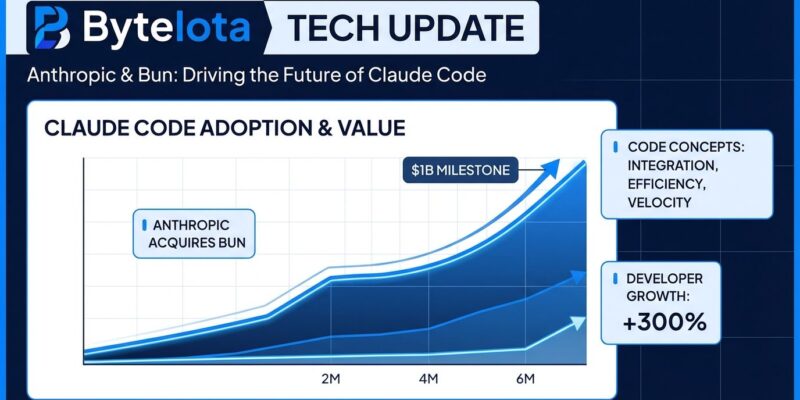

Anthropic made its first acquisition ever on December 2, acquiring Bun—a JavaScript runtime that’s 3-4x faster than Node.js. The announcement coincided with Claude Code reaching $1 billion in annualized revenue just six months after launch. That’s the fastest $0-to-$1B in developer tools history, and it signals the AI coding arms race just went vertical.

This isn’t about buying another AI model. Instead, it’s about control. Anthropic now owns the runtime that powers Claude Code, betting vertical integration beats the old “rent everything” model.

Why Buy a JavaScript Runtime?

Bun handles 120,000 requests per second while Node.js manages 32,000. Moreover, startup time is just 8 milliseconds versus 42ms. That matters when you’re executing AI-generated code thousands of times per second. Founded in 2021 by Jarred Sumner, Bun has grown to 7.2 million monthly downloads.

However, speed isn’t the full story. As one developer put it on Hacker News, “If Bun breaks, Claude Code breaks.” Consequently, owning critical dependencies isn’t paranoia—it’s survival at scale. Additionally, Bun’s single-file executables solve distribution: Claude Code ships to millions without requiring Node.js installation.

After talking with Anthropic’s competitors, Sumner made his bet clear: “I think Anthropic is going to win.”

The $1B Milestone

Claude Code hit $1 billion ARR six months after launch. In contrast, GitHub Copilot took longer despite having 20 million users and Microsoft backing. Meanwhile, Cursor crossed $500 million ARR with 1 million daily active users, but Claude Code’s sprint is unprecedented.

Enterprise adoption validates this is real: Netflix, Spotify, KPMG, L’Oreal, and Salesforce are paying for AI that writes code. Furthermore, Claude Code’s 115,000 developers process 195 million lines weekly. The market is growing 35-40% annually toward $26 billion by 2030.

Vertical Integration Everywhere

Anthropic isn’t alone in this vertical integration shift. On December 8, IBM bought Confluent for $11 billion. Similarly, AMD acquired ZT Systems for $4.9 billion. CoreWeave bought Core Scientific for $9 billion. The pattern is clear: AI companies are done renting infrastructure.

This is the end of the “API economy” for AI tools. Therefore, owning the stack—models, infrastructure, runtimes, tooling—gives performance and control advantages. Microsoft already owns GitHub, npm, VS Code, and TypeScript. Consequently, expect OpenAI and Google to follow with acquisitions.

Open Source Under Pressure

Bun remains open source under its MIT license. Anthropic promises the same team will continue public development. However, developers are skeptical for good reason—corporate acquisitions have a mixed track record with open source independence.

The community is asking: Will Bun stay general-purpose or become Claude-specific? What happens when Anthropic’s goals diverge from JavaScript community needs? These concerns are based on decades of watching corporate acquisitions redirect open source projects.

Sumner’s argument is pragmatic: “Instead of putting users through ‘Bun tries to figure out monetization,’ we can focus on building the best tooling.” In fact, a $26 million funding round doesn’t guarantee Bun exists in 10 years, but Anthropic’s backing does. Ultimately, the tension between corporate resources and community independence will define Bun’s future.

What This Means for Developers

The AI coding tools market is consolidating rapidly. GitHub Copilot dominates with $2 billion ARR. Claude Code hit $1 billion in six months. Cursor grows at 71% quarterly. As a result, dozens of smaller players will be acquired or fade. The market is moving to 3-5 major platforms.

Moreover, runtime choice is increasingly tied to AI platform choice. Betting on Anthropic? Learn Bun. Committed to Microsoft? Stick with Node.js and GitHub Copilot. This isn’t about JavaScript runtimes anymore—it’s about which AI company you’re trusting to build your entire development stack.

Anthropic is preparing for an IPO with a $300 billion valuation target. Therefore, the Bun acquisition positions Anthropic as infrastructure, not just models. The companies that win won’t just have better AI—they’ll own everything from runtime to IDE to cloud.

The open-source buffet is closing. AI companies want to own their stacks, not share them. For developers who value independent tools, this trend is concerning. However, for those who just want fast AI coding, Anthropic’s vertical integration bet is about to get tested at scale. The debate continues on whether this consolidation helps or hurts the developer community.