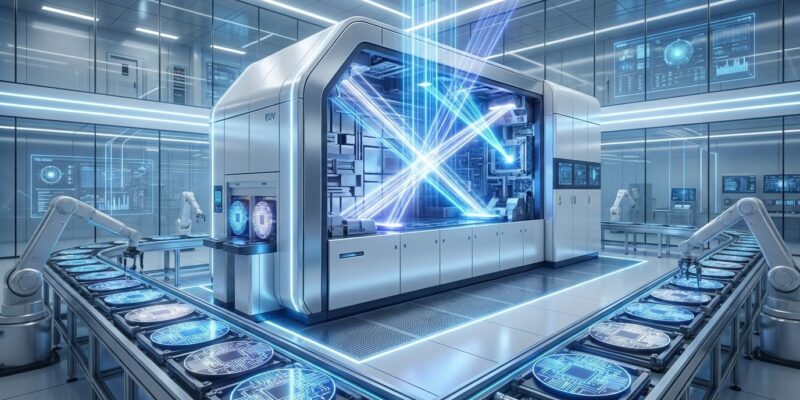

Chinese scientists in Shenzhen completed a working EUV lithography prototype in early 2025 by reverse-engineering ASML’s technology using salvaged parts and former ASML engineers. Around 100 recent university graduates, working under camera surveillance in a high-security lab, systematically reassembled components purchased through secondhand markets—building the same capability U.S. export controls spent years trying to prevent China from acquiring. The prototype successfully generates extreme ultraviolet light, though it hasn’t produced functional chips yet.

If China achieves commercial EUV independence, the West loses its primary leverage over AI chip manufacturing. Moreover, ASML’s $370 million EUV machines are the sole source of technology for cutting-edge 5nm, 3nm, and 2nm chips that power AI. For developers, this isn’t abstract geopolitics—it directly affects cloud costs, GPU availability, and the stability of infrastructure supply chains we depend on daily.

ASML’s $370M Monopoly: Why China Needs EUV

ASML is the only company on Earth that manufactures EUV lithography systems. These machines use light with a 13.5 nanometer wavelength—14 times shorter than older DUV technology—to etch circuits “thousands of times thinner than a human hair” onto silicon wafers. The process involves firing a powerful CO2 laser at molten tin droplets ejected at 70 meters per second, creating plasma that emits EUV light. Furthermore, that light bounces off ultra-precise Zeiss mirrors onto silicon wafers to form chip designs.

The precision is absurd: if you scaled ASML’s mirrors to the size of Germany, imperfections would be smaller than a millimeter. Additionally, each system weighs 331,000 pounds, ships in 250 crates requiring three transport aircraft, contains 100,000+ individual parts, and costs between $150-400 million. The latest High-NA models exceed $370 million each. Consequently, only TSMC, Samsung, and Intel can afford them—those three customers represent 84% of ASML’s business.

EUV isn’t optional for modern AI chips. It’s essential for scaling to 7nm, 5nm, 3nm, and sub-2nm nodes—the foundation of specialized AI accelerators and neural processing units. There’s no alternative technology. Older DUV systems physically can’t reach these scales. Therefore, ASML’s monopoly makes it the “linchpin” and “gatekeeper” of the entire AI revolution. Which is exactly why China is pursuing this prototype with national mobilization.

The Reverse Engineering Operation in Shenzhen

The Shenzhen prototype wasn’t built from scratch. Instead, former ASML engineers led the effort, leveraging their insider knowledge to reverse-engineer the world’s most complex manufacturing equipment. The team procured parts by salvaging components from older, decommissioned ASML machines sold on secondary markets. In addition, they used intermediary companies to obscure the buyer’s identity when sourcing from suppliers.

Inside the facility, which “fills nearly an entire factory floor,” approximately 100 recent university graduates work under constant camera surveillance. They receive bonuses for successfully reassembling components—turning reverse engineering into a systematized, gamified process. It’s scrappy resourcefulness at national scale: $370 million pristine ASML systems versus salvaged parts and determined young engineers.

The prototype is “crude but functional”—larger than ASML’s design after “earlier attempts to copy failed.” However, it works. The machine successfully generates extreme ultraviolet light, which is the fundamental breakthrough. Nevertheless, it hasn’t fabricated functional chips yet, which is the next monumental hurdle. The gap between generating EUV light and mass-producing working chips at commercial scale could be 3-10 years. China has spent decades attempting to indigenize turbofan engines and semiconductors with limited success—complexity matters. But the prototype is real, and it’s operational.

Did U.S. Export Controls Backfire?

Here’s the uncomfortable question: Did U.S. export controls accelerate the very outcome they aimed to prevent? After Biden’s October 2022 semiconductor restrictions, China launched a $41 billion semiconductor fund and President Xi Jinping called for “nationwide mobilization for self-reliance in AI.” The U.S. forced China to choose between dependence and indigenization. China chose indigenization—and backed it with massive capital.

The Huawei precedent is telling. When the U.S. cut Huawei off from Android and Windows, the company built HarmonyOS, which now runs on over 1 billion devices. Similarly, export controls didn’t stop Huawei; they forced Huawei to achieve the exact technological self-reliance Beijing wanted. An ITIF study titled “Export Controls Helped Huawei and Hurt U.S. Firms” argues restrictions promoted independent Chinese innovation and enhanced competitiveness in global markets.

The counter-argument is that indigenization is a “herculean task” China has attempted for decades without full success. Furthermore, ASML’s CEO claims export controls created a 10-15 year technology gap. Some analysts note that China’s YMTC began de-Americanization efforts even before significant export controls applied, driven by fear of future restrictions rather than current reality. Ultimately, the answer to whether controls worked depends entirely on timeline: if AI breakthroughs happen in the next 5 years, the U.S. bought critical advantage. If AI development takes 15+ years, China’s prototype-to-production timeline could catch up.

The truth likely sits between extremes. Export controls bought time, not permanent victory. However, they also motivated China to pursue EUV independence with Manhattan Project-level urgency. The original Manhattan Project went from start to atomic bomb in 3 years (1942-1945). When national survival is on the line, timelines compress.

China AI Chip Production: Current Reality Check

Despite U.S. restrictions, China’s chip output expanded 10.2% in the first 10 months of 2025 to 386.6 billion units. Huawei plans to produce 600,000 Ascend 910C AI chips in 2025—doubling from earlier estimates—scaling to 1.6 million by 2026. Meanwhile, SMIC, China’s largest foundry, is doubling 7nm production capacity in 2025, with utilization rates hitting 92.5% (up 7.3 percentage points year-over-year).

But there’s a critical bottleneck: Huawei’s high bandwidth memory (HBM) stockpile is expected to be depleted by the end of 2025, which could halt production entirely. And despite progress, a CFR report confirms “Huawei still can’t match Nvidia”—Chinese AI chips “pale in comparison to American silicon.” The chips are “good enough” for many AI applications, but not competitive for frontier models.

The 7nm node is China’s current ceiling. Without EUV, they can’t advance to 5nm, 3nm, or 2nm—the cutting edge where Western manufacturers operate. Consequently, the Shenzhen prototype, if successful, unlocks that next generation. That’s the strategic significance: not replacing current production, but enabling the future.

Three Scenarios: What Developers Should Watch

Scenario 1 (Prototype Succeeds, 2028-2032 Commercial EUV): China achieves chip self-sufficiency. U.S. export controls lose their primary leverage. The global semiconductor supply chain bifurcates into China-aligned and West-aligned ecosystems. AI development in China accelerates without bottlenecks. Consequently, geopolitical balance shifts significantly.

Scenario 2 (Partial Success, 2035+ Commercial EUV): China eventually gets there, but slowly. U.S. export controls bought a meaningful 10-15 year time advantage. The Western lead in AI is maintained during the critical early period. Nevertheless, by the time China catches up, the next technology frontier has emerged.

Scenario 3 (Failure): Technical hurdles prove insurmountable. The prototype remains a prototype. China continues relying on DUV technology and smuggled or older equipment. In this case, export controls are validated as an effective containment strategy. China remains 10-15 years behind on the cutting edge.

For developers and infrastructure planners, the conservative approach is to optimize for energy efficiency now and avoid betting on unproven technology. However, watch 2026-2028 closely—that’s the critical window for prototype-to-production transition. If China hits even 80% of milestones, EUV is real. Historical precedent cuts both ways: China’s high-speed rail went from importing technology to world leader in ~15 years. But turbofan engines and advanced semiconductors have taken decades with limited breakthroughs.

Key Takeaways

- China completed a working EUV lithography prototype in early 2025 using reverse-engineered ASML technology, salvaged parts, and ~100 engineers under surveillance in Shenzhen

- ASML’s $370 million EUV systems are the sole source of technology for cutting-edge 5nm/3nm/2nm AI chips—there is no alternative, which makes the monopoly a critical geopolitical chokepoint

- U.S. export controls may have backfired by accelerating Chinese indigenization: after October 2022 restrictions, China launched a $41 billion semiconductor fund and national mobilization (Huawei’s HarmonyOS precedent: 1 billion devices after being cut off from Android/Windows)

- China’s current AI chip production (Huawei 600K→1.6M Ascend chips, SMIC 7nm capacity doubling) shows progress despite restrictions, but performance still lags Nvidia and HBM bottlenecks loom

- Critical timeline: 2026-2028 is the inflection point for prototype-to-production transition—monitor China’s progress closely and plan infrastructure strategies for both success and failure scenarios

- Export controls bought time (ASML CEO claims 10-15 year gap), but whether that’s permanent or temporary depends on whether AI breakthroughs happen in 5 years (U.S. wins) or 15+ years (China catches up)

The gap between generating EUV light and mass-producing functional chips at scale is enormous. However, so was the gap between Sputnik and the Moon landing—and that took 12 years of intense competition. Chip geopolitics is now a fundamental risk factor for developers, like cloud outages or security breaches. Therefore, assume volatility, plan for both scenarios, and watch the inflection points.