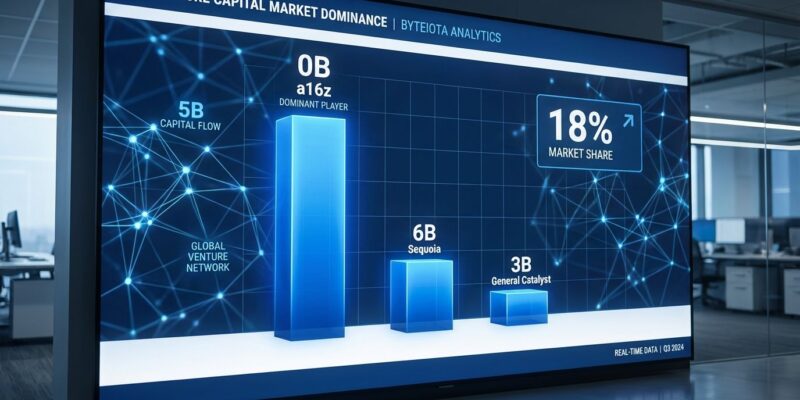

Andreessen Horowitz announced a $15 billion fundraise on January 9, capturing 18% of all U.S. venture capital raised in 2025. Moreover, this happened in the worst VC market since 2017, when overall fundraising fell 35% to just $66 billion. The firm now controls $90+ billion in assets under management—60% larger than Sequoia Capital and more than double General Catalyst. Consequently, this isn’t diversification. It’s market consolidation at scale.

The raise brings a16z’s total assets to a level that dwarfs its competitors. Indeed, TechCrunch called them “the venture firm that ate Silicon Valley,” and the numbers back it up. Since 2015, a16z has funded more early-stage unicorns than any other investor. Furthermore, the distance between a16z at #1 and Sequoia at #2 equals the distance between #2 and #12. For developers and startups, one firm now has outsized influence over which technologies get funded, which salaries get paid, and which technical directions the industry takes.

Where the $15 Billion Goes

The allocation isn’t generic—it’s strategic. Specifically, the largest chunk, $6.75 billion, goes to late-stage growth investments, funding companies scaling toward IPO. Infrastructure gets $1.7 billion, targeting AI infrastructure, cloud platforms, and distributed systems. Applications get another $1.7 billion, focused on AI-powered products like Character.AI. Additionally, bio and health receive $700 million for drug discovery and healthcare AI.

However, the most revealing allocation is $1.176 billion for “American Dynamism”—a16z’s practice focused on defense, aerospace, public safety, and supply chain. The portfolio includes Anduril (autonomous defense systems), Shield AI (military drones), Saronic Technologies (autonomous naval vessels), and Castelion (hypersonic missiles). This isn’t abstract investing. It’s funding the hardware and software that powers modern warfare.

For developers, the message is clear: follow the money. If you’re building AI infrastructure or defense tech, capital is abundant. Conversely, if you’re building consumer social apps without an AI angle, good luck finding funding. The allocation signals where jobs, salaries, and opportunities will be concentrated over the next three to five years.

VC Just Became Explicitly Geopolitical

Ben Horowitz didn’t hide the strategy. In his essay “Why Are We Here? Why Did We Raise $15B?”, he wrote: “At this moment of profound technological opportunity, it is fundamentally important for humanity that America wins.” The $1.176 billion American Dynamism fund explicitly targets technologies that maintain U.S. competitive advantage against China. The focus areas: AI, crypto, defense, and “technologies competitive with China.”

This marks a departure from Silicon Valley’s traditionally global, open ethos. Notably, a16z isn’t just backing good ideas—they’re backing technologies that advance American geopolitical power. The firm’s mission statement now includes ensuring benefits “go to America, the American people, and their allies around the world.”

For international developers and startups, this signals a more U.S.-centric funding environment. Meanwhile, for domestic developers, it’s a bet that aligning with national priorities increases your chances of getting funded. Venture capital just became nationalist.

The Concentration Question Nobody Asks

Here’s what the 2026 VC outlook research shows: “Without a core AI story it’s nearly impossible for a company to get funded.” Funds larger than $500 million control more than 50% of all dry powder. Moreover, the U.S. accounts for 85% of global AI funding and 53% of global AI deals. Non-AI sectors face a funding drought. The market is bifurcated—strong AI companies attract capital easily, while everyone else struggles.

This level of concentration raises questions about innovation. Historically, breakthrough technologies came from non-consensus bets that most VCs initially rejected. However, when capital concentrates at mega-funds with explicit strategic priorities, those non-consensus bets don’t get funded. Emerging fund managers face an “increasingly unforgiving” environment. Diverse, risky early-stage investments get crowded out by “also-ran” AI companies competing for the same capital.

Is this healthy for innovation? When one firm controls 18% of U.S. venture capital and explicitly prioritizes AI and defense, other sectors starve. For developers working on projects outside these categories, the message is unambiguous: pivot or perish.

What Developers Should Watch

The VC market depends on liquidity events to justify current valuations. Expected 2026 IPOs include SpaceX, OpenAI, and Anthropic—all in a16z’s portfolio. If these succeed, the VC market recovers, hiring surges, and salaries increase. However, if they fail, 2026 will be worse than 2025.

For developers, this fundraise is both signal and constraint. The signal: where capital flows, opportunities follow. The constraint: innovation now concentrates in two categories—AI and American Dynamism—while everything else faces a funding winter. Ultimately, the firm that ate Silicon Valley is setting the menu for the next half-decade of tech development.