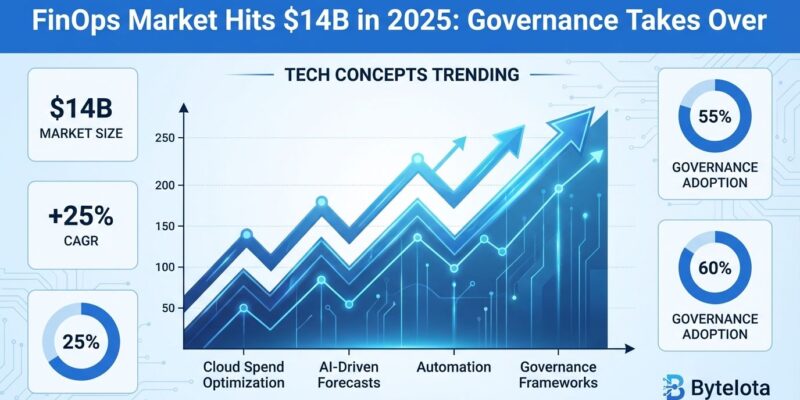

The cloud FinOps market reached $14.39 billion in 2025 and is projected to hit $22.40 billion by 2030, but market size isn’t the real story. For the first time, governance and policy enforcement has overtaken workload optimization as the number one FinOps priority over the next 12 months—a shift that signals the industry’s evolution from tactical cost-cutting to strategic cloud governance. With 87% of organizations running multi-cloud environments yet only 22% achieving effective governance without FinOps tools, the demand for structured cost management has never been higher.

FinOps Grows Up: From Cost-Cutting to Strategic Governance

Governance and policy enforcement is set to become the top FinOps priority over the next 12 months, ahead of workload optimization which is expected to drop 21%, according to the FinOps Foundation’s 2025 State of FinOps Report. This represents a maturity evolution: organizations have tackled cloud waste but now recognize that without scalable policy and governance, those savings don’t stick.

Moreover, the shift makes sense when you consider the numbers. While optimization remains important—50% of practitioners still prioritize it—allocation and governance are gaining ground as teams expand scope to SaaS (65% target adoption, up from 40%), software licensing (49%), private cloud (39%), and data centers (36%). The challenge? FinOps teams are juggling 12 or more capabilities simultaneously and are stretched thin.

For cloud architects and developers, this pivot means understanding policy-as-code, automated budget controls, and governance frameworks is now more valuable than just knowing how to right-size instances. The skill set is evolving from “how to save money” to “how to govern cloud spend at scale.” If your FinOps strategy is still optimization-first in 2025, you’re behind.

FOCUS v1.2: The Standard That Changes Everything

AWS, Microsoft Azure, Google Cloud, Oracle Cloud, Alibaba Cloud, Tencent, Databricks, and Grafana all released support for FinOps Framework v4.0 FOCUS (FinOps Open Cost and Usage Specification) v1.2 in 2025, removing integration barriers and standardizing cost tracking across clouds. FOCUS v1.2 now unifies cloud, SaaS, and PaaS billing in one schema—a single SQL query can cover an organization’s entire technology spend.

Furthermore, adoption is accelerating: 57% of respondents have concrete plans to adopt FOCUS, with 54% intending to automatically integrate into existing data pipelines. The specification includes invoice reconciliation (linking cost data directly to provider invoices), multi-currency normalization, and granular billing account and sub-account allocation. This eliminates the custom ETL pipelines that previously took weeks to build and maintain.

For developers working with cloud cost data, FOCUS is the OpenTelemetry of cost management—you no longer need to write custom integrations for each cloud provider. Understanding FOCUS creates career opportunities as enterprises migrate to the standard, making it the common language for cloud cost management across the industry.

AI Workloads Reshape FinOps: $85K Monthly Spend and Climbing

Average monthly AI spend jumped to $85,521 in 2025, a 36% year-over-year increase from $62,964, and AI and ML cost management has emerged as a critical FinOps focus area. The number of FinOps teams managing AI spend doubled from 31% to 63% in just one year, driven by GPU cost explosions and inference pricing complexity.

The challenge is real: AI workloads rely on premium compute like GPUs and TPUs that cost significantly more per hour than general-purpose VMs, and costs are often spread across multiple platforms—OpenAI services, GPU farms, Databricks, Snowflake—making visibility difficult. As one CloudZero analysis noted: “One of the biggest challenges in AI cost management is understanding where the money is going, as AI workloads are spread across platforms with costs not always clearly categorized.”

However, organizations implementing FinOps for AI techniques report up to 60% GPU cost reduction through time-slicing, regional optimization, and workload placement strategies. For developers building AI and ML applications, understanding GPU cost tracking, inference pricing models, and regional data placement isn’t optional—it’s directly tied to whether your AI project is economically viable. The days of ignoring GPU costs until the invoice arrives are over.

The FinOps Opportunity: 35K to 100K Professionals in 3 Years

The FinOps career explosion is driven by two powerful forces: regulatory mandates and explosive demand. The 2024 Public Company Accounting Oversight Board (PCAOB) amendments require expanded disclosure of technology spend, elevating cloud costs from IT line-item to board-level focal point. Consequently, CFO mandates following these SEC audit-rule changes accelerate enterprise-wide FinOps platform adoption as finance departments insist on audit-ready evidence of cost stewardship.

This regulatory driver, combined with multi-cloud complexity and GenAI workload volatility, forms the primary demand catalyst for the FinOps market’s 9.26% CAGR growth to $22.40 billion by 2030. The practical impact: 93 of Fortune 100 companies now participate in FinOps Foundation programs, and 80% of enterprises with over $1 million in cloud spend report plans to establish formal FinOps practices.

The career numbers are compelling. LinkedIn reports 35,000 FinOps professionals worldwide (9,000 in the US) with projections to reach 100,000 in three years. Average salaries range from $90,000 to $130,000 for FinOps Analysts to $200,000 to $300,000 or more for VP and C-level roles, with 15% to 20% salary growth over the past two years as demand outpaces talent supply.

Gartner forecasts that by 2027, 75% of organizations with over $50 million in cloud spend will have formal FinOps teams. For developers and cloud professionals, FinOps skills—understanding FOCUS, AI cost tracking, policy-as-code, multi-cloud governance—are becoming as valuable as DevOps or security expertise. Certification programs like FinOps Certified Practitioner are emerging as standard hiring requirements.

Key Takeaways

- Governance overtakes optimization: For the first time, policy enforcement and governance is becoming the number one FinOps priority over workload optimization, signaling industry maturity.

- FOCUS v1.2 standardizes everything: Universal cloud provider support for FOCUS eliminates custom ETL pipelines and creates a common language for cost management.

- AI costs demand attention: Monthly AI spend hit $85,521 in 2025 (up 36% YoY), with 63% of FinOps teams now managing GPU and ML workloads.

- Career opportunities explode: From 35,000 to projected 100,000 FinOps professionals in three years, with salaries ranging from $90K to $300K depending on role.

- Skills to acquire: Focus on FOCUS standard adoption, AI cost tracking, policy-as-code governance, and multi-cloud management to stay competitive in this high-demand field.