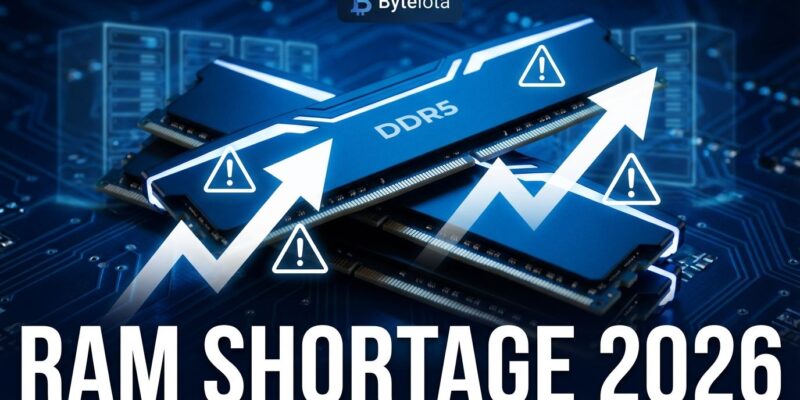

Samsung Electronics, the world’s largest memory manufacturer, issued an unprecedented warning on January 7, 2026: A global RAM shortage will drive massive price increases across the tech industry, and “no company is immune.” The proof is already here. 32GB DDR5 modules jumped from $149 in September to $239 in January—a 60% increase in eight weeks. Contract pricing for DDR5 surged over 100%, climbing from $7 to $19.50 per unit. SK Hynix announced its DRAM, NAND, and HBM capacity is “essentially sold out” through 2026. The culprit? AI infrastructure is consuming all available memory production, leaving developers, PC builders, and enterprise IT departments scrambling to secure RAM before costs climb even higher.

Why This Shortage Is Different

Unlike the 2020-2023 chip shortage caused by pandemic disruptions, this is a structural reallocation. Memory manufacturers are deliberately shifting production capacity from consumer DRAM to high-margin AI memory (HBM3 and HBM3E), and they’re not looking back.

Micron exits the consumer memory market entirely in February 2026, discontinuing its Crucial brand to focus on AI and enterprise customers. SK Hynix sold out its entire 2026 manufacturing capacity—reserved for AI clients willing to pay premium prices. Samsung delayed DDR4 end-of-life for server contracts but offers no relief to consumer markets.

The economics explain everything. HBM memory commands margins three times higher than commodity DRAM. Despite representing only 8% of total DRAM output, HBM accounts for 30% of revenue. Memory manufacturers made a strategic choice: AI infrastructure over consumers. This isn’t a temporary shortage you can wait out. Relief won’t arrive until 2027-2028 when new fab capacity comes online.

Impact on Developers and Tech Professionals

Developers face immediate financial pain. Workstation costs are up 15-20% for systems with 64GB or more RAM. High-RAM configurations—128GB, 256GB, 512GB—are 20-30% more expensive than three months ago. Enterprise server memory costs are projected to rise 70% in Q1 2026.

Cloud providers are likely to pass costs along. AWS raised GPU instance prices by 15% on January 5, and memory-optimized instances (AWS R-series/X-series, Azure E-series/M-series) are at risk for similar hikes. RAM touches every cloud service—compute, storage, databases. Hyperscalers buy in bulk, but they’re not absorbing these increases forever.

The PC market is shrinking in response. IDC forecasts a 5-9% decline in 2026 as buyers delay purchases. Some vendors are selling pre-built systems without RAM, forcing customers to source memory separately. Average PC prices are jumping 4-8%, with Dell, HP, Lenovo, and Acer warning clients of 15-20% price hikes.

If you’re planning a hardware refresh, buy now. Prices in Q1 2026 will be worse. Optimize your code for lower memory footprints. Monitor cloud VM pricing closely—memory-intensive workloads will get hit first.

The AI Memory War

AI data centers are winning the allocation war. HBM3 and HBM3E memory for AI accelerators like Nvidia’s H100 and H200 GPUs require three times more wafer capacity per gigabyte than DDR5. Hyperscalers—Google, Meta, Microsoft—are paying premium prices to secure supply. Nvidia’s H100 uses 80GB of HBM3 per chip. The H200 uses 141GB of HBM3E. A single AI data center with thousands of GPUs needs petabytes of high-bandwidth memory.

SK Hynix reported an $8 billion profit in Q3 2025, a 62% year-over-year increase, and controls 62% of the HBM market. Samsung and Micron are posting record revenues. Meanwhile, developers, PC builders, and enterprise IT departments are getting priced out. PC OEMs like Dell and HP face deteriorating margins. Consumers will pay more for smartphones, laptops, and PCs. Samsung’s Co-CEO TM Roh admitted “smartphone price adjustments may be necessary” for the Galaxy S26.

Should memory manufacturers prioritize AI over consumers and developers? The question matters because this isn’t a free market—Samsung, SK Hynix, and Micron control over 90% of the memory market. There are no alternatives. The “AI arms race” is harming the broader tech ecosystem, and no one in the industry has the power to push back.

What Comes Next

Expect prices to climb another 20-30% in Q1 2026. By mid-year, 32GB DDR5 kits could hit $280-300. Prices will plateau in H2 2026 at elevated levels but won’t meaningfully drop until late 2027 when new fab capacity starts production. Micron’s $9.6 billion Hiroshima HBM facility begins construction in May 2026 but won’t produce output until 2028.

For developers, the path forward is clear: secure RAM now before Q1 increases, optimize code for memory efficiency, and watch cloud costs closely. This isn’t the 2020-2023 shortage. It’s a structural shift. Memory pricing may stabilize 20-40% above 2024 levels long-term. The “new normal” has arrived, and it’s expensive.