low DPI.

The 74% win rate is measured against Mistral OCR 2 across these four categories—forms, scanned documents, tables, handwriting. Internal benchmarks are one thing. Independent validation is another. Hacker News users report mixed results: strong performance on equation parsing and cursive handwriting, weaker accuracy on complex multi-column layouts. One developer building a RAG system praised Mistral as “the only tool that parsed our equations correctly.” Another reported multiple extraction failures on complex tables.

Purpose-built OCR models beat general-purpose vision LLMs on document-specific tasks while costing less per page. Mistral’s smaller model size enables competitive pricing compared to token-based vision models charging $5-10+ for equivalent workloads. However, early feedback suggests production buyers should run pilot testing on representative document samples before full deployment. The model launched two days ago—too new for comprehensive third-party benchmarks on industry-standard datasets like FUNSD or DocVQA.

Commoditization Follows AI Pricing War Pattern

Mistral OCR 3’s pricing isn’t an isolated move. AI model costs dropped 65-90% across the board in 2025. The pattern: VC-backed challengers (Mistral, DeepSeek) undercut incumbents to capture market share, forcing specialized capabilities from “premium service” to “infrastructure pricing.” OCR is transitioning from competitive moat to table stakes, following the same arc as language model pricing compression.

Sixty-five percent of companies are accelerating Intelligent Document Processing with Generative AI, but pricing was a barrier for mid-market adoption. Mistral removes that barrier. The market is bifurcating: commodity OCR (Mistral, open-source) for cost-sensitive, non-regulated use cases versus enterprise OCR (AWS, Google, Azure) for regulated industries prioritizing compliance, SLAs, and ecosystem integration.

This creates a 3-5 year prediction: OCR becomes bundled infrastructure—free with cloud storage, databases, search platforms—rather than standalone revenue source. AWS, Google, and Azure will either match Mistral’s pricing on commodity extraction or double down on enterprise differentiation (custom model training, compliance certifications, seamless cloud integration). Developers should evaluate vendors on differentiation, not just price, because continued price drops are inevitable.

Compliance vs Cost: Choosing Your Tier

Mistral OCR 3’s pricing advantage comes with enterprise gaps. SOC2, HIPAA, and FedRAMP compliance status is undocumented. No published SLAs or uptime guarantees. Limited integration ecosystem—no native AWS Lambda, Google Cloud Functions, or Azure Logic Apps connectors. No custom model training options. AWS, Google, and Azure justify premium pricing with 99.9% SLAs, compliance certifications, and rich enterprise features.

Regulated industries—healthcare, finance, legal—require SOC2, HIPAA, or FedRAMP certifications. Mistral’s compliance posture is unclear. Azure Form Recognizer offers custom neural model training ($3/hour for sessions exceeding 10 hours). AWS Textract provides custom queries for domain-specific extraction. Mistral OCR 3 is a fixed model without customization options. Existing cloud customers face hidden switching costs: AWS ecosystem integration (Lambda, S3, SageMaker) versus Mistral’s standalone API.

The decision tree is straightforward. Need SOC2, HIPAA, or FedRAMP compliance? AWS, Google, or Azure. Non-regulated industry with cost-sensitive workloads? Mistral. Existing cloud ecosystem with tight integration requirements? Match your OCR vendor to your cloud provider. Azure offers 500 pages monthly for free; AWS provides a 3-month trial. Mistral has no free tier. For regulated industries and enterprise buyers prioritizing compliance, SLAs, and seamless cloud integration, incumbents retain the advantage despite 50-97% higher pricing.

Key Takeaways

- Mistral OCR 3 undercuts AWS Textract by 97% ($2/1000 vs $65/1000 for forms+tables), Google Document AI by 93% ($2 vs $30-45), and Azure by 50-87% for structured document extraction. Batch API pricing drops to $1/1000.

- Document AI follows the 2025 AI pricing war pattern—specialized capabilities transitioning from premium services to commodity infrastructure. Expect continued price drops and market bifurcation into commodity (Mistral, open-source) and enterprise (AWS/Google/Azure) tiers.

- The 74% win rate is measured against Mistral OCR 2 (internal benchmark), not against AWS, Google, or Azure. Independent Hacker News feedback shows mixed results: strong on equations and cursive, weaker on complex layouts. Run pilot testing before production deployment.

- Enterprise buyers face a compliance vs cost trade-off. Mistral lacks documented SOC2/HIPAA/FedRAMP compliance, published SLAs, and custom model training. Regulated industries (healthcare, finance, legal) require AWS/Google/Azure certifications despite higher pricing.

- OCR is no longer a moat—it’s becoming table stakes. Developers should evaluate vendors on differentiation (accuracy, compliance, integrations) rather than price alone, because pricing compression will continue across the market.