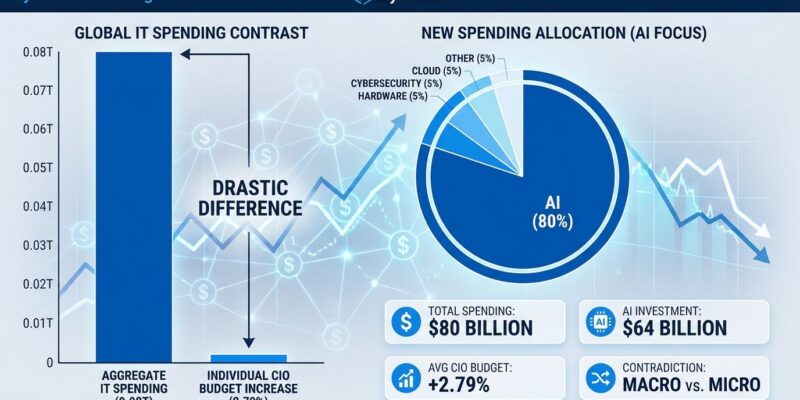

Global IT spending will hit $6.08 trillion in 2026, marking a 9.8% increase and crossing the $6T threshold for the first time, according to Gartner’s October 2025 forecast. However, here’s the contradiction: only 53% of CIOs expect their budgets to increase next year, with the average bump sitting at just 2.79%. Meanwhile, 85% of survey respondents claim their budgets will grow—a 32-percentage-point gap between perception and reality. AI is the culprit. With 80% of government CIOs prioritizing AI/GenAI investments and AI-optimized infrastructure spending alone jumping to $37.5 billion, the budget picture becomes clear: AI gets funded, everything else fights for scraps.

This contradiction explains why you experience budget cuts despite “record tech spending” headlines. Your company claims they’re investing while simultaneously rejecting your tools budget. Understanding this gap—between macro growth and micro reality—reveals what’s actually happening: more AI coding tools, vendor consolidation eliminating favorite platforms, cloud cost scrutiny, and traditional software licenses getting axed to fund GPUs.

AI Takes Everything: $37.5B and Counting

AI-optimized infrastructure spending will reach $37.5 billion in 2026, more than doubling from $18.3 billion in 2025—a 146% growth rate that dwarfs everything else. This reflects AI’s stranglehold on IT priorities: 80% of government CIOs are increasing AI/GenAI investments, 75% of CIOs are spending more time on AI/ML initiatives, and 57% already have major AI projects in production. Moreover, the infrastructure requirements tell the story: GPUs, ASICs, TPUs, high-speed networking, and optimized storage, with 55% of spending supporting inference workloads ($20.6B) and 45% supporting training ($16.9B).

Furthermore, 55% of organizations plan to replace commercial software—CRMs, workflow automation platforms—with AI-generated self-built tools. This isn’t adoption; it’s budget reallocation. Traditional software licenses are being cut to fund AI infrastructure. Consequently, hyperscalers are responding with $600B+ in capex for 2026 (36% increase), building the GPU clusters enterprises are racing to access.

AI isn’t just another budget line item reshaping where money goes. Developers get more AI coding tools while seeing traditional productivity platforms eliminated. The 55% software replacement stat means vendors like Salesforce, ServiceNow, and Atlassian face existential pressure—and developers lose familiar tools in the process. That’s not budget growth; that’s budget cannibalization.

The Budget Pressure CIOs Actually Face

While aggregate spending hits $6.08T, individual CIOs navigate starkly different terrain. Gartner’s CIO survey reveals only 53% expect budget increases averaging 2.79%, with 27% expecting flat budgets and 19% anticipating cuts. Meanwhile, 226 of 284 enterprises (80%) report MORE budget pressure for 2026 despite the “record growth” narrative. Additionally, the math doesn’t add up until you see who’s driving the aggregate numbers: a few massive AI infrastructure investments at large enterprises.

This concentration effect creates the illusion of broad growth. Most CIOs aren’t getting net new money—they’re reallocating existing budgets from traditional categories to AI priorities. Consequently, what looks like 9.8% industry growth translates to 2.79% for the average CIO, and nothing for 46% of organizations. The gap between macro and micro is massive, and it lands on your desk as rejected infrastructure requests and tool consolidation mandates.

Where Budgets Hurt: Consolidation, Cloud Cuts, Software Dies

Budget pressure manifests in three painful ways. First, vendor consolidation: IT leaders are reducing “dozens of overlapping platforms” accumulated through years of siloed purchasing, targeting 5-15% annual savings. Your favorite specialized tool becomes “redundant functionality” on a spreadsheet. Second, FinOps-driven cloud optimization: organizations are shifting from expansion to efficiency, targeting 20-30% cost reductions through audits and right-sizing. Cloud costs are now the second largest expense behind payroll, with 40% going to waste without optimization. Third, traditional software replacement: that 55% replacing commercial applications stat means commercial tools face budget scrutiny developers haven’t experienced before.

FinOps implementations deliver 10-20x ROI with visible results in 30-60 days, making them irresistible to budget-pressured CIOs. However, this means development teams suddenly face chargebacks and must justify every cloud resource. Deep-dive audits uncover 5-15% savings within weeks by eliminating unoptimized workloads, redundant SaaS tools, and contract waste. If your tool doesn’t touch AI or cybersecurity, it’s at risk. Platform solutions that do everything adequately replace specialized tools that do one thing excellently.

Cybersecurity Gets Second Priority

After AI, cybersecurity is the second guaranteed budget winner. 85% of government CIOs and 43% of enterprises are increasing security spending in 2026, with cybersecurity ranking as the top investment area for 45% of IT leaders. Additionally, 34% of companies are prioritizing security talent acquisition alongside AI/ML hires (36%). Cybersecurity spending is mandated—regulations, breaches, and board-level pressure make cuts nearly impossible.

This creates an escape hatch for budget requests. Can’t get AI-related funding? Frame your request through a security lens. Need infrastructure, tools, or headcount approved? Position it as reducing security risk or improving compliance. CIOs are under pressure to increase security spending, making it the second-safest justification after AI. Security isn’t optional in 2026—it’s the only other category besides AI with guaranteed budget allocation.

Selective Hiring: 67% Expanding, But Not for Everyone

While 67% of organizations plan to grow IT teams in 2026, hiring is highly selective and intensely competitive. AI/ML skills are now required in 53% of tech jobs (up from 29% just one year ago in November 2024), with 36% of companies prioritizing AI/ML hires and 34% prioritizing cybersecurity talent. Furthermore, 67% of senior engineers receive multiple offers before even posting resumes, creating fierce competition for experienced talent. The 61% of employees expecting significant job role changes due to AI suggests even existing staff need to upskill.

“We’re hiring” doesn’t mean easy opportunities. Companies want AI/ML skills, cybersecurity expertise, or specialists with cross-functional capabilities (75% of roles). General full-stack or backend positions face more competition than before. If you have AI/ML or security skills, it’s a strong market. If you’re a traditional developer without those specializations, expect more interviews and longer job searches.

Related: AI Productivity Paradox: 19% Slower, Feel 20% Faster

Key Takeaways

- Aggregate $6.08T spending growth masks individual CIO reality: only 53% expect increases averaging 2.79%, while 19% face cuts—the 32-point perception gap reveals massive AI concentration at large enterprises.

- AI infrastructure dominates with $37.5B spending (146% growth), consuming budget through reallocation not net new money—55% are replacing commercial software with AI-generated tools to fund GPU infrastructure.

- Budget pressure hits through vendor consolidation (5-15% savings), FinOps cloud optimization (20-30% reductions), and traditional software elimination—specialized tools lose to “good enough” platforms.

- Cybersecurity is the escape hatch: 85% of government CIOs increasing spend makes security the second-safest budget justification after AI—frame requests accordingly.

- Hiring growth is selective: 53% of jobs require AI/ML skills (up from 29% in 2024), with 67% of senior engineers getting multiple offers—traditional development roles face increased competition.

The $6T headline doesn’t mean broad prosperity. It means a few companies are making massive AI bets while most CIOs stretch smaller budgets further. Understanding this contradiction helps you navigate budget decisions, frame requests strategically, and set realistic expectations for tools, infrastructure, and career opportunities in 2026.