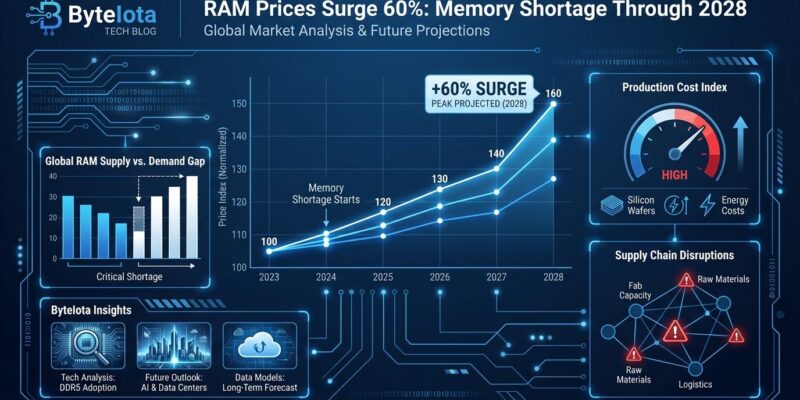

The Price Shock

Samsung has raised memory chip prices by 60% since September 2025, and the shortage driving this surge could last until 2028 or beyond. A 32GB DDR5 kit that cost $149 three months ago now sells for $239, with analysts projecting 30-50% quarterly increases through mid-2026. PC builder CyberPowerPC announced December 7, 2025 price hikes across all systems, citing what it calls a “500%” increase in memory costs. This isn’t a temporary blip—it’s a fundamental shift in memory economics driven by AI infrastructure demand competing with consumer markets.

Supply Squeeze or Strategic Scarcity?

Samsung can fulfill only 70% of incoming DRAM orders. SK Hynix says all its chips are sold out for 2026. The memory market is so constrained that Samsung is reportedly negotiating with itself over internal supply contracts. But here’s where it gets interesting: these same manufacturers just posted record profits in Q3 2025.

The shortage is real, but it’s also strategic. After bleeding billions during the 2022-2023 memory crash—when oversupply crushed prices—Samsung and SK Hynix have adopted what they euphemistically call a strategy to “minimize the risk of oversupply.” Translation: keep supply tight and prices high. PC Gamer’s headline captures the skepticism: “Memory crisis could run past 2028 as Samsung and SK Hynix opt to minimize oversupply risk.”

This isn’t a conspiracy theory. It’s oligopoly economics. Samsung, SK Hynix, and Micron control 95% of the global DRAM market. They learned their lesson from the last crash: better to have scarce, expensive memory than abundant, cheap memory. Profit-first has become the industry consensus.

AI Gets First Dibs, You Get the Scraps

The AI boom has fundamentally reordered memory priorities. High-bandwidth memory (HBM) for AI processors now consumes 30% of total DRAM production, up from nearly zero two years ago. Samsung is scaling back over 20% of conventional DRAM capacity to focus on “advanced offerings”—industry speak for AI memory.

OpenAI’s Stargate project alone will require up to 900,000 DRAM wafers monthly by 2029, representing roughly 40% of global output. Your PC upgrade isn’t just competing with other consumers anymore—it’s competing with NVIDIA’s H100 GPUs and Google’s TPU clusters. In this hierarchy, AI infrastructure comes first, enterprise second, and consumers get whatever’s left over.

This isn’t temporary allocation. It’s a permanent shift. AI data centers pay premium prices and lock in multi-year contracts. Consumer DRAM has become the commodity tier.

The Ripple Effect

Memory shortages don’t stay isolated. AMD has confirmed 10% graphics card price increases for 2026, driven by soaring GDDR memory costs. NVIDIA is expected to follow. Some analysts predict manufacturers may discontinue budget GPUs entirely—the bill of materials no longer makes economic sense at lower price points.

CyberPowerPC’s December 7 announcement isn’t just about RAM sticks. Entire system costs are rising. Memory represents 10-25% of a typical PC or smartphone’s bill of materials. A 20-30% memory price jump translates to 5-10% higher device costs across the board. Cloud providers running memory-optimized instances on AWS or Azure face similar pressure, and those costs will eventually flow to customers.

For developers, gamers, and businesses, this means every tech purchase just got more expensive. The AI boom has an economic externality: everyone else pays more.

Why This Lasts Until 2028

Samsung and SK Hynix are boosting capital expenditures for 2026—11% and 17% respectively—but that pales against explosive AI demand growth. New fabrication facilities take 2-3 years to come online, and manufacturers are deliberately moving slowly. After the 2022-2023 crash left them with 31 weeks of inventory, they’re in no rush to repeat that mistake.

SK Hynix told analysts the memory shortfall will last through late 2027. TrendForce projects the price rally may run past 2028. Some analysts speculate it could persist for a decade as AI infrastructure buildout continues. These aren’t wild predictions—they’re based on the math of AI’s memory appetite versus manufacturers’ cautious expansion strategies.

The market structure enables this. With just three companies controlling 95% of supply, coordinated supply discipline becomes the default. They don’t need to collude—they just need to independently choose profit stability over aggressive expansion.

What Developers and Gamers Should Do

If you need a memory upgrade, buy sooner rather than later. Prices are unlikely to return to early-2025 levels anytime soon. Production for 2026 is largely pre-sold to data center clients, and promotional discounts will apply to increasingly higher baselines. Waiting won’t save money—it’ll just mean paying even more in six months.

For capacity planning: 16GB remains the gaming minimum, but it’s getting expensive. 32GB is now the sweet spot for workstations and serious gaming, though it’s crossed into premium pricing territory. DDR5 is becoming standard despite higher costs, but DDR4 still offers value for budget builds while supply lasts.

If your purchase is optional, you’re betting on post-2028 normalization. That’s a long wait with no guarantee. Make your decision based on current need, not hope that prices will drop soon. In this market, the only certainty is that memory costs more than it used to—and it’s going to stay that way.