Elon Musk’s xAI announced on January 8, 2026, a $20+ billion investment in a Southaven, Mississippi data center—the largest private investment in state history. The MACROHARDRR facility will house what xAI CFO Anthony Armstrong claims is “the world’s largest supercomputer” with 2 gigawatts of computing power, beginning operations in February 2026. Moreover, this marks xAI’s third data center in the greater Memphis area as AI companies shift from renting cloud infrastructure to owning massive compute resources outright.

At 2GW, this single facility will consume nearly 10% of what all U.S. data centers used in 2024. The scale raises urgent questions about energy sustainability, state tax policies, and whether this compute buildout is necessary or defensive spending.

The Unprecedented Scale

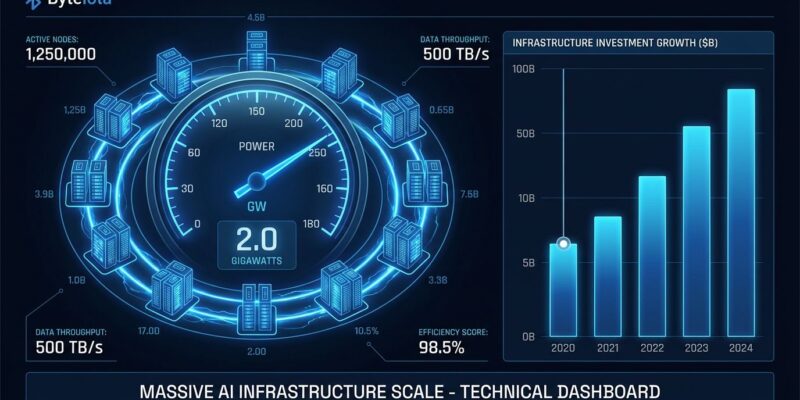

MACROHARDRR will consume 2 gigawatts of power—equivalent to eight nuclear reactors or more than New Hampshire’s total power demand. To put this in perspective: U.S. data centers consumed 183 terawatt-hours (TWh) in 2024, about 4% of national electricity. This single xAI facility, running continuously at 2GW, will use 17.5 TWh annually—nearly 10% of what the entire U.S. data center industry consumed last year.

The power requirements are staggering. Furthermore, xAI recently acquired a power plant site in Southaven to support this massive energy demand, following Meta’s approach of vertically integrating energy generation alongside AI infrastructure. According to the International Energy Agency, global AI data center power demand is projected to quadruple by 2030 to 945 TWh—more than double 2024 levels.

For comparison, the Stargate initiative plans 5GW data centers, and by 2030, a single AI training run could demand 8GW of power. The industry is on an unsustainable trajectory. If every AI company builds 2GW facilities, where does the power come from?

Own vs Rent: The Strategic Split

xAI is betting $20 billion on owned infrastructure while competitors OpenAI and Anthropic rent from cloud providers. This represents a fundamental strategic split in the AI industry.

OpenAI relies on Microsoft Azure, spending $7 billion in 2024 ($3B training + $4B inference). Anthropic rents roughly 16,000 H100 GPUs from AWS at an estimated $2 billion annually. In contrast, xAI owns Colossus 1 and 2 in Memphis (100,000-200,000 H100 GPUs) and now MACROHARDRR. Meta is following the same playbook, building 600,000+ GPUs in-house alongside 6.6GW nuclear power investments.

Ownership provides asymmetric advantages: priority access to the latest NVIDIA GPUs, faster model training and iteration cycles, lower long-term operating costs, and pricing power for AI services. However, it requires massive upfront capital—xAI’s $20B investment could become stranded assets if the AI bubble bursts or efficiency gains reduce compute demand.

The industry-wide trend is clear: hyperscalers (Amazon, Google, Microsoft, Meta, Oracle) are projected to spend over $600 billion on AI infrastructure in 2026, a 36% increase from 2025, according to IEEE ComSoc analysis. Roughly 75%—$450 billion—is directly tied to AI infrastructure like servers, GPUs, and data centers. Microsoft executives have acknowledged that supply constraints will persist into fiscal 2026, reinforcing the “whoever builds first wins” dynamic.

Which model wins long-term? If AI revenue justifies the investment, owners gain control and margins. If demand drops, renters can scale down while owners hold depreciating assets.

Mississippi’s Tax Incentive Gamble

Mississippi is waiving all sales, corporate income, and franchise taxes for xAI for 10 years under a 2024 data center law. According to John Mozena of the Center for Economic Accountability, “I’m not aware of any other state that even comes close to Mississippi in the scope of those subsidies.”

In exchange for this unprecedented tax holiday, xAI promises “hundreds of permanent jobs.” Do the math: $20 billion divided by hundreds of jobs equals $50-200 million per job created. Data centers are capital-intensive, not labor-intensive. This is a terrible jobs-to-investment ratio.

The 2024 Mississippi law (SB3106) provides 10-year exemptions from sales, corporate income, and franchise taxes for certified data center enterprises. Performance requirements exist, but the economics are questionable. Consequently, Mississippi foregoes a decade of tax revenue for minimal job creation while other industries pay full rates.

This isn’t Mississippi’s first bad deal. The Compass data center in Meridian was named “worst economic development deal of 2025” due to extensive tax breaks and minimal local impact. As detailed in Mississippi Today’s investigation, states are competing aggressively to attract data centers, but the ROI doesn’t add up. What’s the opportunity cost of $20B in foregone tax revenue over ten years? How many schools, roads, or public services could that fund?

Community Backlash and Environmental Concerns

Local communities in Memphis and Southaven are pushing back. The Safe and Sound Coalition gathered 900+ petition signatures opposing MACROHARDRR, citing lack of transparency and environmental concerns. Shannon Samsa, coalition cofounder, said: “It feels like a slap in the face to every resident who’s been fighting for transparency around xAI’s power plant in Southaven. The public wasn’t informed or given any say.”

The NAACP and Southern Environmental Law Center raised air pollution concerns near predominantly Black communities in Memphis, where xAI’s Colossus 1 data center already operates. Adding 2GW of power consumption through MACROHARDRR compounds these environmental justice issues.

Tech companies often ignore local communities when building massive infrastructure, creating regulatory risk. If opposition grows, permitting delays or environmental lawsuits could stall projects. This pattern—tech company announces huge project, community fights back—is repeating across the industry. Therefore, developers should pay attention: sustainable AI growth requires community buy-in, not just capital and GPUs.

Is the February Timeline Credible?

xAI announced MACROHARDRR on January 8, 2026 and claims operations will begin in February 2026—just one to two months later. This timeline seems impossibly fast for an 800,000 sq. ft. data center requiring 2GW of power infrastructure.

For context, Colossus 1 in Memphis took months to retrofit from a former Electrolux factory. Installing 2GW of power infrastructure requires massive electrical work, cooling systems, and GPU deployment. Either significant pre-work was done in secret, “operations begin” means partial activation (not full 2GW capacity), or the announcement is aspirational.

The “world’s largest supercomputer” claim also warrants skepticism. Stargate plans 5GW data centers (2.5x larger). Meta’s distributed cluster may exceed 2GW across multiple facilities. “Largest” is subjective—measured by power, GPU count, or compute performance? This sounds like marketing, not verified fact.

Tech companies routinely overpromise on infrastructure timelines. Maintain healthy skepticism until February arrives and we see actual proof of operations.

Key Takeaways

- xAI’s $20B Mississippi investment represents the AI infrastructure race becoming an energy race, with 2GW power consumption rivaling small states

- The industry is splitting: xAI and Meta own infrastructure for control and long-term savings; OpenAI and Anthropic rent cloud for capital efficiency

- Mississippi’s 10-year tax exemption creates $50-200M per job—questionable ROI when states forego revenue for minimal employment gains

- Local communities are fighting back against opacity and environmental impact, creating regulatory risk for future AI infrastructure projects

- The February 2026 timeline and “world’s largest” claims need verification—tech companies often overpromise and underdeliver on infrastructure

The core question: Is this massive compute buildout necessary to advance AI, or defensive spending to prevent competitors from gaining advantage? At $600B industry capex in 2026, the bet is that AI revenue will justify the infrastructure costs. If not, we’re building a very expensive bubble.