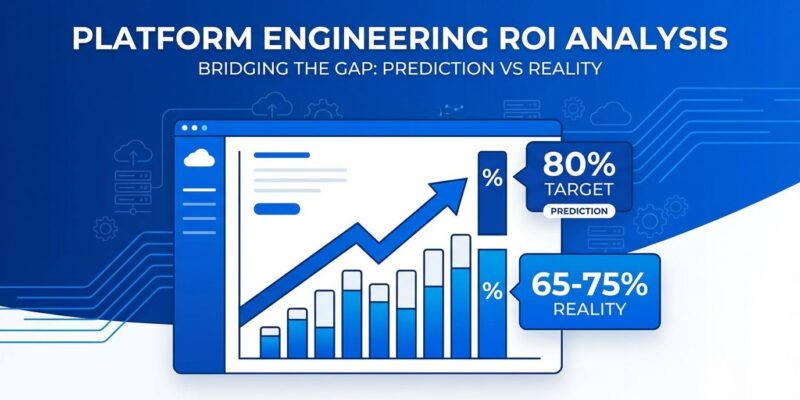

Platform Engineering ROI 2026: 80% Adoption Reality Check

Gartner predicted 80% of software engineering organizations would have platform teams by 2026. We’re here. The platform engineering market is on track to hit $40 billion by 2032, growing at 24% annually. However, here’s the reality check engineers need: while some companies report $2.7 million in annual benefits from their platforms, others cite implementation costs as “prohibitive.” 2026 isn’t the year platform engineering reaches 80% adoption — it’s the year it proves whether the ROI is real or hype.

The Math Doesn’t Support 80%

Gartner’s October 2023 prediction was ambitious: 80% of software engineering organizations establishing platform teams by 2026, up from 45% in 2022. The problem? Adoption didn’t accelerate — it plateaued.

From 2022 to 2025, adoption grew just 10 percentage points (45% to 55%). To hit 80% by year-end 2026, the industry needs 25% growth in one year. That’s 2.5× faster than the three-year average. Unless platform engineering suddenly solved its two biggest problems — cost barriers and talent shortages — the math doesn’t work.

Break it down by company size and the gap becomes clear. Large enterprises with 1,000+ employees? They’ll hit 90%+ adoption easily. Mid-sized companies (100-1,000 employees) struggle with budget constraints, landing around 60-70%. Small companies under 100 employees? Maybe 20-30% adoption, if they can afford it at all. Weighted across the market, that puts actual 2026 adoption at 65-75%, not 80%.

The gap isn’t about timing. It’s about economics. Platform engineering scales up beautifully — benefits multiply with developer count — but it doesn’t scale down. As InfoQ noted, “the effort is the same no matter if you have one hundred or thousands of developers.” Small teams pay enterprise-grade costs for fraction-sized benefits.

The ROI Paradox: Millions for Some, Prohibitive for Others

Here’s where platform engineering ROI gets uncomfortable: the story bifurcates completely.

For enterprises, the returns are staggering. A 25-person team case study shows $2.76 million in annual benefits: $390,000 from toil reduction, $1.56 million from AI productivity boosts, $468,000 saved on incident response, and $337,000 from faster time-to-market. Platform costs? $98,000 annually for 0.4 FTE maintenance. That’s a 28:1 return on investment.

Google Cloud’s survey of 500 IT professionals found 71% of leading platform adopters significantly accelerated time-to-market, compared to 28% of less mature adopters. High-maturity teams report 40-50% reductions in developer cognitive load. Moreover, organizations with internal developer platforms (IDPs) average 28% lower cloud costs.

For small and mid-sized companies, however, the picture flips. Market reports cite “high implementation costs and shortage of skilled professionals” as barriers limiting market penetration. Building a custom platform takes 12+ months and costs millions. Commercial IDP pricing starts at $999 monthly and scales with team size. Even “free” open-source Backstage requires substantial internal engineering investment for customization and maintenance.

The enterprise case studies don’t transfer down-market. Platform engineering doesn’t offer a lightweight entry point. You’re either all-in with the full infrastructure investment, or you’re out.

2026 Forces the Business Value Question

This year marks a measurement shift that platform teams can’t avoid. Pre-2026 metrics — developer satisfaction scores, cognitive load reduction, platform adoption rates — aren’t enough anymore. Organizations now demand ROI in business terms: revenue enabled, costs avoided, profit center contribution.

The accountability moment has arrived. Gartner’s prediction deadline hits, budgets tighten, and AI platform investments need business cases beyond “developer experience improved.” Atlassian’s 2025 survey found 50% of developers lose 10+ hours weekly to organizational inefficiencies. Platform teams must now quantify how they recover that time in revenue impact, not just productivity feelings.

Leading adopters already made the shift. They measure Lead Time for Changes, Deployment Frequency, Change Failure Rate, and MTTR — technical metrics that tie to business outcomes. They calculate time-to-market acceleration as customer acquisition enablement. Furthermore, they track cloud cost optimization as profit contribution.

Platform teams that can’t demonstrate business value in 2026 face budget cuts. It’s no longer acceptable to say “developers are happier.” CFOs want to know: how much revenue did that happiness create?

Talent Shortage Is the Real Bottleneck

The dirty secret behind stalled adoption? Platform engineering requires a rare skill combination — software engineering expertise plus infrastructure automation mastery — and there aren’t enough people with both.

Microsoft’s enterprise platform team runs 250-280 members: architects and engineers managing compute, runtime, CI/CD, tools, and observability. Most companies can’t staff that. The global talent shortage hits recruitment and retention hardest, with platform engineers commanding premium salaries and choosing enterprise-scale challenges over SME constraints.

Even organizations with budgets can’t hire fast enough. This explains why 92% of CIOs plan AI platform integrations, yet actual adoption lags. Talent concentration in enterprises (better pay, bigger projects) leaves mid-sized and small companies scrambling for scraps.

The 2026 Reckoning

Platform engineering isn’t failing — it’s maturing into what it always was: an enterprise-grade solution that doesn’t scale down economically. The 80% prediction overestimated how quickly SMEs could overcome cost and talent barriers.

2026 sorts the market into four tiers: winners with full platform teams and measured business ROI (20%), adopters with platforms established but still proving value (35%), explorers evaluating build-versus-buy in pilot projects (20%), and laggards constrained by costs and talent shortages (25%).

The platform engineering market will hit $40 billion by 2032. The ROI is real for companies at scale. Nevertheless, 2026 isn’t platform engineering’s victory lap — it’s the year platforms prove business value or get defunded. Expect 65-75% adoption by year-end, not 80%. The gap isn’t a timing miss. It’s a market reality check.