The Supply Crisis Hits Different This Time

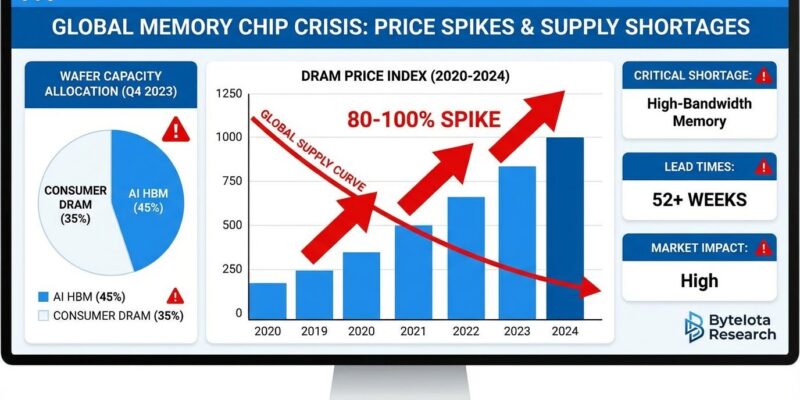

The global memory chip market is experiencing a supply crisis unlike anything the semiconductor industry has seen before. In December 2025 alone, DRAM and NAND contract prices spiked 80-100% month-over-month. Micron’s CEO dropped a bombshell in Q4 earnings: the company can only meet half to two-thirds of customer demand. SK Hynix and Phison report all 2026 production is already sold out.

This isn’t the 2020-2023 chip shortage redux. That crisis stemmed from pandemic-era supply chain disruptions. This one is driven by cold market economics: AI infrastructure is consuming all available manufacturing capacity.

Why Manufacturers Choose AI Over Consumer DRAM

Here’s the math reshaping the memory market: HBM (High Bandwidth Memory) consumes roughly three times the wafer capacity of consumer DDR5 per gigabyte. That sounds inefficient until you see the revenue side. While HBM accounts for just 8% of DRAM output, it generates over 30% of total DRAM revenue. For manufacturers like Samsung, SK Hynix, and Micron, the economics are straightforward—every wafer allocated to an HBM stack for an Nvidia GPU generates significantly more profit than that same wafer would as smartphone memory.

The result? A zero-sum capacity battle. Samsung, SK Hynix, and Micron are reallocating up to 40% of their advanced wafer capacity to AI memory production. SK Hynix has sold its entire 2026 output to Nvidia alone. Micron just posted a record $11.3 billion quarter driven by HBM margins and is exiting the consumer Crucial brand in February 2026.

Every wafer allocated to AI infrastructure is one denied to consumers. It’s not a supply failure; it’s rational profit maximization.

Price Impact Across Every Segment

The smartphone industry is getting crushed first. Counterpoint Research reports DRAM price surges have increased bill-of-materials costs by 25% for budget phones, 15% for mid-range devices, and 10% for flagships. Xiaomi’s president warned the company secured 2026 supply but expects “product costs to reflect component rises.”

PC buyers face similar pain. IDC forecasts PC prices will jump 4-8% in 2026, with some vendors adjusting 15%. Kingston’s datacenter SSD manager issued a blunt warning: “Don’t wait if you’re planning to upgrade—prices will continue to go up.” NAND wafer prices are up 246% from Q1 2025. A 1TB TLC chip that cost $4.80 in July now costs $10.70.

Some PC builders are already selling pre-built systems without RAM included. That’s how tight allocation has become. For developers and enterprises, the hit comes through infrastructure costs—workstations, build servers, and test rigs are all facing 20-40% price increases.

Why Recovery Won’t Come Until 2028

The timeline to recovery is longer than most expect because semiconductor fab construction is measured in years, not quarters. Building a new cleanroom facility takes a minimum of 2-3 years. SK Hynix is committing $500 billion to construct four new memory fabs, with the first scheduled for completion in H1 2027. Micron’s Idaho fab will begin wafer output in H2 2027. Samsung’s P5 fab targets late 2027 production.

However, even when these new fabs come online, initial capacity will prioritize HBM and enterprise products because they generate higher margins. Nomura’s analysis is explicit: “meaningful supply increases will not occur until 2028 at the earliest.” A leaked SK Hynix internal analysis projects PC DRAM supply will trail demand until late 2028.

Meanwhile, the short-term outlook gets worse before it improves. Distribution stockpiles are expected to exhaust in Q1-Q2 2026, at which point obtaining memory allocation becomes difficult regardless of price. Industry analysts project another 40% price increase for DRAM in Q1 2026.

What Tech Professionals Should Do Now

If you’re planning hardware purchases, the calculus is straightforward: buy now. Prices are rising through at least Q1 2026, and allocation will tighten further when distributor inventories run dry. Budget 20-40% more for memory-dependent hardware through 2026. Extend device upgrade cycles to 3-4 years instead of 2-3.

Strategically, this shifts cloud versus on-prem economics. Cloud providers are passing through cost increases, but on-prem purchases face both higher acquisition costs and allocation challenges. Startups with less negotiating power should plan budgets accordingly. Developers should prioritize memory efficiency in infrastructure decisions—optimization matters more when memory costs spike.

The memory market has entered a multi-year supercycle driven by AI infrastructure demand. As NPR reports, AI data centers are consuming memory supply, making technology more expensive through 2026. The constraint isn’t temporary logistics—it’s structural capacity allocation. Until new fabs reach mass production in 2027-2028, AI infrastructure wins that allocation battle every time.