When 1800s Tech Solves 2026’s Biggest AI Problem

Applied Digital just made what might be the smartest infrastructure bet in tech: using steam turbine technology from the 1800s to power its AI data centers. While Meta chases nuclear power and competitors wait years for modern gas turbines, Applied Digital partnered with Babcock & Wilcox and Siemens Energy to deploy 1 gigawatt of proven steam turbine capacity by 2028. The kicker? Natural gas turbines are sold out until 2032 according to NextEra Energy’s CEO. That four-year gap could determine which AI companies scale and which get left behind waiting for perfect but unavailable solutions.

The Gas Turbine Bottleneck Nobody’s Talking About

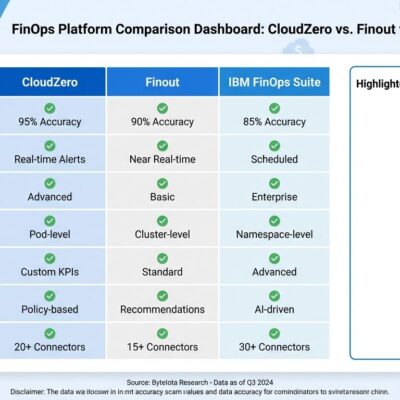

Three manufacturers—GE Vernova, Siemens Energy, and Mitsubishi Power—control over 70% of global gas turbine supply, and delivery slots for 2026-2027 are “largely sold out” according to GE Vernova’s CEO. NextEra Energy, one of the largest US power generators, won’t see new gas-fired facilities until 2032. For AI data center operators racing to capture exploding demand—Applied Digital just reported 250% year-over-year revenue growth to $126.6 million—waiting isn’t an option.

The Century-Old Solution

Applied Digital’s answer bypasses the bottleneck entirely. Four 300-megawatt steam turbine plants will deliver 1 gigawatt of capacity by end of 2028—four years before gas turbines become available. The technology is straightforward: natural gas-fired boilers generate steam that drives turbines. Babcock & Wilcox brings 150 years of experience and 300,000 megawatts of capacity globally. These aren’t prototypes—they’re battle-tested workhorses with decades proving reliability.

The $1.5 billion project supports long-term contracts worth over $5 billion with investment-grade hyperscalers like CoreWeave. That’s enough power for continuous AI training workloads impossible without reliable generation.

The Trade-Off: Efficiency vs Availability

Steam turbines aren’t more efficient than gas turbines. Where gas turbines achieve 60%+ efficiency, steam turbines reach around 35%—meaning 70% more natural gas per megawatt-hour and perhaps $40-45 million per year in additional fuel costs per plant.

But Applied Digital has locked in over $11 billion in contracted revenues. Four years of revenue generation from 2028 to 2032 dwarfs the fuel cost penalty. And those contracts almost certainly pass power costs through to customers—hyperscalers are paying for availability, not efficiency. It’s the classic trade-off: fast, cheap, good—pick two. Applied Digital picked fast and good.

Everyone’s Scrambling for Power

Power, not GPUs or algorithms, has become AI’s primary constraint. Meta inked 6-gigawatt nuclear deals with Vistra and TerraPower. Microsoft recommissioned Three Mile Island’s 819-megawatt nuclear plant. Global AI data center power demand is projected to nearly double from 2023 to 2026, reaching 96 gigawatts, with US data centers consuming 6% of total electricity in 2026.

But nuclear takes years (Meta’s reactors won’t deliver until 2032), and gas turbines are sold out. Grid connections face multi-year queues. Applied Digital found the gap: proven steam turbines that ship on time.

What This Means for AI Infrastructure

Applied Digital’s move sets a precedent. When cutting-edge solutions face years-long bottlenecks, pragmatic engineering wins. The company’s targeting $1 billion in annualized net operating income within five years, built on power capacity delivered when competitors are still waiting.

This is infrastructure strategy revealing itself as competitive moat. In 2026, power availability trumps everything. Applied Digital recognized the constraint early and secured supply chain access while others optimized for theoretical efficiency. And in an industry obsessed with frontier models and cutting-edge everything, they just proved that sometimes innovation means choosing what works over what’s newest.

Four years is a long time in AI—long enough to build market position, lock in customers, and generate billions in revenue. While others wait for the perfect solution, Applied Digital will be operational. That’s the real advantage of shipping 1800s technology in 2026.