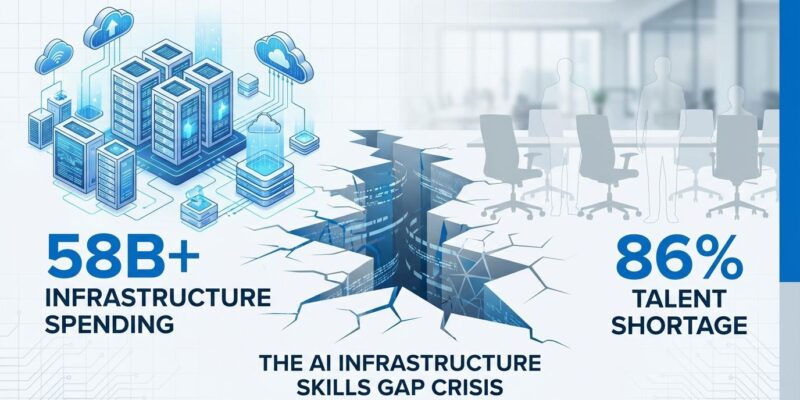

The AI infrastructure market is racing toward $758 billion by 2029, with organizations increasing compute and storage spending by 166% year-over-year in Q2 2025 alone. Hyperscalers are pouring $350 billion into capacity this year. Enterprise AI spending exploded from $1.7 billion to $37 billion since 2023. But beneath this massive build-out lies a critical problem: 86% of organizations lack the talent needed to meet their AI goals, and the skills gap is widening, not closing. The emperor has no data scientists.

The $758B Infrastructure Race Nobody Can Staff

IDC projects the AI infrastructure market will hit $758 billion by 2029, driven overwhelmingly by hyperscalers and cloud providers who account for 86.7% of current spending. In Q2 2025 alone, organizations spent $82 billion on AI compute and storage hardware—a 166% year-over-year increase. Accelerated servers will comprise 94.3% of the market by 2029. Cloud and shared environments dominate, representing 84.1% of total AI infrastructure spending.

The United States leads with 76% of global spending, followed by China at 11.6%. But the real story isn’t geography—it’s velocity. China’s AI infrastructure market is growing at 41.5% CAGR, followed closely by the US at 40.5%. The race to build capacity is accelerating, with hyperscalers betting hundreds of billions on infrastructure demand that may not materialize.

The Skills Crisis Is Getting Worse, Not Better

Only 14% of organizations report having adequate talent to meet their AI goals. That means 86% face talent gaps. Worse, the gap is widening: 61% of organizations now face staffing shortages in managing specialized AI infrastructure, up from 53% a year ago. That’s a 15% increase in a single year. While infrastructure spending surged 166%, the talent pool barely budged.

The global picture is even bleaker. AI talent demand exceeds supply by 3.2:1—1.6 million open positions chasing just 518,000 qualified candidates. In the United States, AI job demand could surpass 1.3 million positions over the next two years, but current supply is on track to fill fewer than 645,000. That implies up to 700,000 US workers will need reskilling by 2027 just to close the gap.

Germany faces the worst shortage among developed economies, with projections showing 70% of AI jobs unfilled by 2027. The UK isn’t far behind, facing a talent shortfall exceeding 50%. This isn’t a temporary hiring slowdown—it’s a structural deficit that will take years to resolve.

Exploration Is High, Production Is Stalled

Ninety percent of IT leaders are deploying generative AI, and 81% of C-suite executives are personally driving AI decisions—up 28 points from the prior year. Seventy percent of organizations allocate at least 10% of their total IT budgets to AI initiatives. The commitment is real. The execution is not.

When asked about barriers to scaling AI, 44% of organizations cite infrastructure limitations as the top obstacle. But dig deeper and the real constraint emerges: those “infrastructure limitations” are actually talent limitations in disguise. Data center vacancy rates hit a record low of 1.9% in primary markets, and procurement timelines now exceed 24 months for organizations seeking 5+ MW capacity. Physical infrastructure is constrained, yes—but the bottleneck is expertise, not hardware.

The proof is in the delays. Sixty-seven percent of companies report that skills shortages delayed deployment of critical automation or analytics initiatives. Eighty-five percent of tech executives have postponed important AI projects due to engineer shortages. Infrastructure is sitting idle because no one knows how to operationalize it.

The ROI Crisis: Optimism Meets Reality

Fifty-one percent of organizations expect measurable financial returns from AI within one year. That optimism doesn’t match reality. Infrastructure investments are sitting underutilized while companies scramble to hire talent that doesn’t exist. AI roles command 67% higher salaries than traditional software positions, with 38% year-over-year growth across all experience levels. The market is bidding up prices for a finite talent pool.

Even when companies succeed in hiring, they’re often not getting qualified talent. Fifty-seven percent of newly hired data professionals lack essential familiarity with industry best practices, and 56% lack up-to-date technical knowledge. Throwing money at the problem doesn’t work when the candidates themselves aren’t ready.

The hardest roles to fill tell the story. Seventy-eight percent of organizations struggled to find AI ethics specialists in 2024. Seventy-four percent couldn’t hire skilled AI data scientists. Seventy-two percent faced difficulties recruiting AI compliance specialists. These aren’t niche positions—they’re foundational to operationalizing AI at scale. Without them, billion-dollar infrastructure investments deliver minimal returns.

What Comes Next: The Gap Will Worsen Before It Improves

The timeline for developing AI talent is measured in years, not months. Universities can’t scale fast enough, bootcamps produce graduates with shallow expertise, and on-the-job training requires years of experience that junior hires don’t have. Meanwhile, infrastructure spending continues accelerating. The gap between capacity and capability will widen before it narrows.

Organizations that solve the talent problem will gain a durable competitive advantage. The winners won’t be those with the most compute or the biggest models—they’ll be the ones who can attract, retain, and develop specialized AI talent faster than competitors. Skills development must catch up to infrastructure spending, or the industry will drown in underutilized capacity.

The “build it and they will come” fallacy is fully exposed. Hyperscalers bet that demand would follow supply. But demand is constrained by talent, not infrastructure availability. The bottleneck has shifted from machines to people, and no amount of capital expenditure can fix a structural talent deficit. The emperor has no data scientists, and infrastructure without expertise is just expensive hardware sitting idle.