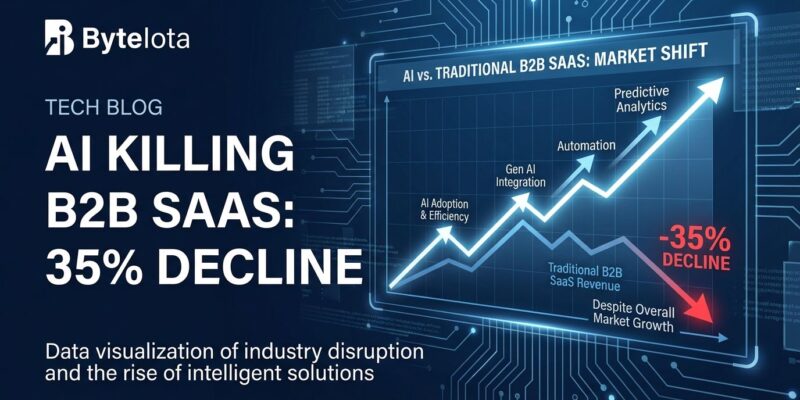

The B2B SaaS industry is experiencing a brutal bifurcation in 2026. While the overall market grows 18% annually toward $1.1 trillion by 2032, more than 35% of individual SaaS companies are in decline, according to data published this week in the Maxio Report. The culprit isn’t market saturation – it’s AI agents that automate what software merely enables, threatening the fundamental economics that made SaaS profitable for two decades.

This isn’t incremental disruption. It’s a structural shift in how software creates value and captures revenue.

AI Breaks the SaaS Margin Model

Traditional SaaS companies enjoyed gross margins of 80-90% because costs scaled per customer. You built infrastructure once, then amortized it across thousands of users. Each additional customer cost almost nothing. AI-first SaaS companies see margins of 50-70% because costs scale per action – every AI inference burns GPU compute. Each user prompt costs money, consuming 40-50% of revenue in COGS for model hosting and inference.

The per-seat pricing model that built the industry is dead for AI-enabled products. When 10 AI agents can do the work of 100 sales reps, you don’t need 100 Salesforce seats anymore – you need 10. That’s a 90% reduction in seat revenue for the same work output. The math is brutal and unavoidable.

Real companies are responding accordingly. Klarna publicly announced it’s dropping Salesforce CRM and Workday entirely. Publicis Sapient is cutting traditional SaaS licenses by 50%, including Adobe. Microsoft CVP Charles Lamanna predicts traditional business applications will be obsolete by 2030, replaced by AI-powered “business agents.” When Microsoft says your business model is dead, pay attention.

Winners Get 10x Budgets, Losers Fight for Scraps

The SaaS market isn’t declining uniformly – it’s splitting into two distinct worlds. AI-native companies raise seed rounds at a $19.8 million median valuation, up from $14.7 million in 2024. They command a 42% valuation premium versus non-AI startups and achieve revenue multiples of 20x-30x. Lovable went from co-working space to $6.3 billion valuation with $100M ARR and a 50-person team – that’s $2M in annual recurring revenue per employee.

Traditional SaaS companies face flat budgets, price resistance, and difficulty raising funding without “AI-native” credentials. The spending data confirms the split: while overall software spend is up a record percentage in 2026, half of that increase goes to price increases from existing vendors, and 30%+ of new spending is allocated specifically to AI, not traditional SaaS products.

The stock market priced in the disruption immediately. In January 2026, Anthropic unveiled Claude Cowork, an agentic AI platform for business tasks. Analysts coined the term “SaaSpocalypse” as Gartner plummeted 21%, S&P Global dropped 11%, and Intuit and Equifax each lost more than 10%. The market understands what many SaaS companies refuse to accept: AI agents don’t complement software – they replace it.

Probabilistic SaaS Dies First

Not all SaaS categories are equally vulnerable. Bain & Company identifies the key distinction: AI will consume probabilistic categories while deterministic systems become more valuable by adding AI as a complementary layer. Probabilistic tasks – content generation, recommendations, analysis, decision support – are exactly what LLMs excel at. Deterministic systems – ERP, compliance platforms, financial records – require precision and accountability that AI assists but doesn’t replace.

Customer service and support software face the most immediate threat. Gartner predicts AI will resolve 80% of user issues without human assistance by 2029, and agents are already expected to handle 40-60% of initial customer interactions by year-end. Sales automation follows close behind, with autonomous AI SDRs identifying leads, sending personalized outreach, replying to follow-ups, and booking demos with zero human intervention. Marketing automation and BI dashboards complete the vulnerable category list – when AI can query data directly via natural language, dashboard interfaces become unnecessary middleware.

Vertical SaaS offers the strongest defense. Vertical-focused companies grew 20-31% in 2026 versus 16-28% for horizontal platforms. The vertical SaaS market expands at a 23.9% CAGR, nearly double the broader SaaS rate, and 89% of executives view vertical specialization as the sector’s future. Deep domain expertise, industry-specific workflows, and compliance requirements create moats that AI can’t easily cross. Horizontal SaaS platforms without AI-native architecture will struggle to compete.

The Pricing Model Crisis

Per-seat pricing can’t survive AI agents. The unit of value shifted from “access” to “outcome” – when AI agents execute workflows autonomously, charging per human seat makes no economic sense. The industry is racing toward alternatives, but the transition is messy and winners aren’t clear yet.

Usage-based pricing achieved 61% adoption by 2022 and remains dominant for AI-heavy products. It aligns costs with consumption, but creates revenue unpredictability for vendors and budget anxiety for customers. Outcome-based pricing targets 40% adoption by end of 2026, up from 15% two years prior, according to Gartner. Intercom’s Fin AI chatbot charges $0.99 per successful resolution – you pay only when the AI actually solves a customer issue. The model suits vertical SaaS with clear ROI metrics, but requires sophisticated outcome tracking infrastructure.

Most AI SaaS products (80%+) default to hybrid models combining a base fee for predictability with usage components for fairness. It’s a compromise that satisfies no one perfectly but avoids the extremes of pure seat-based or pure usage pricing. Paradoxically, as AI infrastructure costs drop, some providers are reintroducing seat-based packages with tight usage caps in 2026. The market hasn’t settled on a winning pricing architecture, which means companies must experiment – and some will guess wrong.

What Developers Should Actually Do

This isn’t theoretical. Developers need to make concrete decisions today that determine career trajectory and company survival.

If you’re building new products, go AI-native from day one. That means agents as core architecture, not AI features bolted onto existing workflows. Design for usage-based or outcome-based pricing from launch – retrofitting pricing models later means rebuilding product architecture, sales processes, and customer contracts simultaneously. Target vertical specialization over horizontal platforms. The data proves vertical companies outperform horizontal, and deep domain moats offer the strongest defense against commoditization.

If you’re at a traditional SaaS company, push for architectural transformation, not feature additions. Adding a chatbot or “AI insights” panel doesn’t make you AI-native – it makes you a traditional SaaS company with expensive AI bolt-ons. Advocate for pricing model shifts now, not in six months. The companies making these decisions in Q1 2026 will capture the tailwinds; those waiting for Q3 will fight uphill.

Prioritize agent orchestration skills over implementation details. Forward-deployed engineer roles have grown 800% since 2022, copying the Palantir playbook of ontologies operationalized by engineers embedded with customers. Learn frameworks like LangGraph, CrewAI, and AutoGen. Build hybrid human-AI workflows, not fully autonomous systems – 81% of AI usage remains assist-only, not autonomous. Focus on orchestration, not coding – vibe coding is already cutting development costs 70-95% and democratizing application development beyond traditional software engineers.

The reality check matters: the market is still growing from $315 billion in 2026 to a projected $1.1 trillion by 2032. Enterprises still need accountability, governance, and audit trails that AI can’t fully automate. Vertical specialization creates real moats. Infrastructure and platform SaaS remain strong. This is transformation, not extinction.

But the winners will look different than today’s incumbents. AI-native architecture, outcome-based pricing, vertical specialization, and agent orchestration capabilities separate the companies riding 10x budget tailwinds from those fighting for scraps of declining non-AI budgets. The bifurcation is real, it’s accelerating, and positioning happens now – not next quarter.

Key Takeaways

- The economic mechanism is brutal: AI turns software from an 80-90% margin product to a 50-70% margin service because costs shift from per-customer to per-action, breaking the profit model that built the industry for 20 years

- Market bifurcation is accelerating: AI-native companies command 42% valuation premiums and access 10x budgets while 35%+ of traditional SaaS companies decline despite overall market growth – you’re in one world or the other with no middle ground

- Probabilistic SaaS faces existential threat: Customer service, sales automation, marketing tools, and BI dashboards will be replaced first; vertical SaaS with domain expertise and deterministic systems like ERP and compliance have defensive moats

- Per-seat pricing is dead for AI products: When 10 AI agents replace 100 human workers, seat licenses collapse 90%; outcome-based pricing suits vertical SaaS, usage-based works for AI-heavy products, hybrid dominates for now but market hasn’t settled

- Action required immediately: Build AI-native from day one if starting new, push architectural transformation at existing companies, learn agent orchestration not just coding, specialize vertically – 81% assist-only usage means transformation not extinction, but winners emerge now