The Biggest Nuclear Bet in Tech History

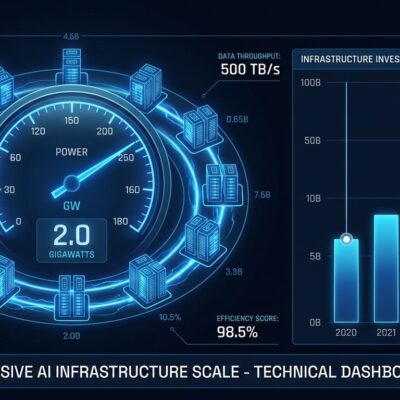

Meta just made a power play that dwarfs every other tech company’s energy strategy. On January 9, the company announced agreements for 6.6 gigawatts of nuclear power—enough to run 5 million homes. This isn’t about going green. It’s about securing the energy infrastructure to win the AI arms race.

The deal spans three nuclear partnerships. Vistra supplies 2.1 gigawatts from existing plants in Pennsylvania and Ohio. Oklo, a small modular reactor startup, will build a 1.2-gigawatt campus in southern Ohio. TerraPower, Bill Gates’ nuclear venture, provides 690 megawatts initially with rights to expand to 2.1 gigawatts. All of it powers two massive AI facilities: Prometheus, a 1-gigawatt supercluster in Ohio launching this year, and Hyperion, a 5-gigawatt behemoth in Louisiana.

Bigger Than Google, Microsoft, and Amazon Combined

Compare Meta’s commitment to its competitors. Google’s nuclear deal totals 500 megawatts. Microsoft’s Three Mile Island restart provides 835 megawatts. Amazon’s agreements add up to roughly 3.4 gigawatts. Meta’s 6.6 gigawatts is larger than all three combined. Big Tech signed over 10 gigawatts of nuclear capacity in the past year, according to CNBC, and Meta alone accounts for two-thirds.

Nuclear power isn’t an experiment anymore—it’s the default path for hyperscale AI. Every company competing at the frontier now has nuclear deals in place. Without a decade-long nuclear partnership, you can’t train the next generation of frontier models.

What This Means for Developers

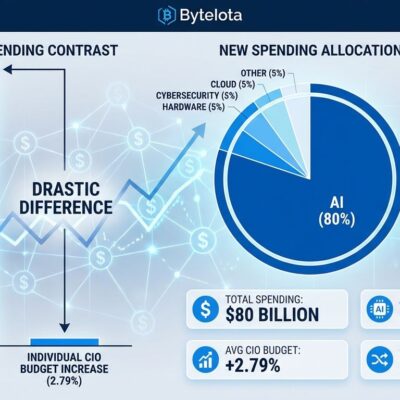

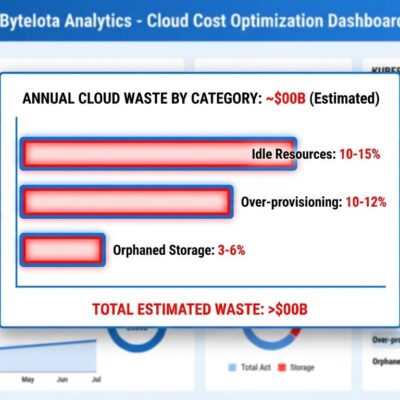

Cloud AI costs are going up, not down. The industry needs $5.2 trillion in data center investments by 2030, according to McKinsey, and those costs get passed through to API pricing. Consumer electricity bills near data centers jumped 10% in two years while industrial rates dropped 2%. Big tech locks in cheap nuclear power while smaller companies pay premium grid prices.

Open source AI is getting squeezed at the frontier. Training GPT-4 cost $40 million. Gemini Ultra ran $30 million. Epoch AI projects these costs will hit $1 billion by 2027, with power requirements reaching multiple gigawatts by 2030. Only companies with nuclear-scale energy partnerships can afford that. Open source models will either lag behind or depend entirely on big tech’s cloud infrastructure.

This creates a brutal barrier to entry. Nuclear deals require years of lead time and billions in capital. Meta’s Oklo reactors won’t come online until 2030. TerraPower’s advanced reactors target 2032. The AI industry just consolidated around four companies: Meta, Google, Microsoft, and Amazon.

Energy Is the Real Bottleneck

Meta’s deal reveals they don’t believe efficiency will solve AI’s power problem. If dramatic model improvements were coming, why secure 6.6 gigawatts—enough for 5 million homes? Why plan Prometheus at 1 gigawatt and Hyperion at 5 gigawatts? Meta is betting on exponential growth in AI compute.

The actual constraint on superintelligence isn’t chips, talent, or algorithms. It’s energy. Building nuclear capacity takes a decade. You can’t spin up 5 gigawatts when you need it. Meta’s deal locks them in through 2035, planning AI infrastructure a decade out.

AI data center electricity consumption grows at 30% annually, according to Goldman Sachs. U.S. data centers consumed 4% of the country’s electricity in 2024, projected to hit 133% growth by 2030. Even with nuclear replacing fossil fuels, total energy consumption is unsustainable. We’re not asking “Should we use this much energy for AI?” Only “How do we get enough?”

The 10-Year Timeline

Prometheus comes online this year on temporary natural gas. Hyperion’s first phase launches in 2028. Oklo’s reactors target 2030. TerraPower’s Natrium reactors arrive around 2032. Full capacity won’t hit until 2035. This is a 10-year energy strategy that can’t pivot.

Any company that hasn’t secured nuclear partnerships now will be a decade behind. The AI race became an energy procurement race, and the starting gun fired years ago. Meta just lapped the field.

Bottom Line

Meta’s 6.6-gigawatt nuclear purchase signals that the AI industry has fundamentally changed. Frontier development now requires nuclear-scale infrastructure. Open source can’t compete at the cutting edge. Cloud costs will rise. And the companies that secured nuclear deals early just built a moat that will last a decade.

The AI arms race is now an energy arms race. And Meta made the biggest bet.