Monarch Quantum, Inc. launched on January 6, 2026, to solve quantum computing’s “fragile laser bench” bottleneck—the complex array of 200+ discrete optical components that quantum labs manually assemble over 12-18 months at costs exceeding $500,000 per system. Led by serial photonics entrepreneur Dr. Timothy Day (New Focus $338M exit, Daylight Solutions founder), the San Diego company delivers integrated “Quantum Light Engines™” that consolidate laser systems into factory-aligned modules, promising to accelerate quantum hardware development similarly to how chip fabs enabled the PC revolution.

The timing is strategic. Quantum computing’s transition from R&D to commercialization isn’t bottlenecked by qubit physics—it’s stuck on photonics engineering. IonQ’s $1.08 billion Oxford Ionics acquisition and Quantinuum’s $10 billion valuation signal market maturity, but both companies remain constrained by laser system complexity. Monarch addresses the infrastructure problem blocking scale.

The “Fragile Laser Bench” Problem Every Quantum Lab Faces

Every quantum computer currently relies on custom-built “laser benches”—hundreds of discrete optical components (lasers, mirrors, beam splitters, modulators, detectors) manually assembled on optical tables. This fragmented approach dominates quantum hardware timelines and budgets, yet it rarely gets attention in qubit breakthrough headlines.

The numbers tell the real story. Building a laser system takes 12-18 months, costs $500,000 to $2 million per system, and requires PhD-level expertise just for optical alignment. According to Dr. Day, “Today’s quantum companies rely on large, fragile, and insecure supply chains for these ‘laser engines.'” Manual alignment takes 4-8 weeks per system and needs realignment every 1-3 months due to vibration and thermal drift.

Sandia National Labs’ Trapped-Ion Workshop identifies “optical access and addressing” as the main barrier to scaling trapped-ion quantum computers. The constraint isn’t theoretical—it’s mechanical. Trapped-ion systems like IonQ and Quantinuum need precise laser control for every quantum operation: state preparation, cooling, trapping, gate operations, and readout. Without reliable photonics, qubits sit idle.

Quantum Light Engines™: Factory-Aligned Photonics

Monarch’s solution consolidates hundreds of discrete optical components into single, factory-aligned modules. Each Quantum Light Engine™ integrates chip-scale lasers, electro-optics, modulators, fiber-optics, and low-noise control electronics—all robotically assembled and factory-tested before shipping.

The vertical integration matters. Monarch runs design through manufacturing in its San Diego facility, using robotic assembly and machine learning for quality control. This isn’t incremental improvement—it’s a different approach to photonics manufacturing. Instead of custom optical tables requiring weeks of manual alignment, quantum labs get plug-and-play modules with fiber-coupled inputs and outputs.

The platform works across multiple quantum architectures: trapped-ion (IonQ’s ytterbium ions, Quantinuum’s ytterbium + barium), neutral-atom, vacancy-center, and photonic systems. Supporting different ion species and wavelengths without complete redesigns makes Monarch a photonics supplier, not a quantum computer company betting on one qubit type.

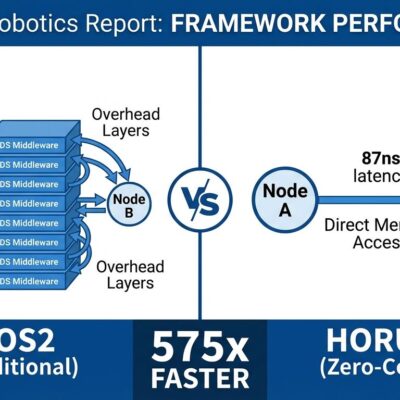

Cost and timeline improvements follow from manufacturing discipline. Estimated cost reduction: 50-70% (roughly $150K-$600K versus $500K-$2M). Timeline improvement: 6-9 months versus 18-30 months for traditional builds. These aren’t marketing projections—they’re what happens when you eliminate manual assembly and multi-vendor supply chains.

Dr. Timothy Day’s Track Record and Market Timing

Dr. Day brings 35 years of photonics industry experience, having co-founded New Focus (sold to Bookham Technology for $338 million in 2004) and Daylight Solutions (merged with Leonardo DRS in 2017). His specialty: translating complex photonics into high-volume commercial products. That’s exactly what quantum computing needs now.

The quantum computing market is at an inflection point. Market projections show growth from $3.5 billion in 2025 to $20.2 billion by 2030—a 32-41% CAGR depending on the source. More importantly, the money is moving. IonQ acquired Oxford Ionics for $1.08 billion in Q4 2025 (largest quantum deal ever). Quantinuum raised $600 million at a $10 billion pre-money valuation. Global quantum investments surpassed $1 billion in 2024, with average funding rounds now exceeding $50 million.

IonQ is targeting 256-qubit systems in 2026. The industry consensus puts commercial maturity 5-10 years out. Monarch isn’t betting on distant timelines—it’s positioning as infrastructure for companies that are scaling now.

Quantum’s Component Supply Chain Emerges

Monarch’s launch represents quantum computing maturation: the emergence of specialized component suppliers. Just as the PC industry needed Intel (CPUs), Micron (RAM), and Seagate (storage), the quantum industry needs specialized photonics suppliers, cryogenic system makers, and control electronics vendors.

Currently, every quantum company—IonQ, Quantinuum, Google, IBM—builds custom photonics in-house. That made sense in the R&D phase. It doesn’t scale to manufacturing. The future looks different: quantum companies buy standardized Quantum Light Engines™ from Monarch and focus R&D on qubits and error correction. Early PCs (Apple II, Commodore) built everything in-house. Modern PCs assemble standardized components.

For developers and tech professionals, infrastructure maturation means more stable quantum hardware, better cloud quantum access (AWS Braket, Azure Quantum, IBM Quantum), and more predictable quantum algorithms. Quantum computing becomes practical when the infrastructure stops being the bottleneck.

Key Takeaways

- Quantum computing has been bottlenecked by photonics engineering, not qubit physics—Monarch’s Quantum Light Engines™ address the “fragile laser bench” problem blocking commercialization

- Vertical integration (design to manufacturing) enables 50-70% cost reduction ($150K-$600K versus $500K-$2M) and 2-3x faster time-to-market (6-9 months versus 18-30 months)

- Dr. Timothy Day’s proven track record (New Focus $338M exit, Daylight Solutions) de-risks the bet—he’s built and sold commercial photonics companies before

- Market timing is strategic: IonQ’s $1.08B acquisition, Quantinuum’s $10B valuation, and $20B market by 2030 signal infrastructure investment phase

- Infrastructure maturation (specialized supply chains) makes quantum computing practical—stable hardware enables reliable cloud quantum access and predictable algorithms