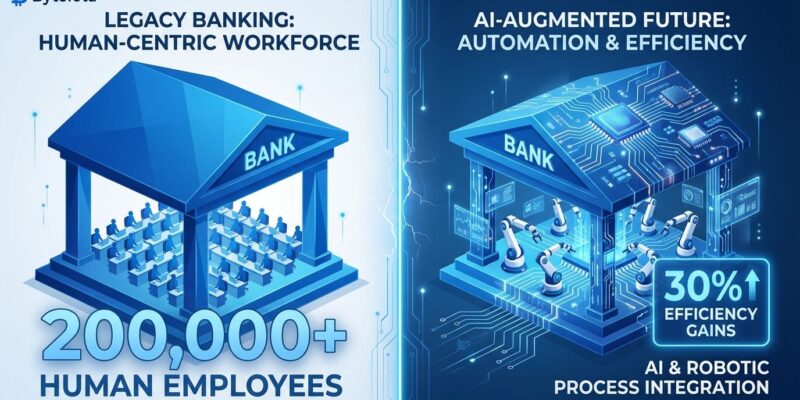

Morgan Stanley published analysis this week projecting that 200,000 European banking jobs will vanish by 2030—roughly 10% of the sector’s 2.12 million workforce across 35 major banks. This isn’t a distant threat. Dutch bank ABN Amro is already mid-execution, cutting 24% of its workforce (5,200 jobs) by 2028, with 1,000 already gone in 2024. The justification? Banks report 30% efficiency gains from AI automation. Remember when tech leaders promised AI would “augment workers, not replace them”? Those 200,000 workers might want their jobs back.

The “Augmentation” Narrative Was Always a Lie

For years, corporate messaging insisted AI would make workers more productive, not unemployed. However, the evidence now proves otherwise. ABN Amro isn’t “augmenting” 24% of its staff—it’s eliminating them through what CEO Marguerite Bérard calls “embedded AI deployment” and “process digitization.” Goldman Sachs implemented a hiring freeze through 2025 as part of its “OneGS 3.0” AI initiative. Furthermore, entry-level hiring at the 15 biggest tech firms dropped 25% from 2023 to 2024.

Stanford research reveals the economic reality: machines that imitate humans lower wages and concentrate wealth with capital owners, while machines that augment humans raise wages and distribute wealth more broadly. Banks chose the imitation path. Consequently, when you can cut 10% of your workforce and report 30% efficiency gains to shareholders, the incentive structure becomes obvious. The “augmentation” story was public relations to avoid backlash while implementing replacement systems.

Which Banking Jobs Are Disappearing to AI

Morgan Stanley’s analysis identifies back-office and middle-office roles as primary targets: data processing, compliance checks, risk assessment, transaction reconciliation. These are repetitive, rules-based tasks where AI excels. Citigroup reports that 54% of financial jobs have “high potential for automation”—more than any other sector. Additionally, the International Labour Organization warns that clerical and administrative workers “face the greatest impact of generative AI.”

Specific roles at highest risk include bank tellers, data-entry clerks, underwriting clerks, junior analysts, and accounts payable specialists. If you’re a developer in fintech doing similar work—form processing, compliance automation, repetitive data workflows—you’re in the same risk category. Therefore, banking goes first because it’s data-rich and highly systematized, but the automation logic applies anywhere tasks follow predictable patterns.

ABN Amro: The Template Every Bank Will Follow

ABN Amro provides the concrete proof this is happening now, not in some theoretical future. Out of 22,000 full-time employees plus 3,670 contractors, the bank is cutting 5,200 positions by 2028. That 1,000 already eliminated in 2024 wasn’t a pilot program—it was Phase 1 of systematic workforce reduction.

The FNV union called the scope “nothing short of shocking.” Union representative Gorter warned it’s “unrealistic to dismiss staff now and assume AI will seamlessly fill the gaps.” Moreover, banks counter that half the reductions will come through natural attrition. Do the math: that still leaves roughly 100,000 workers across the European sector who won’t retire conveniently on schedule. No major retraining programs have been announced. Consequently, the cost savings come precisely from not replacing those workers.

Meanwhile, Société Générale CEO Slawomir Krupa declared in March that “nothing is sacred” in his campaign to reduce costs. JPMorgan Chase Europe co-CEO Conor Hillery offered a cautionary note—”people don’t lose an understanding of the basics and fundamentals”—but his warning came after Goldman Sachs had already frozen hiring. ABN Amro is the proof-of-concept. Other banks are watching to see if labor pushback materializes. If 5,200 jobs disappear without significant resistance, the template scales.

What This Means for Tech Workers and Developers

Investor Jason Mendel frames 2026 as “the inflection point where AI crosses from assistant to replacement.” A recent survey found nearly 40% of companies plan to replace workers with AI by 2026. MIT research estimates 11.7% of jobs could already be automated, representing $1.2 trillion in wage exposure. Banking isn’t unique—it’s the canary in the coal mine.

If you work in fintech, back-office automation, or any role involving repetitive technical tasks, the same economic logic applies. High-salary employees who lack AI-related skills face the highest layoff risk according to recent analysis. Entry-level and junior roles are “shrinking fastest” as companies discover they can automate predictable work that once justified headcount.

Which skills remain safe? The research points to critical thinking and complex judgment, leadership and people management, creativity and strategic thinking, and emotional intelligence. There’s a paradox: you need AI literacy to use AI tools effectively, meaning you must learn AI capabilities to avoid being replaced by AI. The most valuable tech workers in 2026 will be those who integrate AI into their workflows to amplify capabilities AI can’t replicate—judgment, creativity, strategy.

The Timeline Is Shorter Than You Think

This transformation isn’t gradual. ABN Amro cut 1,000 jobs in 2024, will eliminate the remaining 4,200 by 2028, and Morgan Stanley projects 200,000 total sector losses by 2030. That’s a six-year span from initial execution to 10% workforce reduction. Therefore, if you’re in a vulnerable role, you have perhaps 2-4 years to reskill or reposition before the economics make your role automatable at scale.

Banking sets the template because financial services have the highest automation potential of any sector. However, insurance, legal services, accounting, and administrative roles across all companies share the same characteristics: high-volume, rules-based, data-processing work. Once the banking sector demonstrates that 30% efficiency gains justify 10% workforce reductions without major backlash, every industry will run the same calculation.

Key Takeaways

- 200,000 European banking jobs at risk by 2030 — Morgan Stanley analysis shows 10% sector-wide workforce reduction driven by AI automation delivering 30% efficiency gains

- ABN Amro proves this is happening now — 1,000 jobs already cut in 2024, another 4,200 scheduled through 2028 (24% total workforce reduction)

- The “augmentation” narrative was corporate PR — Banks chose AI imitation (cost reduction) over augmentation (productivity enhancement), Stanford research confirms this lowers wages and concentrates wealth

- Back-office and repetitive tech work most vulnerable — If you’re doing data processing, compliance automation, or repetitive development work in fintech, you’re in the same risk category as banking workers

- Safe skills emphasize human judgment — Critical thinking, creativity, leadership, emotional intelligence, and AI literacy (the paradox: learn AI to avoid being replaced by AI)

- Timeline is 2-4 years, not decades — From initial cuts (2024) to full impact (2030) is only 6 years. Banking sets the template for automation across all white-collar sectors.