While the tech world obsesses over which large language model will dominate, Credo Technology Group’s stock surged 13% on November 25, jumping from around $133.50 to $150-151 per share. The catalyst? A patent licensing deal with The Siemon Company announced the day before. The agreement covers Credo’s Active Electrical Cable technology—the high-speed connectors that make AI data centers possible. It’s a stark reminder that in the AI gold rush, the companies selling pickaxes are making real money while everyone else debates which direction to dig.

What Are Active Electrical Cables and Why Do They Matter?

Active Electrical Cables integrate signal processing chips directly into copper cables to boost data transmission speeds. Credo’s AEC technology supports 400G to 800G speeds over 5-7 meters while consuming 75% less power than optical alternatives and costing about 50% less than Active Optical Cables. For AI clusters with up to one million GPUs, every millisecond of latency between processors affects training speed. AEC fills the gap between cheap-but-limited traditional copper and expensive optical fiber.

The technology matters because modern AI workloads require massive GPU clusters that communicate constantly. When you’re training a large language model across 100,000 GPUs, the cables connecting them become a critical bottleneck. Credo’s solutions address this by providing what industry analysts call the “connective tissue” for AI servers—handling everything from server-to-switch connections to rack-to-rack networking.

The “Pickaxe Sellers” Winning in AI Infrastructure

There’s an old gold rush wisdom: sell pickaxes, don’t mine for gold. Credo’s patent deal with Siemon demonstrates this principle in action. While AI model companies battle over uncertain monetization strategies—what some insiders are calling “vibe revenue”—infrastructure providers are building guaranteed demand.

Consider the numbers. Credo’s revenue grew 126% year-over-year to $436.8 million in fiscal 2025. The company’s stock is up 221% overall on the AI infrastructure wave. Meanwhile, November 2025 alone saw over $500 billion in AI infrastructure announcements: the Stargate initiative ($500B over four years from OpenAI, SoftBank, Oracle, and Microsoft), Anthropic’s $50 billion US data center build-out, Microsoft’s $10 billion Portugal investment, and Google’s €5.5 billion Germany expansion.

Every one of those data centers needs thousands of high-speed cables. Whether GPT-5, Gemini 3, or Claude Opus 4.5 ultimately wins the LLM wars doesn’t matter to Credo—they’re selling connectivity to all sides. Goldman Sachs forecasts data center demand to grow 50% by 2027, with 17% compound annual growth through 2028. That’s not speculation; that’s infrastructure already under construction.

Patent Licensing Signals Market Maturation

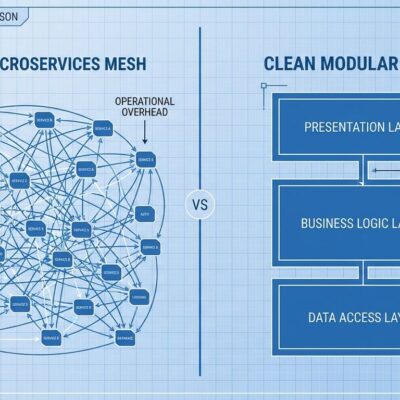

The Credo-Siemon deal reveals something beyond stock price movements. Siemon, a 122-year-old cabling company operating in over 100 countries with more than 400 patents of its own, chose to license Credo’s technology rather than develop competing AEC solutions. This signals market maturation in AI hardware supply chains.

Patent licensing creates recurring revenue beyond product sales—a strategy similar to Qualcomm’s IP monetization model in mobile chips. For Credo, it means multiple revenue streams from the same technology. For Siemon, it’s faster and cheaper than building from scratch. For the industry, it suggests AEC is becoming a de facto standard rather than one option among many.

The deal terms remain confidential, but the market reaction speaks clearly: investors believe Credo holds defensible intellectual property in a critical segment of AI infrastructure. When an established player like Siemon validates a newcomer’s innovation by licensing rather than competing, that’s a vote of confidence in the technology’s long-term viability.

The Infrastructure Bubble Question

Not everyone believes AI infrastructure investment is sustainable. Tech companies are issuing record bonds to fund estimated $570 billion in AI capital expenditures. Some analysts draw parallels to the dot-com era, when telecom companies overbuilt fiber infrastructure that took decades to fill. Enterprise AI pilots reportedly fail 95% of the time, according to MIT research. AI company executives themselves admit concerns about bubble dynamics.

But infrastructure has a crucial advantage over applications: demand exists regardless of which specific AI use cases succeed. AWS and Azure became cloud infrastructure winners even as thousands of SaaS companies failed. The same logic applies to AI data centers. Whether generative AI lives up to its hype or not, the GPU clusters are already deployed and need connectivity. Credo’s 126% revenue growth suggests demand is real, not speculative.

The company is also hedging technology risk. Its recent acquisition of Hyperlume, a microLED optical interconnect developer, positions Credo for a potential future where optical solutions become more cost-effective. That’s strategic planning, not blind faith in copper cables.

What This Means for Developers

If you’re building AI infrastructure, understanding connectivity is as important as choosing GPUs. Your cluster is only as fast as your slowest cable. GPU utilization is limited by inter-GPU communication speed, and infrastructure costs are often underestimated in AI projects. AEC’s 75% power savings compared to optical solutions translates to lower total cost of ownership over multi-year deployments.

Technology choices made today lock in costs and capabilities tomorrow. When evaluating AI infrastructure, look beyond the flashy GPU specifications to the “boring” components like connectivity, power distribution, and cooling. Those unglamorous details determine real-world performance and economics.

Credo’s stock surge on a patent licensing deal tells a simple story: infrastructure will outlast whatever AI model is hot this week. The least sexy part of AI is where investors are getting rich.