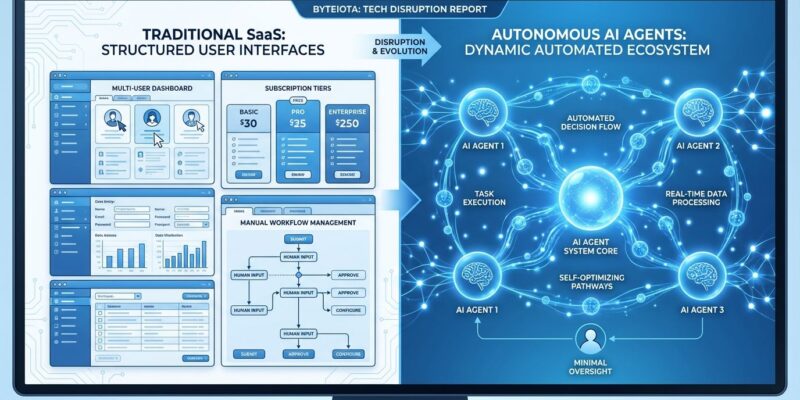

The SaaS extinction event has begun. OpenAI reports corporate consumption of reasoning tokens exploded 320 times year-over-year, while 79% of enterprises have already deployed AI agents to replace workflows that once required dedicated software platforms. This isn’t gradual disruption—it’s an accelerating reckoning that will determine which software companies survive the next three years.

Y Combinator predicts vertical AI agents could create a market 10X larger than SaaS itself. Moreover, Microsoft CEO Satya Nadella warns that traditional business applications could “collapse” by 2030 as autonomous agents replace the business logic layer that defines most enterprise software. The question isn’t whether AI agents will eat SaaS—it’s which categories get devoured first.

The Data Is Staggering

When enterprise usage grows 8X in months and acquisitions hit multi-billion dollars, dismissing AI agents as hype becomes willful ignorance. OpenAI’s 2025 State of Enterprise AI report reveals ChatGPT Enterprise seats grew ninefold, exceeding 7 million users. Furthermore, corporate reasoning token consumption—the most complex AI operations—surged 320X year-over-year.

The PwC AI Agent Survey confirms 79% of organizations have adopted AI agents to some extent, with 23% scaling deployments enterprise-wide. Among adopters, 66% report measurable productivity gains. Additionally, U.S. enterprises forecast an average 192% ROI from agentic AI.

ServiceNow validated the trend by acquiring AI agent platform Moveworks for $2.85 billion in March 2025. Consequently, legacy software incumbents are making billion-dollar strategic bets that agents will replace traditional SaaS. Meanwhile, 88% of executives plan budget increases driven specifically by agentic AI opportunities—capital is flowing away from SaaS subscriptions toward agent infrastructure.

The Death Zone: Which SaaS Dies First

Bain & Company research identifies six vulnerability indicators that predict which SaaS categories face extinction. Customer support platforms (Zendesk, Intercom), workflow automation tools (Zapier, Make), form software, scheduling apps (Calendly), and basic CRM systems score highest on all risk metrics. These tools share common traits: repetitive tasks, accessible APIs, low regulatory barriers, and minimal domain expertise requirements.

Gartner predicts 75% of customer service interactions will be AI-handled by 2026, up from 25% in 2023. However, the shift is already underway. Gig.ml autonomously manages tens of thousands of support tickets daily for Zepto, while MCH replaces entire QA teams with AI systems. These aren’t pilot programs—they’re production deployments eliminating the need for traditional support SaaS.

The irony is delicious: workflow automation companies built to automate your job are having their own jobs automated. When HubSpot’s list building and Monday.com’s task boards become agent-accessible via API, companies reduce license counts by 80% as autonomous systems replace human operators. Single-purpose tools that provide glorified interfaces to databases are discovering that agents don’t need interfaces.

Related: Google Antigravity: Multi-Agent IDE Debuts at #1 (Free Preview)

What Survives: Platform Tools and Regulated Industries

Not all SaaS is doomed. Six protection indicators shield certain categories from agent disruption: regulatory barriers (healthcare, finance), proprietary data depth, network effects, switching friction, and deep technical complexity. For instance, Stripe survives because agents need payment infrastructure. AWS endures because agents run on cloud compute. Procore’s construction project management persists because regulatory oversight mandates human decision-making.

Medidata’s clinical trial randomization requires strict FDA compliance—autonomous agent decisions violate audit requirements. Similarly, financial services SaaS serving SOX-compliant workflows remain protected by regulatory frameworks that haven’t adapted to agentic AI governance. Healthcare platforms handling HIPAA data face similar protection, where manual oversight isn’t optional—it’s legally mandated.

Deep technical tools that agents can’t yet replicate also survive. GitHub, Datadog, and Snowflake possess domain complexity and proprietary optimization that exceeds current agent capabilities. Network-effect platforms where value derives from the network (LinkedIn, Airbnb) rather than software features remain insulated. The pattern is clear: infrastructure agents depend on, specialized domains requiring human expertise, and platforms where regulation demands human oversight all survive.

Reality Check: 70% Failure Rates

AI skeptic Gary Marcus provides necessary perspective: current agents fail approximately 70% of complex benchmark tasks per CMU studies, with errors compounding across multi-step workflows. Security research reveals even the most hardened systems suffer 1.45%+ successful attack rates. Fortune magazine reports enterprise customers finding “reality doesn’t match the hype.”

Agents produce mangled documents, hallucinate information, and generate brittle code that resists maintenance. These systems operate through pattern matching rather than genuine comprehension, making them unsuitable for critical-path operations where 70% success rates are catastrophic.

However, trajectory matters more than current state. Reliability will improve. Models advance monthly. The gap between “70% success on benchmarks” and “production-ready for repetitive workflows” is narrowing faster than SaaS vendors acknowledge. The enterprises dismissing agents due to current limitations are making the same mistake Blockbuster made dismissing early Netflix streaming quality.

What to Build Instead

Y Combinator’s bold prediction that vertical AI agents could be 10X bigger than SaaS rests on a crucial insight: agents don’t just replace software spending—they replace payroll expenses. Consequently, a customer support agent SaaS subscription costs hundreds monthly. The support team it replaces costs tens of thousands. Vertical AI agents attack the larger expense.

Three categories represent the future. First, vertical AI agents for specific industries: Sweet Spot monitors government contracts, MCH automates QA testing, Gig.ml handles customer support at scale. These specialized agents develop domain expertise and regulatory compliance that horizontal tools lack.

Second, agent infrastructure and orchestration. As 64% of deployments focus on business process automation, demand surges for tools that help agents coordinate, monitor decisions, and implement human-in-the-loop escalation. This is the picks-and-shovels play—selling infrastructure to the gold rush.

Third, hybrid platforms providing 80% agent automation with 20% expert oversight. Pure automation hits reliability walls. Nevertheless, hybrid systems that route edge cases to humans while agents handle routine operations deliver production-grade reliability today, not eventually.

The strategic imperative: Build FOR agents, not AGAINST them. SaaS that agents consume (via APIs) survives. SaaS that agents replace dies.

Key Takeaways

- The disruption is measurable and accelerating. OpenAI’s 320X reasoning token growth, ServiceNow’s $2.85B acquisition, and 79% enterprise adoption aren’t speculative—they’re current reality.

- Customer support platforms, workflow automation tools, form software, scheduling apps, and basic CRM face existential threats. Repetitive, API-accessible workflows with low regulatory barriers get automated first.

- Regulated industries (healthcare, finance), core infrastructure (payments, cloud), and deep technical platforms (developer tools, data analytics) remain protected by compliance requirements, switching costs, and complexity.

- Agent reliability currently lags production needs with 70% failure rates on complex tasks. However, trajectory matters more than snapshots. Enterprises betting on current limitations persisting are misreading the trend.

- Developers should build vertical AI agents for specific industries, agent infrastructure and orchestration tools, or hybrid human-in-the-loop platforms. Traditional single-purpose SaaS is a dying category.

Is your SaaS product already dead? If it automates repetitive workflows, exposes APIs, and lacks regulatory moats, the answer is probably yes. The question is whether you’ll be the one building its replacement or watching someone else collect that outcome.