After nearly a decade of microservices dominance, the industry is experiencing a quiet reversal. According to a 2025 CNCF survey, 42% of organizations that adopted microservices are now consolidating services back into larger deployable units. The primary drivers aren’t technical limitations—they’re economic reality and operational overhead. Simultaneously, service mesh adoption plummeted from 18% in Q3 2023 to 8% in Q3 2025. Cost, not scalability, has become the primary architectural constraint in 2026.

This isn’t about microservices being “bad.” It’s about architectural decisions being context-driven, not dogmatic. Most teams don’t have Google’s scale problems, yet they’re paying Google-scale operational costs. The 42% consolidation isn’t retreat—it’s pragmatism winning over dogma.

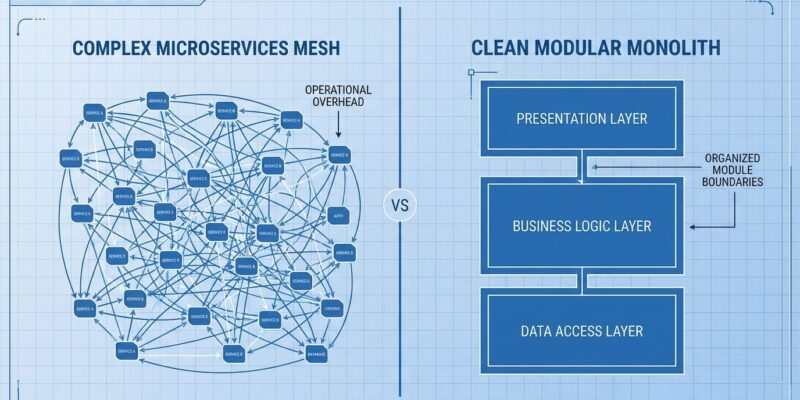

Operational Reality Bites: The Microservices Premium

The consolidation trend is backed by hard data from real engineering teams. Amazon Prime Video’s Video Quality Analysis team migrated from distributed microservices to a single-process monolith, achieving 90% infrastructure cost reduction plus improved scaling capabilities. Twilio Segment documented their reversal publicly: they collapsed 140+ microservices into a single monolith after three full-time engineers spent most of their time firefighting instead of building features.

The failures aren’t limited to tech giants course-correcting. One startup raised $2.5M with 40% month-over-month revenue growth. However, six months after moving to microservices, they were out of money, their product was broken, and half the team had quit. The “microservices tax” was higher than their burn rate.

Martin Fowler coined the term “microservices premium“—the productivity cost teams pay for distributed architecture. The 2025 CNCF data proves this premium is real: 42% of organizations are consolidating because the operational overhead outweighs the benefits for most use cases.

The Real Cost: 3-6x More Than You Think

Microservices infrastructure costs are 3.75x to 6x higher than monoliths for equivalent functionality. Moreover, at enterprise scale, the math is brutal: monoliths cost roughly $15,000 per month versus microservices at $40,000-$65,000 per month when you factor in infrastructure, operations, platform teams, and coordination overhead.

The breakdown reveals hidden costs most teams underestimate. Furthermore, a modular monolith needs a single server and database ($200/month for smaller teams). Microservices? Add API gateways, load balancers, service mesh, distributed logging, monitoring across dozens of services—suddenly you’re at $750-$1,000 monthly for the same functionality. At enterprise scale, tack on $8,000 for operations, $12,000 for the platform team (Kubernetes requires 1-2 platform engineers per 50 application developers), and $5,000 for coordination overhead. That’s 4.3x more expensive before writing a single line of business logic.

Additionally, the productivity hits are worse. Microservices introduce 25% resource overhead just from operational complexity. Teams need 3-6 months to become productive with Kubernetes tooling—half a year before developers deliver at full velocity. For small and medium teams, microservices reduce feature delivery by 20-40% despite promises of independence.

Your CFO cares about cloud bills. Your architecture should too.

Modular Monolith: Sophistication Without Overhead

A modular monolith isn’t “big ball of mud” rebranded. Instead, it’s a sophisticated architectural pattern: well-separated modules with explicit boundaries (like microservices), deployed as a single unit with in-process calls (like monoliths). Shopify proves this works at massive scale.

Shopify’s monolith contains 2.8 million lines of Ruby code and 500,000 commits. Specifically, at Black Friday peak, it handles 30 terabytes per minute, 32 million requests per minute, and 11 million MySQL queries per second. The architecture organizes code into domain modules—Shop, Product Catalog, Checkout, Payments, Fulfillment—each with clear public APIs. Consequently, their Packwerk tool automatically detects boundary violations, enforcing architectural discipline without manual reviews.

As Shopify Engineering explains: “All the things we liked about our monolith were a result of the code living in and being deployed to one place, and all the issues we were experiencing were a direct result of a lack of boundaries between distinct functionality in our code.”

The modular monolith delivers 80% of microservices benefits (modularity, clear boundaries, domain-driven design) with 20% of the cost (no service mesh, no distributed tracing, no cross-service debugging nightmares). Therefore, it’s the pragmatic choice for 90% of teams.

Other companies using modular monoliths at production scale include Gusto, Appsmith, and PlayTech. Meanwhile, frameworks like Service Weaver, Spring Modulith, and Light-hybrid-4j provide structure and enforcement tooling. The pattern has matured from “legacy thinking” to legitimate architectural choice.

Decision Criteria: Specific Thresholds

The choice between architectures isn’t ideological. Specifically, microservices benefits only appear with specific organizational thresholds: 100+ engineers, genuine independent scaling needs, and proven DevOps maturity. Below that threshold, teams pay for complexity they don’t need.

Choose modular monolith when: Team size is 10-100 engineers. Scale is thousands to millions of users (not billions). Furthermore, DevOps maturity means fewer than 5 platform engineers. Priority is cost efficiency and development velocity.

Choose microservices when: Team size exceeds 100 engineers with Conway’s Law issues (organizational structure forcing architectural boundaries). Independent scaling is genuinely needed (payment service requires 50x compute versus other services). Moreover, polyglot requirements exist (ML in Python, core backend in Java, can’t unify). Regulatory isolation mandates physical separation (PCI compliance for payment processing).

The 2025-2026 industry consensus recommends a hybrid approach for many teams: modular monolith core plus 2-5 extracted services for hot paths. Start modular, extract selectively when business justifies it—not because “microservices best practice” says so.

Most architecture articles say “it depends” without criteria. However, these thresholds give developers specific decision points based on organizational reality, not architectural purity.

The Industry Grows Up

The 42% consolidation signals maturity, not failure. After years of “microservices or bust” dogma, teams are making context-aware, pragmatic decisions. Consequently, cost-consciousness and developer experience are trumping architectural sophistication.

McKinsey observed that “complexity introduced by modern architectures often outpaces the organization’s ability to manage it, leading to higher operational costs without commensurate productivity gains.” Furthermore, IEEE research notes “renewed industry interest in modular monoliths as response to microservices sprawl.” The “boring tech” movement embodies this shift: developers choosing SQLite over Kubernetes, simplicity over sophistication.

The pendulum is swinging from “move fast and break things” to “move deliberately and build sustainably.” Boring, simple, maintainable architectures let teams ship features instead of managing infrastructure.

Key takeaways:

- 42% consolidation represents industry maturity, not architectural failure

- Cost, not scalability, drives architectural constraints in 2026

- Modular monoliths deliver architectural rigor without operational overhead

- Start modular, extract to microservices only when business justifies it

- Most teams don’t have Google’s problems—stop solving them

The data is clear. The trend is real. The question isn’t whether to consolidate—it’s whether your team is ready to admit microservices were premature optimization.