Joby Aviation sued rival Archer Aviation on November 20, 2025, accusing the company of corporate espionage after a former employee allegedly stole confidential partnership strategies to help Archer undercut an exclusive vertiport deal. The lawsuit—filed in California Superior Court—alleges George Kivork downloaded dozens of files containing business strategies and infrastructure plans before joining Archer in July, then Archer used this intelligence to approach Joby’s strategic partner with a more lucrative counter-offer.

This is Archer’s second trade secret lawsuit in four years. The timing is critical: both companies are racing for FAA certification to launch commercial air taxi services in 2026, and vertiport partnerships are the competitive moat that will determine market winners.

The Allegations: Midnight Downloads and Strategic Theft

George Kivork, Joby’s former U.S. state and local policy lead, allegedly exfiltrated confidential files two days before resigning in July 2025. According to Joby’s complaint, Kivork downloaded files containing partnership terms, vertiport infrastructure strategies, regulatory tactics, and technical aircraft information. He sent some to his personal email and changed security permissions for hundreds more files to access them after leaving.

The forensic investigation revealed what Joby calls “planned and premeditated” corporate espionage. When approached, Kivork allegedly refused to return the stolen files.

But the theft itself isn’t the smoking gun. Joby claims Archer weaponized this intelligence. Armed with knowledge of Joby’s confidential terms with a vertiport developer, Archer allegedly approached the same partner and offered a more lucrative deal. The developer later attempted to terminate its agreement with Joby, citing breach of confidentiality—exactly what Archer would want if it had inside information about Joby’s weaknesses.

Archer’s Defense: “Baseless Litigation”

Archer’s response? Complete denial. Eric Lentell, Archer’s chief legal and strategy officer, called it “baseless litigation meant to slow its leading competitor.” He emphasized that Kivork was a “non-technical employee” in business development, implying he didn’t have access to truly valuable trade secrets. Archer insists it has “no deal with this developer” and that “Mr. Kivork did not bring any Joby confidential information to Archer.”

The market doesn’t believe them. Archer’s stock plunged 8% following the lawsuit announcement, and the company is down 25% year-to-date while Joby is up 60%. As one analyst noted, “the rebuttal failed to assuage investors, as the case raises questions about Archer’s governance and risk management.”

The Wisk Precedent: This Is Archer’s Second Rodeo

Here’s why investors are spooked: Archer settled a nearly identical lawsuit just two years ago. In 2021, Wisk Aero (now a Boeing subsidiary) sued Archer for allegedly stealing 50+ trade secrets via a former employee who downloaded thousands of files before joining Archer. The company hired 10 Wisk engineers, and its aircraft bore a “striking resemblance” to a Wisk-patented design.

After two years of bitter litigation, Archer settled in August 2023—days before trial—by paying tens of millions in stock, making Wisk its exclusive autonomy technology provider, and granting stock options worth millions more. Archer settled “without admitting wrongdoing,” but the pattern is damning.

Two lawsuits in four years, both alleging former employees downloaded files before joining Archer, both involving suspiciously similar competitive intelligence. Once is an accident. Twice is a pattern.

Why Vertiports Matter More Than Aircraft Design

The stolen information wasn’t aircraft schematics—it was partnership strategies and vertiport access. That’s the real story here.

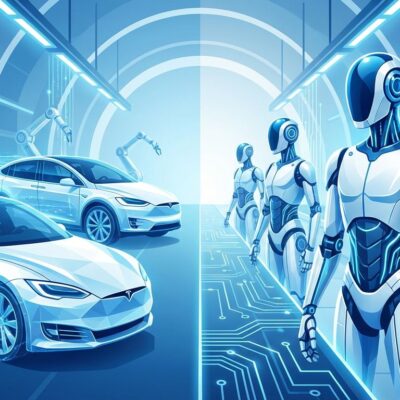

Vertiports are landing and takeoff zones for eVTOLs, the urban air taxi equivalent of prime airport gates or ride-sharing pickup zones. Securing exclusive agreements in major cities is the competitive moat in this industry, because limited urban real estate makes these locations extraordinarily valuable. If you control the infrastructure, you control the market.

Archer understands this. The company spent $126 million on a 30-year lease for Hawthorne Airport in Los Angeles—80 acres of dedicated airspace access. Joby has partnered with Nomura Real Estate in Japan and Delta Air Lines for multi-city vertiport networks. Without exclusive locations, competitors face what industry insiders call “structural disadvantages”: worse scheduling priority, limited pricing control, and inferior customer experience.

This is why Joby is furious. Knowing the confidential terms of a competitor’s exclusive vertiport deal is like having the playbook to undercut them precisely where it hurts most. If Archer used stolen intelligence to offer better terms, it could disrupt Joby’s infrastructure strategy right as both companies approach commercial launch.

The Stakes: FAA Certification and First-Mover Advantage

Both companies are approaching the finish line of FAA Type Certification, which allows commercial passenger operations. Joby has completed approximately 70% of Stage 4 testing and analysis and plans to carry passengers in 2026. Archer is approaching Type Inspection Authorization testing by the end of 2025, with a UAE launch next year.

Only two U.S. companies have FAA Part 135 Air Carrier Certificates: Joby and Archer. In a fragmented market with over 800 eVTOL programs competing globally (projected to reach $2.93 billion by 2032), the winner of this two-horse race gets first-mover advantage in the world’s largest aviation market.

The lawsuit threatens Archer’s momentum precisely when it can least afford distraction. Partnership negotiations, investor confidence, and FAA scrutiny all take hits when “corporate espionage” enters the conversation. The March 2026 hearing won’t resolve before both companies’ planned launches, meaning months of uncertainty.

What Happens Next

If history repeats—and the Wisk precedent suggests it will—this lawsuit ends in settlement. Archer will likely pay Joby in stock or cash, possibly grant partnership concessions, and settle “without admitting wrongdoing.” The March 2026 hearing becomes a negotiation deadline rather than a trial date.

But the damage is done. Archer’s pattern of trade secret lawsuits is now public record, its stock is underperforming, and future partners will demand higher due diligence. Joby, meanwhile, has sent a clear message: vertiport exclusivity is worth fighting for, and competitors who cross the line will face legal warfare.

The air taxi industry is maturing from R&D to commercialization, and the stakes are shifting from who builds the best aircraft to who controls the best infrastructure. Joby’s lawsuit reveals what really matters in this market: not your aircraft’s range or speed, but whether you can lock competitors out of the airports.