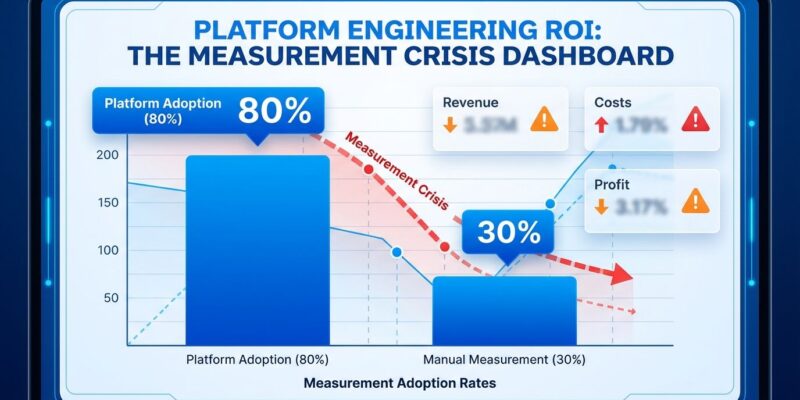

Platform engineering hit an inflection point in 2026. Gartner predicts 80% of software engineering organizations will have platform teams by year-end, yet 29.6% of those teams don’t measure ANY success metrics, according to a survey of 518 platform practitioners. This is a $5-10 million investment discipline where nearly one-third of companies can’t answer the question: “Is this working?”

The paradox is stark: Platform engineering adoption exploded from 45% in 2022 to a projected 80% by end of 2026, with median budgets doubling from under $1 million to $5-10 million for comprehensive capabilities. Organizations are betting big on platforms—self-service infrastructure, reduced cognitive load, faster delivery—but many are flying blind on whether these investments deliver value.

The Adoption Boom Behind Platform Engineering

The numbers tell the story of a discipline reaching critical mass. Gartner’s 80% adoption prediction represents near-universal embrace of platform engineering, and the role of “Head of Platform Engineering” is becoming as common as “VP of Engineering” in mid-to-large enterprises. This isn’t incremental growth—it’s a fundamental shift in how organizations structure engineering teams.

Moreover, budget trends mirror the adoption surge. Median platform budgets are doubling from sub-$1 million concentrations to $5-10 million for mature capabilities including AI integration, security tooling, and observability platforms. Over 55% of organizations had already adopted platform engineering by 2025, and those investments are substantial: comprehensive platform teams often employ 250-280 members focusing on compute, runtime, CI/CD, tools, observability, and cost efficiency.

The rationale is sound. Platforms promise developer self-service, elimination of ticket queues for infrastructure requests, reduced cognitive load from managing dozens of tools, and faster time-to-market. DevOps philosophy meets engineering discipline: Platform engineering is the “how” that scales DevOps principles across enterprise organizations.

The Platform Engineering Measurement Crisis

Here’s the problem: 29.6% of platform teams don’t measure success at all. That’s down from 45% in 2024, but the improvement is modest given the stakes. A survey of 518 platform practitioners reveals not just a measurement gap, but a measurement crisis with multiple layers.

Among those who claim to measure (70.4%), a significant portion can’t actually track improvement. The report identifies a “5% delta of liars”—teams that have measurement infrastructure but lack visibility into whether metrics have progressed. Furthermore, another 24.2% of measuring teams cannot determine if their key indicators have actually improved. Having dashboards doesn’t equal meaningful measurement.

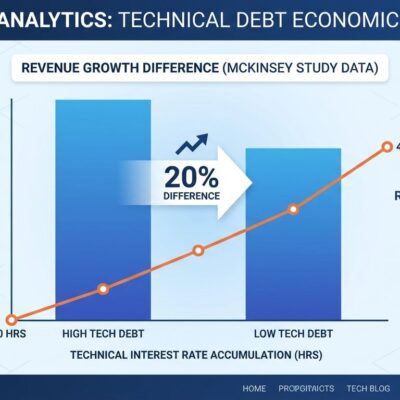

The metrics these teams do track often miss the mark. Among measuring teams, 40.8% use DORA metrics (deployment frequency, lead time, mean time to recovery, change failure rate), 31% track time-to-market, and just 14.1% employ SPACE framework. These are technical performance indicators, not business impact measures.

The gap between “we deployed 50% faster” and “we enabled $2 million in revenue” is the difference between a platform that survives budget scrutiny and one that doesn’t. Technical metrics are necessary but insufficient—they don’t translate to the business language CFOs speak.

What Platform Teams Should Actually Measure

Platform teams must measure and communicate ROI in business terms: revenue enabled, costs avoided, and profit center contribution. This is not aspirational guidance—it’s survival strategy for when budget cuts come.

Revenue-enabled metrics include time-to-market reduction (faster revenue capture), new features shipped per quarter, and developer capacity freed for customer-facing work instead of infrastructure toil. Additionally, a mature platform should reduce onboarding time from weeks to hours, translating directly to productivity gains that finance teams can quantify.

Costs avoided are equally concrete. Reduced incident costs from fewer outages and faster recovery, cloud waste elimination from idle resources and over-provisioning, reduced ops headcount requirements as self-service replaces manual tickets, and infrastructure efficiency gains all translate to dollar savings. For instance, one platform team reported reducing environment costs from $30 per hour to 70 cents per hour through optimization.

The profit center model positions platforms as competitive advantage rather than cost center. Developer retention improves with better tooling experiences, reducing expensive turnover. Platforms enable new products and services by accelerating delivery. Speed becomes strategic moat.

Yet case studies consistently miss these numbers. A Fortune 500 food manufacturer with $9 billion in annual revenue and 14,000 employees transitioned 40+ automations to a stable platform, achieving “reduced dependency on specialized expertise” and “faster issue identification via centralized logging.” The qualitative benefits are clear, but no specific dollar savings are quantified—the measurement gap in action.

The 70% Failure Rate and 2026 Stakes

The consequences of measurement failure are dire. Up to 70% of platform engineering teams fail to deliver measurable impact, and without executive buy-in driven by clear ROI demonstration, platforms risk becoming what one report calls “expensive monuments to engineering excellence that deliver zero business value.”

Platform teams are feeling pressure to connect technical delivery to business goals, but most are measuring the wrong things, if anything at all. The inflection is happening now: AI hype is cooling, CFO budget scrutiny is intensifying, and platforms without business metrics are vulnerable.

The 2026 prediction is optimistic—fewer than 15% of organizations will lack measurement practices IF current improvement trajectories persist. But that’s a big IF. Consequently, teams deprioritizing measurement infrastructure now risk future funding crises and inability to demonstrate ROI when the next budget cycle demands cuts.

Key Takeaways

- Platform engineering reached 80% adoption in 2026, yet 30% of teams still don’t measure success—a $5-10 million blind spot for organizations betting big on infrastructure.

- Technical metrics like DORA don’t prove business value. CFOs need revenue-enabled and cost-avoidance metrics (features shipped, incident costs reduced, cloud waste eliminated), not just faster deployment frequency.

- Seventy percent of platform teams fail to demonstrate measurable impact. Without ROI proof in business terms, platforms become “expensive monuments” when budget cuts arrive.

- The window is closing. Teams that can’t speak CFO language in 2026 will face elimination when the AI spending boom inevitably cools and budget scrutiny intensifies.

- Start measuring now: Revenue enabled, costs avoided, profit center contribution. Platform maturity isn’t about tooling—it’s about proving the investment was worth it.

For engineering leaders and platform teams: Measurement is not optional infrastructure—it’s the difference between survival and becoming the first line item cut when budgets tighten. The organizations documenting business impact today will be the ones still funded tomorrow.