Cloud costs are killing margins. 89% of CFOs report cloud spending negatively impacted profitability in the past 12 months, and 48% of organizations cite rising costs as their top cloud management challenge. However, here’s the paradox: choosing the right FinOps tools 2026 platform to fix the problem is harder than fixing the problem itself. Platform engineers face 10+ platforms with vastly different approaches, price points ranging from free native tools to $100K+ enterprise suites, and marketing claims promising 30% savings that may or may not materialize. Moreover, most companies overpay for features they’ll never use—particularly multi-cloud capabilities when 90% of their spend is on a single provider.

Start With Native Tools, Upgrade Strategically

Here’s the contrarian take that vendor sales teams don’t want you to hear: 60% of single-cloud companies can achieve their FinOps goals with free native tools like AWS Cost Explorer, Azure Cost Management, or GCP Cost Management. These platforms provide basic cost tracking, budget alerts, and rightsizing recommendations at no additional cost. Furthermore, the catch? AWS Cost Explorer has a critical limitation—single-dimension grouping. You can’t filter by region AND service simultaneously without exporting data to Excel.

Multi-cloud visibility is impossible with native tools, but that’s not the dealbreaker vendors claim it is. While 90% of companies report having “multi-cloud strategies,” many use secondary clouds for less than 10% of infrastructure. Consequently, paying $50K-$100K annually for multi-cloud FinOps platforms when 90% of spend sits on AWS is waste masquerading as best practice. Additionally, the right approach: start with AWS Cost Explorer or Azure Cost Management, then graduate to third-party platforms only when hitting specific limits—true multi-cloud distribution, Kubernetes cost attribution needs, or engineering workflow integration requirements.

CloudZero, Finout, and IBM: Which Solves Your Problem?

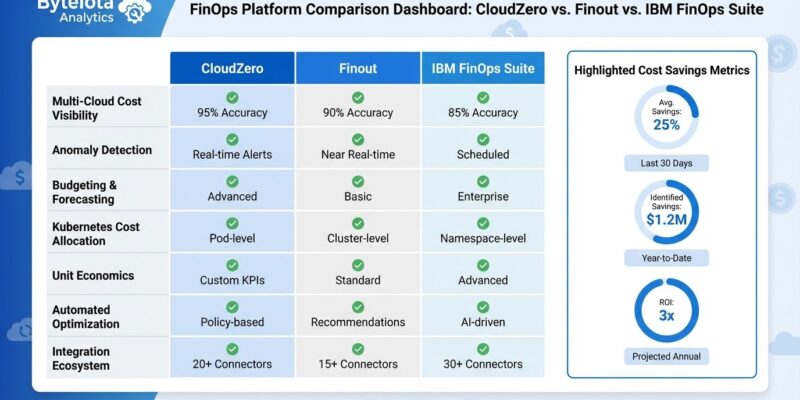

When native tools fall short, three platforms dominate the 2026 third-party FinOps market with distinct approaches. CloudZero targets engineering-led organizations with cost attribution organized around metrics engineers understand—cost per customer, cost per feature, cost per deployment. The platform automatically attributes costs to business units by analyzing infrastructure relationships, no manual tagging required. Moreover, it’s built like an observability tool rather than a financial dashboard, which matters because engineers actually use it.

Finout solves the multi-cloud consolidation problem with MegaBill, which unifies AWS, Azure, and GCP billing into a single view. Virtual tagging enables retroactive cost allocation without modifying thousands of existing resource tags. Furthermore, users report eliminating “countless hours manually consolidating data in spreadsheets.” The pricing model is transparent at roughly 1% of cloud bill, making it predictable for CFOs evaluating ROI.

IBM’s FinOps Suite takes the comprehensive approach, integrating Cloudability (multi-cloud visibility and reporting), Turbonomic (AI-powered workload optimization), and Kubecost (Kubernetes-specific cost attribution) into a unified platform. IBM’s pitch is “FinOps for all”—all cloud providers, all maturity levels, all stakeholders. However, the trade-off? Enterprise licensing that likely exceeds $100K annually, justified only at significant scale.

Why Dashboard FinOps Tools Fail (And What Works Instead)

Dashboard fatigue kills more FinOps initiatives than budget constraints. Finance logs in monthly for budget reviews, engineering never looks, and $50K annual platform subscriptions deliver zero ROI. Moreover, the problem isn’t the dashboard quality—it’s the standalone approach. Modern FinOps tools must integrate into existing engineering workflows instead of creating separate portals. As the Platform Engineering blog puts it: “If you put cloud costs into people’s existing workflow (CI/CD, Jira, etc.), half the battle has already been won.”

Effective platforms surface costs where engineers work—pull requests showing “This deployment adds $200/month infrastructure cost,” CI/CD pipelines running cost estimation before merge approval, and Slack digests reporting “Your team’s cloud costs this week: $5,200 (+12% vs last week, mostly from new Redis cluster).” This shift-left approach makes costs visible at decision time rather than after-the-fact reporting. Traditional tools present costs in standalone dashboards. In contrast, modern 2026 platforms embed costs into GitOps, CI/CD pipelines, and developer communication channels. That’s why third-party platforms justify their cost—native tools can’t integrate this deeply into engineering workflows.

Kubernetes Attribution and AI Optimization Trade-offs

Standard cloud billing creates massive blind spots for Kubernetes environments. Your AWS bill shows “$20K for EC2 instances” but doesn’t reveal which of your 50 microservices consumed those resources. Without namespace-level, label-level, and pod-level cost visibility, chargeback models are impossible and teams lack cost accountability. Consequently, this is where specialized tools like Kubecost or CloudZero’s Kubernetes integration become mandatory rather than optional. IBM’s 2025 acquisition of Kubecost signals how critical this capability has become—Kubernetes cost management moved from “nice-to-have” to baseline requirement for cloud-native architectures.

AI-powered optimization platforms like IBM Turbonomic and ProsperOps claim 30% waste reduction through automated rightsizing and reserved instance management, but automation means giving up manual control. The platforms use AI-driven analytics to make real-time adjustments balancing performance needs with cost-efficiency. However, the risk? An AI recommendation to “reduce this RDS instance from db.m5.2xlarge to db.m5.large” saves $200 monthly but might cause query timeouts during peak traffic. Additionally, the right approach: automate dev/staging environments and reserved instance purchases, require manual approval for production workload changes. Trust but verify until AI optimization proves reliability on your specific infrastructure.

Your FinOps Tool Evaluation Framework

Platform engineers evaluating FinOps tools in 2026 should ask five critical questions. First: What’s your actual multi-cloud spend distribution? If 90%+ sits on one provider, skip expensive multi-cloud platforms. Second: Do you run Kubernetes workloads? Cloud-native architectures require specialized K8s attribution—native tools completely fail here. Third: Will engineering teams actually use this tool? If it’s another dashboard, the answer is no. Moreover, demand CI/CD integration, GitOps support, and Slack/Teams notifications.

Fourth: What’s your tolerance for AI-driven automation? Platforms offering autonomous optimization deliver impressive savings but require giving up control. Therefore, start with AI recommendations plus manual approval, graduate to full automation after building confidence. Fifth: Do you face GreenOps requirements? Carbon tracking alongside financial costs is becoming mandatory for enterprise procurement and regulatory compliance—evaluate tools with sustainability metrics built in, not bolted on later.

The FinOps Foundation framework breaks implementation into three phases: Inform (gaining visibility), Optimize (implementing efficiencies), and Operate (continuous improvement). Most teams get stuck in Phase 1-2, building dashboards and running one-time cleanup sprints. However, real ROI comes from Phase 3—operationalizing FinOps as continuous practice embedded in daily engineering workflows. Choose tools that enable Phase 3, not just prettier Phase 1 dashboards.

The FinOps tool landscape offers a clear path: start with free native tools, identify specific limitations, upgrade strategically to platforms solving those exact problems. Don’t buy comprehensive enterprise suites chasing 30% savings claims when AWS Cost Explorer delivers adequate visibility. Furthermore, most companies need workflow integration and Kubernetes attribution more than AI-powered automation. Choose tools platform engineers will actually use—half the battle is won when costs appear in existing workflows rather than standalone dashboards finance reviews quarterly.