Enterprise AI budgets are growing in 2026—but fewer vendors will see the money. According to a TechCrunch survey of 24 enterprise-focused VCs published December 30, the overwhelming consensus is that enterprises will increase AI spending next year while dramatically consolidating vendor relationships. Gartner forecasts $6.08 trillion in IT spending for 2026, a 9.8% jump, with AI infrastructure alone leaping from $18.3 billion to $37.5 billion. But here’s the twist: this flood of capital will concentrate around proven solutions with defensible moats, not scatter across hundreds of experimental AI startups. After years of running parallel pilots, enterprises are entering a “pick the winners” phase—and many AI vendors won’t make the cut.

The Consolidation Wave

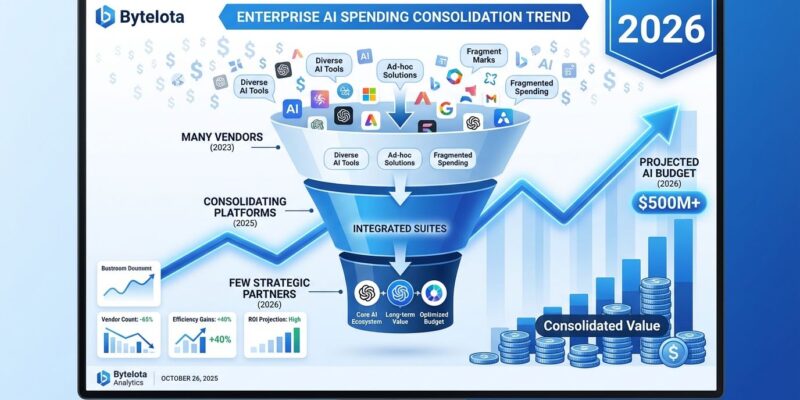

Andrew Ferguson, vice president at Databricks Ventures, calls 2026 “the year enterprises start consolidating their investments and picking winners.” The experimentation era is over. Today, enterprises test multiple AI tools for identical use cases, creating what Ferguson describes as “an explosion of startups focused on certain buying centers like go-to-market, where it’s extremely hard to discern differentiation even during proof of concepts.” As proof points emerge, enterprises will “cut out some of the experimentation budget, rationalize overlapping tools and deploy that savings into the AI technologies that have delivered.”

The numbers confirm this shift. Gartner projects inference spending—production workloads, not research experiments—will claim 55% of AI infrastructure budgets in 2026, up from a minority share in 2025. This is the telltale sign of maturation: enterprises are moving from “can this work?” to “does this deliver ROI?” And when ROI becomes the metric, vendor count drops fast.

Rob Biederman, managing partner at Asymmetric Capital Partners, predicts even broader consolidation: “Enterprise companies will not only concentrate their individual spending, but also the broader enterprise landscape will narrow its overall AI spending to only a handful of vendors across the entire industry.” Translation: 2026 could be the year enterprise budgets increase but many AI startups don’t see a bigger slice of the pie.

Where Enterprise AI Spending Goes in 2026

Harsha Kapre, director at Snowflake Ventures, breaks down 2026 enterprise AI spending into three distinct categories. First, strengthening data foundations—the unglamorous infrastructure work that makes AI actually function. This includes unified data platforms to reduce integration costs and improve data quality for AI workloads. Second, model post-training optimization—fine-tuning AI models for specific enterprise use cases, making them faster and cheaper to run. Third, and most critically, consolidation of tools.

That last category is the killer. Kapre notes that “chief investment officers are actively reducing software-as-a-service sprawl and moving toward unified, intelligent systems that lower integration costs and deliver measurable return on investment.” If your AI startup adds to SaaS sprawl rather than solving it, you’re swimming against a powerful tide. Enterprises are done with overlapping vendor relationships. They want fewer, deeper partnerships with platforms that actually integrate.

This framework reveals the strategic error many AI startups are making: they’re building point solutions in a market that’s consolidating toward platforms. The budget is there—$37.5 billion in AI infrastructure alone—but it’s concentrating around vendors who can solve multiple problems, not just one narrow use case.

Winners and Losers: AI Vendor Moats Decide Survival

The VC consensus is brutally clear: AI startups with defensible moats will capture the consolidated spending, while commoditized solutions easily replicated by AWS, Salesforce, or Microsoft will see funding and pilots dry up. More than half of VCs surveyed by NFX cite “quality or rarity of proprietary data” as the most durable moat. Vertical specialization runs a close second—deep expertise in healthcare, legal, or finance that big tech platforms can’t easily replicate.

Consider the evidence: Salesforce became the fastest-growing AWS Marketplace seller, hitting over $2 billion in sales within 18 months by bundling AI capabilities that would be standalone products for startups. When platforms like AWS and Salesforce can bundle your features for free as part of existing enterprise contracts, you don’t have a business—you have a feature. The market is already filtering aggressively for companies with proprietary data advantages, real unit economics, and deep integration into enterprise workflows.

Ferguson warns that startups in commoditizable categories will face “drying pilots and funding” as enterprises pick winners. The math is stark: AI funding consumed 50-53% of all venture capital in 2025 (up from 34% in 2024), totaling $190-$200 billion. That level of concentration is unsustainable without consolidation. VCs are tightening criteria, demanding proof of moats instead of just AI features slapped onto SaaS products.

The survivors will be vertical AI specialists with proprietary datasets, governance platforms with deep compliance expertise, and infrastructure plays embedded in critical enterprise workflows. Generic AI chatbots and easily replicated automation tools? They’re competing for scraps in an increasingly crowded market where big tech can undercut them to zero.

The AI Governance Opportunity

Here’s an underinvested category with real potential: AI governance, safety, and oversight. While AI capabilities receive 10,000 times more funding than AI safety, a massive “readiness gap” in enterprise AI governance is creating new spending opportunities. The Cloud Security Alliance found that 72% of enterprises are either not confident or neutral in their ability to secure AI systems, despite actively deploying them.

Scott Beechuk, partner at Norwest Venture Partners, sees this as the unlock for scaled deployments: “Enterprises now recognize that the real investment lies in the safeguards and oversight layers that make AI dependable. As these capabilities mature and reduce risk, organizations will feel confident shifting from pilots to scaled deployments, and budgets will increase.” Leading organizations already allocate 5% or more of their AI budgets to safety, ethics, and governance—IBM went from 2.9% in 2022 to 4.6% in 2024—but industry averages lag far behind.

The governance gap is the primary blocker preventing enterprises from scaling AI pilots to production. Companies with comprehensive AI governance are training staff at nearly 5 times the rate of those with developing policies (65% vs. 14%), according to CSA research. This isn’t just compliance theater—it’s the difference between running endless pilots and actually deploying AI at scale.

For startups, governance tools represent a category with real moats: deep expertise, proven frameworks, regulatory knowledge, and integration into risk management workflows. It’s also a greenfield opportunity. Most AI investment chases model performance and application features, leaving governance dramatically underfunded relative to enterprise need.

What This Means for Developers, Startups, and Enterprises

The consolidation wave hits different stakeholder groups in distinct ways. For developers, career planning now hinges on picking platforms with staying power. Look for proprietary data moats, vertical specialization, or big tech backing. Generic AI skills are commoditizing fast—specialize in governance, safety engineering, or deep vertical domains where expertise actually matters. The shift from training to inference also signals that production engineering and deployment skills will matter more than pure machine learning research.

For AI startups, 2026 will be the hardest funding year since the boom began. VCs now demand proof of moats, not just AI features. If you’re building commoditized SaaS with AI sprinkled on top, consider M&A exits before windows close. The viable paths forward are vertical specialists (healthcare AI, legal AI, fintech AI) and governance/safety tools. Platform plays require massive capital and network effects—most startups should avoid this lane.

Enterprises should stop running parallel pilots immediately. The data is clear: commit to 3-5 strategic AI vendors across Snowflake’s three investment categories (data foundations, model optimization, tool consolidation). CIOs are already reducing SaaS sprawl—join them. And invest in governance now. It’s no longer optional; it’s the prerequisite for scaling AI beyond departmental experiments.

The market itself will see a painful but necessary correction. Expect unicorn valuations to compress for companies without defensible moats. The AI ecosystem will get smaller but stronger, consolidating around platform players (AWS, Salesforce, Microsoft) and specialized vertical leaders. The hype cycle is ending. What comes next is a sustainable AI market where moats matter and ROI determines survival.