Waymo robotaxis started driving on freeways across San Francisco, Los Angeles, and Phoenix on November 12, cutting ride times by up to 50% and expanding service to 260 square miles. This is the first time fully autonomous taxis operate on high-speed freeways at commercial scale. But here’s the tension: Waymo rides still cost 31-41% more than Uber or Lyft. Does 50% faster service justify a 40% price premium?

The answer matters because freeway access isn’t just a feature. It’s the unlock for commercial viability.

Freeway Driving Is the Technical Mt. Everest

Autonomous vehicle companies have avoided freeways for years. Waymo “wanted to be sure its technology was safe before deploying it at faster speeds,” and for good reason. IEEE characterized freeway driving as “very easy to learn but very hard to master when it comes to full autonomy.” At city speeds, an autonomous vehicle predicts 3 seconds ahead. On freeways at 65 mph, it must predict 10 seconds ahead while sensing “much farther down the road.” The consequences of errors magnify at highway speeds.

Yet there’s a safety paradox. Freeways might actually be SAFER for autonomous vehicles than city streets. Freeways offer predictable environments: consistent lanes, no pedestrians, fewer intersections, uniform traffic flow. City streets throw infinite edge cases: jaywalkers, delivery trucks double-parked, cyclists weaving through traffic, construction zones appearing overnight.

Waymo’s safety data supports the paradox. Swiss Re analysis found 92% fewer bodily injury claims and 88% fewer property damage claims compared to human drivers over 25 million miles. Waymo’s fleet has driven 96 million rider-only miles with zero deaths blamed on the autonomous system. While federal records show 80+ injury-causing incidents since 2021, research shows Level 4 autonomous vehicles are 90% less likely to be involved in fatal accidents than human-driven cars.

About 18% of US traffic fatalities occur on interstate highways. Waymo just bet that autonomous systems handle freeways better than humans do.

The 50% Speed Claim Changes Economics

Waymo’s freeway expansion delivers concrete metrics. Service area grew to 260 square miles spanning San Francisco to San Jose. Ride times dropped up to 50%. San Jose Mineta International Airport became the first commercial California airport offering curbside autonomous rides.

Here’s why the speed boost matters: robotaxis haven’t solved the cost problem yet. Current pricing shows Waymo at $3.50/km versus Uber’s $2.90/km and Lyft’s $2.60/km. Waymo costs 31-41% more despite eliminating driver labor costs. Industry analysts note “it’s actually quite expensive to run an AV, and that’s not going to be happening, at least in the near term.” Fleet operations, sensor maintenance, and infrastructure costs keep prices high.

But 50% faster rides mean autonomous vehicles complete twice as many trips per hour. That’s the path to better unit economics. Waymo isn’t competing on price. They’re competing on speed, safety, and experience. And it’s working: 70% of Waymo riders prefer driverless cars to traditional rideshare. TechCrunch found “Waymo rides cost more than Uber, Lyft — and people are paying anyway.”

The math: Waymo is 40% more expensive but 50% faster. If you value time, that’s a net win. For most riders, cheaper still beats faster. But Waymo is playing the premium strategy, not the commodity game.

Waymo Pulled Far Ahead of Competitors

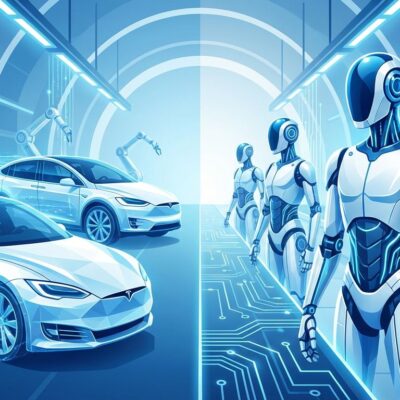

The autonomous vehicle race is over for now. Waymo won.

Tesla’s Full Self-Driving remains Level 2 autonomy, requiring a safety driver. Tesla “still doesn’t have the permits or government-reported test mileage necessary to operate driverless in California.” Their robotaxi operates on Bay Area bridges, but with a human in the front seat. Tesla is years behind.

Zoox focuses on urban ride-hailing with vehicles capable of 75 mph but cruising at 45 mph in cities. They’re running employee-only test rides with commercial service slated for 2026. No freeway operations announced.

Cruise is attempting a comeback after a 2023 pedestrian accident triggered legal troubles and staff departures. No current freeway capabilities.

Meanwhile, Waymo operates commercially in five cities: San Francisco, Los Angeles, Phoenix, Austin, and Atlanta. They’ve driven 96 million autonomous miles. And now they’re the only company offering freeway robotaxi service at scale.

The gap is widening, not closing.

What’s Next: Rapid Expansion

Waymo is rolling out freeway access to Austin and Atlanta in the near term. In 2026, they’re launching operations in Dallas, Houston, San Antonio, Miami, and Orlando. More airport integrations are coming after San Jose’s successful deployment.

The robotaxi market is projected to reach $45.7 billion by 2030. Traditional ride-hailing companies see it too: Uber and Lyft now offer robotaxis “as a ride option in select cities.” They’re partnering with Waymo because they see the writing on the wall.

Freeway access is the inflection point. You can’t run a viable robotaxi network confined to city streets. Now Waymo can operate across entire metro regions. That enables the scale required to drive costs down.

The 2020s debate was “Will robotaxis work?” That question is answered. The 2030s question is “Who will dominate: Waymo or someone else?” Right now, Waymo is the only company capable of answering that challenge.