The enterprise AI spending boom isn’t spreading evenly—it’s consolidating. VCs predict 2026 as the year enterprises increase budgets while slashing vendor counts, a shift confirmed by Ramp’s January 2026 rankings: Google swept all four enterprise procurement categories, with Anthropic and OpenAI following. After two years of pilots, CFOs are done testing. They want ROI, and they want it from fewer vendors.

Platform plays—Azure OpenAI Service, AWS Bedrock, Google Vertex AI—are winning because they solve what CFOs actually care about: vendor risk, predictable economics, and unified governance. For AI startups without proprietary data or proven ROI, the math is brutal. Budgets are rising, but most vendors won’t see a cent of it.

The Numbers Don’t Lie: Google Dominates, Anthropic Outspends OpenAI

Ramp’s January 2026 vendor rankings confirm what VCs have been predicting: consolidation is here. Google topped all four categories—new customer count, new spend, fastest-growing customer count, fastest-growing spend. Not one or two. All four. This marks a dramatic shift from 2023, when ChatGPT’s launch put OpenAI in the enterprise driver’s seat.

However, the Anthropic data tells a more nuanced story. Despite 12% enterprise penetration versus OpenAI’s 36%, Anthropic outperforms on per-seat spend. Enterprises pay more for Claude than ChatGPT, signaling a quality and safety premium among large buyers. Meanwhile, xAI ranks fifth in customer growth but captures only 2% of US businesses—a long road ahead.

Moreover, Microsoft’s $300 billion in locked-in commercial contracts (up 67% year-over-year) demonstrates enterprises aren’t just talking consolidation—they’re signing multi-year commitments. The experimental phase is over. Production deployments are the new normal, and enterprises are voting with their wallets.

Related: GitHub Copilot Multi-Model: Claude Opus 4.5 & GPT-5.2 Now GA

AI Enterprise Spending Consolidates to Platform Plays

Azure OpenAI Service, AWS Bedrock, and Google Vertex AI aren’t winning on cutting-edge models. They’re winning on vendor risk reduction. Enterprises prefer Microsoft, Amazon, and Google over standalone API providers because platforms offer unified billing, built-in governance, and integration with existing infrastructure. These aren’t technical advantages—they’re procurement advantages.

Azure’s strength lies in exclusive OpenAI access (63% of companies use OpenAI models) and deep Microsoft ecosystem integration. AWS Bedrock leads on model diversity, offering Claude, Titan, Stable Diffusion, and Llama through a single managed service. Google Vertex AI attracts data-heavy organizations with advanced MLOps and tight integration with Google Cloud’s analytics stack. Each platform has ~500,000 developers, with AWS maintaining 30% cloud market share, Azure at 20% (39% YoY growth), and GCP at 13% (32% YoY growth).

For developers, this matters for career decisions. Specialization in one platform (Azure, AWS, or GCP) increasingly outweighs generalist AI engineering skills. Job postings for AWS Bedrock experience alone number 8,000-12,000 globally. The market is sending a clear signal: deep platform expertise pays better than shallow tool familiarity.

Who Loses: Generic AI Startups Without Defensible Moats

VCs are blunt about who won’t survive 2026: vendors offering generic AI products without clear differentiation. Chatbots without specific use cases, model wrappers without proprietary data, and point solutions that duplicate platform functionality are the first casualties. “Budgets will increase for a narrow set of AI products that clearly deliver results and decline sharply for everything else,” multiple VCs told TechCrunch.

The survival criteria are harsh. Proprietary data, unique workflows, or elite Forward Deployed Engineering teams—pick at least one. Companies building on generic foundation models without distribution advantages will lose as Microsoft, Amazon, and Google embed equivalent functionality into existing suites. As a result, predictions suggest 40-60% of AI startups will fail or be acquired in 2026.

Furthermore, CFO veto power is emerging as the final boss for AI vendors. “CFOs will kill more AI projects than CTOs launch,” warns CIO Magazine. The era of “innovation for innovation’s sake” is dead. If you can’t prove ROI in 90 days, you won’t get renewed. Enterprises have spent two years testing; now they’re cutting the losers.

Why Now? The Experimental Phase Ends

The 2024-2025 pilot phase followed a predictable pattern: enterprises tested everything, committed to nothing. Companies ran dozens of AI experiments across 15-25 vendors, spending $150,000 monthly with low ROI visibility. This created SaaS sprawl on steroids—the average enterprise now juggles 125+ SaaS applications, with 60% of IT leaders reporting new tool additions every month.

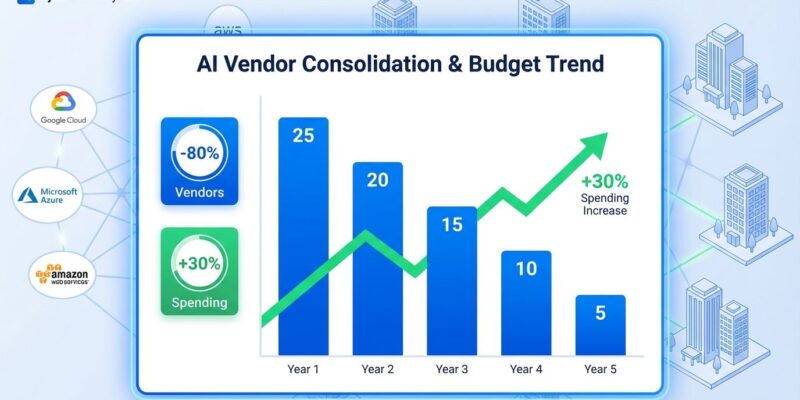

CFOs and CIOs have had enough. The “ROI benchmarking shift” is real: renewal decisions now hinge on comparative proof versus narrative. Vendors must demonstrate measurable business outcomes—revenue impact, cost savings, or risk reduction—not just feature lists. Consequently, enterprises are consolidating from 15-25 vendors to 3-5 strategic platforms, often increasing per-vendor spend while cutting total vendor count by 80%.

“If 2025 was the year of proof, 2026 will be the year of scale,” summarizes the consolidation timeline. Enterprises that participated in the pilot phase now know what works. Therefore, they’re doubling down on proven platforms (Azure, AWS, GCP) with established integrations rather than continuing vendor experimentation.

Related: Cloud Repatriation 2026: 80% of Enterprises Leaving AWS

The Lock-In Debate: Trade-Off, Not Dealbreaker

Platform consolidation reignites the classic “best-of-breed versus platform” debate, but the 2026 version has a twist: 87% of enterprises already run multi-cloud environments. Lock-in isn’t binary. The real trade-off is operational complexity versus integration simplicity, and most enterprises are choosing simplicity.

“Most companies aren’t choosing an AI partner—they’re locking themselves into a system, and once you do, escaping it is nearly impossible,” warns one platform analysis from Constellation Research. However, this framing misses the point. Lock-in is inevitable. The question is which ecosystem aligns with existing infrastructure. Platform vendors offer unified billing, single-pane-of-glass management, and integrated security controls—benefits that outweigh theoretical flexibility for most organizations.

Nevertheless, a new complexity is emerging: agent sprawl. Even as enterprises consolidate tools, AI agent proliferation creates a new form of sprawl. Gartner warns organizations will realize “AI doesn’t eliminate tool sprawl; it only accelerates it” as mature AI agents multiply. This suggests the consolidation battle won’t end with vendor reduction—it will shift to agent orchestration and governance.

Key Takeaways

- Google swept all four Ramp vendor ranking categories in January 2026; Anthropic outspends OpenAI per-seat despite lower penetration, signaling enterprise quality premiums

- Platform plays (Azure OpenAI, AWS Bedrock, Google Vertex) win on vendor risk reduction and operational simplicity, not cutting-edge models—CFOs prioritize predictable economics over innovation

- 40-60% of AI startups face failure or acquisition in 2026; survival requires proprietary data, unique workflows, or elite engineering support—generic model wrappers won’t make it

- Enterprises are consolidating from 15-25 AI vendors to 3-5 strategic platforms while increasing total spend 20-30%—more money, fewer recipients

- For developers, platform specialization (Azure, AWS, or GCP AI services) outweighs generalist skills; job market demands deep expertise in one ecosystem, not shallow knowledge of many tools

The vendor consolidation wave isn’t slowing—it’s accelerating. Enterprises have clarity after two years of experimentation, and they’re acting on it. If you’re an AI vendor without proven ROI or defensible differentiation, 2026 won’t be kind. If you’re a developer choosing which skills to invest in, the data points toward platform specialization. And if you’re an enterprise still running 20+ AI vendors, your CFO is already planning the cuts.