Pennsylvania lawmakers are being asked this week to approve a $40 million quantum initiative after the state failed to qualify for major federal quantum funding programs from the Department of Energy and National Science Foundation. The state is now locked out of federal quantum center funding until at least 2030, forcing it to pursue a self-funded catch-up strategy over the next two years.

This is the first major state response to losing the federal quantum race. Pennsylvania’s explicit “we lost, here’s how we catch up” strategy highlights a broader trend: states are entering the quantum funding arms race with their own multi-million dollar initiatives. Moreover, for developers and tech professionals, this creates opportunity. An estimated 30,000 quantum jobs are expected by 2026, but fewer than 10,000 qualified candidates exist globally.

The State vs. Federal Funding Gap

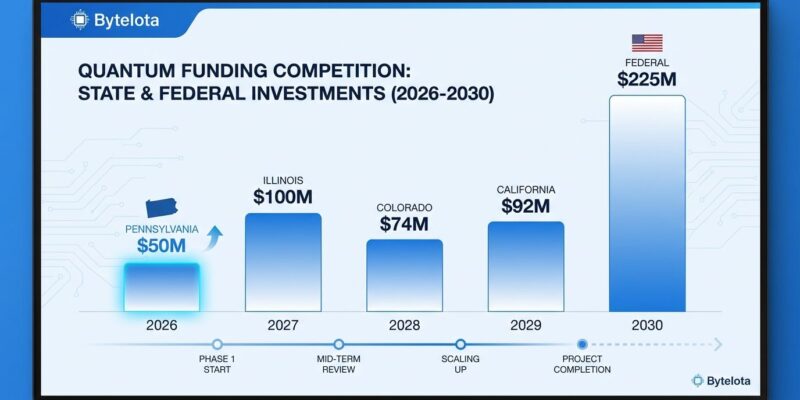

Pennsylvania’s proposed $40 million over two years competes against $625 million in Department of Energy funding for five National Quantum Information Science Research Centers. The scale gap is stark. The DOE announced this funding in January 2025, with $125 million allocated for Fiscal Year 2025 alone. Meanwhile, the Department of Energy Quantum Leadership Act of 2025 proposes $2.5 billion in total federal quantum funding from 2026-2030.

$40 million sounds impressive until you see Illinois’ $500 million quantum park or the DOE’s $625 million. Pennsylvania’s playing catch-up in a billionaires’ game with a modest budget. However, Illinois’ model shows state funding can work: the quantum park has attracted IBM, PsiQuantum (with a $200 million incentive package), and DARPA, targeting $20 billion in total investment—a 40:1 leverage ratio on state funding. Colorado took a different approach with $74 million in tax credits and loan programs, while California allocated $4 million annually for quantum research.

The question Pennsylvania faces: can workforce development and strategic positioning compete with Illinois’ massive infrastructure bet and federal programs worth billions?

30,000 Quantum Jobs, Fewer Than 10,000 Candidates

While states fight over cutting-edge research labs, the real opportunity is unglamorous: quantum technicians. An estimated 30,000 quantum jobs will be available by 2026, but fewer than 10,000 qualified candidates exist globally—a 20,000 position shortage representing 66% of roles unfilled. Critically, 80% of these jobs will be for non-advanced degrees. Furthermore, engineers who can build, operate, and maintain quantum systems are needed, not just PhDs researching algorithms.

Workforce development programs are emerging to meet this demand. The Quantum Technician Bootcamp runs February 23 – May 1, 2026, with applications due February 6. The program teaches fundamentals of quantum science and technology, targeting the 80% of quantum jobs that don’t require PhDs. Additionally, DOE’s National QIS Research Centers are expanding workforce programs including schools, workshops, and career fairs.

This workforce shortage explains Pennsylvania’s strategy focus. Building cutting-edge quantum labs costs billions and takes decades. In contrast, training technicians and engineers costs millions and produces results within years. Consequently, Pennsylvania is betting on workforce development as faster ROI than infrastructure—a pragmatic choice given budget constraints.

For developers and tech professionals, the 66% job shortage means demand far exceeds supply. Quantum skills command premium salaries, and the barrier to entry is dropping as bootcamp programs proliferate.

Pittsburgh Quantum Institute: 140+ Faculty, 3 Universities

Pennsylvania isn’t starting from scratch. The Pittsburgh Quantum Institute comprises 140+ faculty and 190+ students across Carnegie Mellon, University of Pittsburgh, and Duquesne University. Founded in 2012, the institute conducts research across quantum physics, chemistry, and engineering disciplines. Moreover, the university ecosystem already received an $11.6 million loan to establish the Western Pennsylvania Quantum Information Core, demonstrating infrastructure exists.

Carnegie Mellon hosts the NSF Center for Quantum Computing and Information Technologies (QCiT), an industry-university cooperative research center. Regional collaboration extends to West Virginia University, Penn State, and Ohio State University through joint workshops and research programs. This isn’t isolated Pittsburgh effort—it’s a regional quantum ecosystem.

The 140+ faculty and 190+ students provide a talent pipeline and research base that makes workforce development realistic. Consequently, Pennsylvania’s strategy leverages existing strengths rather than building from zero—a critical differentiator from states without established quantum ecosystems trying to enter the race.

Can Pennsylvania Reach 2030 Federal Cycle?

Pennsylvania’s proposed initiative runs 2026-2028 with a specific goal: build workforce capacity, infrastructure, and institutional readiness to compete for the next expected cycle of national quantum funding around 2030. The strategy timeline includes advisory board appointments and initial funding in 2026, site selection for facilities in 2027, and construction later in the decade.

The Pennsylvania Quantum Public Lobby Group argues that a 4-year runway allows the state to build sufficient capacity to win competitive federal grants in the next cycle. This reveals Pennsylvania isn’t trying to go it alone forever—the $40 million is explicitly designed as catch-up funding to re-enter the federal competition.

Pennsylvania has 4 years to build enough capacity to win 2030 federal grants. That’s ambitious. Illinois had a decade and $500 million. Can Pennsylvania catch up with $40M and a tight deadline? The bet is workforce development—cheaper and faster than infrastructure—will differentiate Pennsylvania enough to win federal dollars later.

One complication: even as states compete for quantum funding, experts remain divided on practical timelines. One quantum scientist noted “the jury’s still out” on whether quantum computing will deliver practical value in their lifetime. Google acknowledges “a useful, large-scale, error-corrected quantum computer that solves lots of practical, real-world problems is still a ways off.”

The disconnect between workforce demand (30,000 jobs by 2026) and technology maturity (practical systems mid-2030s) explains the paradox: companies are hiring for long R&D timelines, creating jobs today even though useful quantum computers are years away. Pennsylvania’s workforce investments target roles that will exist before the technology fully matures.

Key Takeaways

- Pennsylvania’s $40M state response to losing federal quantum race highlights states entering the quantum funding arms race (Illinois $500M, Colorado $74M, California $4M)

- 30,000 quantum jobs expected by 2026 with fewer than 10,000 qualified candidates globally—a massive 66% talent shortage creating career opportunities

- 80% of quantum jobs don’t require PhDs—technicians and engineers who can build/maintain systems are in demand (Quantum Technician Bootcamp deadline: February 6, 2026)

- State vs. federal scale gap is stark: Pennsylvania’s $40M vs. DOE’s $625M and proposed $2.5B federal funding (2026-2030)

- 2026-2030 timeline gives Pennsylvania 4 years to build workforce capacity and compete for next federal cycle—ambitious but leverages existing Pittsburgh Quantum Institute (140+ faculty, 190+ students)