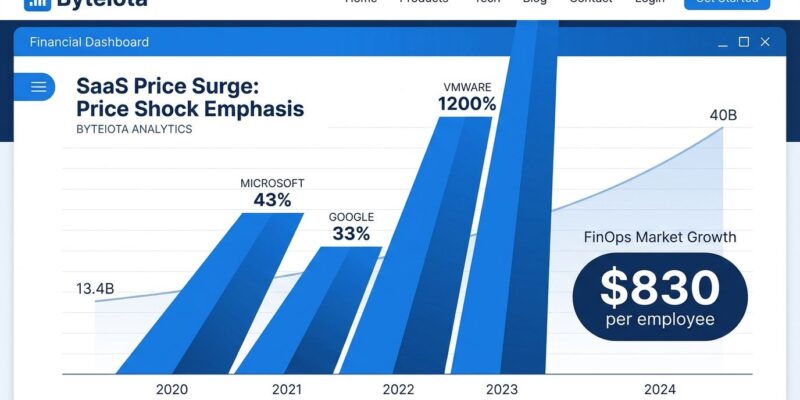

The enterprise software bill just got 43% more expensive. Microsoft 365 jumped from $6.99 to $9.99 per month in February 2025, forcing Copilot AI on subscribers whether they want it or not. Google Workspace followed in March with 16-33% increases, bundling Gemini AI with zero opt-out option. The average enterprise now spends $4,830 per employee per year on SaaS—up 21.9% in just one year—and global SaaS spend is projected to hit $390.5 billion in 2025.

This isn’t normal market pricing. SaaS inflation is running 5x higher than standard market inflation. Vendors are using “AI infrastructure costs” to justify price gouging, forcing developers and tech teams to completely rethink tool selection and budgeting. The pain is so severe it’s creating a gold rush: the Cloud FinOps market is exploding from $13.47 billion in 2024 to a projected $38-40 billion by 2034.

The Forced AI Bundling Strategy

Major SaaS vendors discovered a profitable trick: bundle AI features nobody requested, cite “infrastructure costs,” and force price increases with no escape hatch. Microsoft’s playbook is textbook vendor lock-in exploitation. Copilot gets bundled into Microsoft 365, prices jump 43%, and the only alternative is switching to “Classic” plans—which Microsoft introduced only after customer backlash and Australian regulators filed a lawsuit for misleading pricing practices in January 2025.

Google took an even harder line. Workspace Business and Enterprise plans now include Gemini AI automatically, adding $2-4 per user per month starting March 17, 2025. There’s no Classic plan, no opt-out option, and no way to decline features you don’t use. Even if you disable Gemini in the admin console, you still pay the new prices. For a 1,000-employee company, that’s $48,000 in additional annual costs with zero choice in the matter.

The “AI infrastructure costs” excuse doesn’t hold up under scrutiny. GPT-4 API costs have dropped over 90% since 2023, yet Microsoft justifies a 43% price increase for bundled AI features. This is profit maximization disguised as necessity—vendors are extracting maximum revenue while they have market power and customer lock-in.

FinOps Market Explodes: A $40B Industry Built on Vendor Greed

Here’s the perverse economic cycle: SaaS vendors increase prices aggressively, forcing companies to adopt FinOps tools to manage runaway costs. FinOps vendors profit from enterprise cost anxiety, creating yet another SaaS subscription to manage SaaS subscriptions. The market is growing from $13.47 billion in 2024 to $14.93-15 billion in 2025, with projections reaching $38-40 billion by 2034 at 11-34% CAGR depending on which analyst you ask.

McKinsey estimates $120 billion in potential cloud waste—28% of total spending goes to idle resources and over-provisioned instances. Deloitte predicts companies implementing FinOps tools could save $21 billion in 2025 alone, with some achieving up to 40% cloud cost reductions. It’s no surprise that 71% of organizations expect cloud budget increases in 2025, driving urgent FinOps adoption across enterprises.

Large enterprises (10,000+ employees) are leading the charge—over 70% now have dedicated FinOps teams. The FinOps Foundation even launched a certification program to standardize practices, turning FinOps from niche discipline to mandatory enterprise function. FinOps has shifted from “nice-to-have optimization” to “defensive necessity” against vendor price aggression.

Related: Cloud Waste Burns $200B: Why 30% of Spend Disappears

Developers Must Now Prove ROI for Every Tool

The era of “just use whatever tools you want” is dead. With SaaS spend hitting $4,830 per employee per year (up 21.9% year-over-year), developers must now justify every tool choice with business value, ROI calculations, and alternative evaluations. Tool selection has shifted from feature-driven to cost-driven decision making.

Docker’s 67-80% price increase pushed development teams to seriously evaluate Podman and containerd alternatives. VMware’s 150-1,200% increases following Broadcom’s acquisition accelerated mass migrations to Proxmox, OpenStack, and Nutanix—thousands of enterprises fleeing what European customers called “price hikes under significant pressure.” Mid-market companies (500-10,000 employees) got hit hardest, seeing 40% year-over-year cost increases per employee.

IT and healthcare sectors now exceed $10,000 per employee in SaaS spending. Organizations average 112 SaaS applications with an estimated 28% waste from unused licenses, redundant tools, and forgotten dev environments burning cash. Finance teams are demanding accountability, and engineering teams are discovering that budget constraints force long-overdue SaaS portfolio cleanup.

Open Source Alternatives Gain Serious Momentum

As SaaS vendors maximize extraction, open source alternatives are crossing the ROI threshold. Transitioning enterprise SaaS applications to open source can achieve up to 95% cost reduction. At $4,830 per employee per year, the calculus has shifted: LibreOffice was “good enough” before; at current Microsoft 365 prices, it’s financially compelling even with self-hosting costs factored in.

VMware’s Broadcom-driven price explosion exemplifies the trend. Facing 1,200% increases, enterprises aren’t just complaining—they’re migrating. Proxmox and OpenStack deployments are surging as companies break free from vendor lock-in. Multiple GitHub repositories now catalog open source alternatives for every major SaaS category, with developer communities creating comprehensive migration guides.

Open source isn’t free—hosting, maintenance, and support create real costs. But those costs are predictable and controllable, unlike endless subscription price increases. Organizations willing to invest infrastructure expertise can achieve data ownership, customization freedom, and protection from future vendor price shocks. The trade-off equation has flipped.

What This Means for Tech Teams

Expect more price increases—this is the new normal. SaaS vendors have discovered they can bundle AI features, claim infrastructure costs, and extract 20-43% increases from customers with limited alternatives. Australian regulators filed lawsuits, European customers complained about VMware’s “significant pressure” tactics, yet price hikes continue accelerating.

FinOps is transitioning from optional optimization to defensive requirement. If your organization spends over $500K annually on cloud and SaaS, FinOps tools deliver positive ROI. McKinsey’s $120 billion waste estimate and Deloitte’s 40% reduction potential aren’t aspirational—they’re achievable with mature FinOps practices and dedicated teams.

Conduct quarterly SaaS audits. With 28% average waste and 112 applications per company, unused licenses are guaranteed money sitting on the table. Identify redundant tools—does your company really need three project management platforms? Kill forgotten dev environments that burn $500/month while nobody’s looking.

Evaluate open source alternatives for non-core tools. 95% cost reduction is possible, but requires honest assessment of hosting and maintenance capabilities. Not every tool justifies migration, but vendor lock-in leaves you vulnerable to future price shocks.

Negotiate with data. FinOps platforms provide ammunition for vendor discussions. Show actual usage: “Only 15% of our users access Copilot features—we won’t pay 43% more for something most employees ignore.” Large customers with leverage can demand custom pricing. Vendors may prefer discounts over losing enterprise contracts entirely.

Key Takeaways

- SaaS inflation runs 5x higher than market inflation, with Microsoft (43%), Google (16-33%), and VMware (up to 1,200%) leading price increases in 2025

- The FinOps market explodes from $13.47B to $38-40B (2024-2034) as vendor greed creates a defensive industry managing vendor greed

- Developers must prove ROI for tool choices—engineering culture shifts from freedom to budget accountability with $4,830/employee annual costs

- Open source alternatives achieve up to 95% cost reduction; at current SaaS prices, migration ROI thresholds are crossed for many tools

- Quarterly SaaS audits eliminate 28% average waste; FinOps practices can reduce cloud costs 15-40% for organizations spending $500K+ annually